John G Ullman & Associates Inc increased its stake in M D U Resources Grp (MDU) by 11.11% based on its latest 2019Q1 regulatory filing with the SEC. John G Ullman & Associates Inc bought 39,350 shares as the company’s stock declined 3.43% while stock markets rallied. The institutional investor held 393,471 shares of the basic industries company at the end of 2019Q1, valued at $10.16M, up from 354,121 at the end of the previous reported quarter. John G Ullman & Associates Inc who had been investing in M D U Resources Grp for a number of months, seems to be bullish on the $5.10 billion market cap company. The stock decreased 0.43% or $0.11 during the last trading session, reaching $25.75. About 496,394 shares traded. MDU Resources Group, Inc. (NYSE:MDU) has declined 9.92% since June 18, 2018 and is downtrending. It has underperformed by 14.35% the S&P500. Some Historical MDU News: 23/04/2018 - MDU RESOURCES GROUP INC - ANTICIPATES ACQUISITION WILL BE ACCRETIVE TO 2018 EARNINGS PER SHARE; 23/04/2018 - MDU Resources Group Acquires Operations Of Teevin & Fischer Quarry, LLC; 02/05/2018 - MDU RESOURCES 1Q ADJ EPS 22C; 02/05/2018 - MDU RESOURCES 1Q OPER REV. $976.3M; 23/04/2018 - MDU RESOURCES - TEEVIN & FISCHER WILL BECOME PART OF KNIFE RIVER CORP, A UNIT OF CO; 07/03/2018 MDU Resources Announces Webcast of Analyst Seminar; 23/04/2018 - MDU RESOURCES GROUP - FINANCIAL DETAILS OF ACQUISITION WERE NOT DISCLOSED; 20/04/2018 - DJ MDU Resources Group Inc, Inst Holders, 1Q 2018 (MDU); 23/04/2018 - MDU RESOURCES GROUP BUYS OPS OF TEEVIN & FISCHER QUARRY, LLC; 23/03/2018 - MDU Resources Forms Golden Cross: Technicals

Acropolis Investment Management Llc decreased its stake in Unitedhealth Group Inc (UNH) by 9.11% based on its latest 2019Q1 regulatory filing with the SEC. Acropolis Investment Management Llc sold 1,372 shares as the company’s stock declined 10.51% while stock markets rallied. The institutional investor held 13,691 shares of the medical specialities company at the end of 2019Q1, valued at $3.39M, down from 15,063 at the end of the previous reported quarter. Acropolis Investment Management Llc who had been investing in Unitedhealth Group Inc for a number of months, seems to be less bullish one the $233.76 billion market cap company. The stock increased 0.24% or $0.6 during the last trading session, reaching $245.97. About 1.78M shares traded. UnitedHealth Group Incorporated (NYSE:UNH) has declined 2.81% since June 18, 2018 and is downtrending. It has underperformed by 7.24% the S&P500. Some Historical UNH News: 13/03/2018 - UNITEDHEALTH GROUP INC - COMPANY TO LAUNCH NEW OPTUM VENTURES GLOBAL FUND; 17/04/2018 - UNITEDHEALTH OUTLOOK ALSO REFLECTS PLANNED INVESTMENT SPENDING INCREASE IN SECOND HALF AND COSTS AROUND THE HEALTH INSURANCE TAX; 02/04/2018 - AMERICAN RENAL ASSOCIATES HOLDINGS - ON MARCH 30, UNITED HEALTHCARE INSURANCE CO AND UNITED HEALTHCARE SERVICES FILED A COMPLAINT AGAINST UNITS; 17/04/2018 - UNITEDHEALTH 1Q REV. $55.2B, EST. $54.87B; 16/05/2018 - United Healthcare Steve Nelson To Keynote Second Annual Medicare Advantage Summit; 24/05/2018 - UnitedHealthcare Establishes Long-Term Strategic Partnership with Quest Diagnostics; 17/04/2018 - Health insurer UnitedHealth’s quarterly profit rises 30.6 pct; 17/04/2018 - UnitedHealth 2018 outlook based in part on medical cost control -CFO; 13/03/2018 - FITCH AFFIRMS UNITEDHEALTH’S IFS RATINGS AT ‘AA-‘; OUTLOOK STAB; 17/04/2018 - UNITEDHEALTH GROUP INC UNH.N FY2018 SHR VIEW $12.54, REV VIEW $224.88 BLN — THOMSON REUTERS l/B/E/S

Since March 14, 2019, it had 2 insider buys, and 0 sales for $140,250 activity.

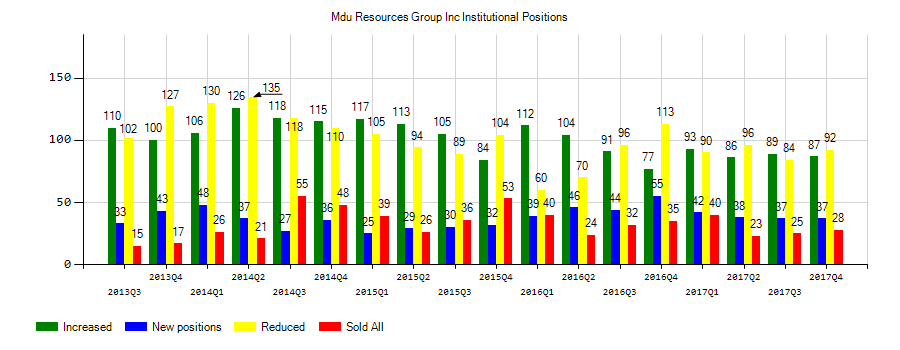

Investors sentiment decreased to 1.06 in Q1 2019. Its down 0.21, from 1.27 in 2018Q4. It worsened, as 30 investors sold MDU shares while 89 reduced holdings. 46 funds opened positions while 80 raised stakes. 128.34 million shares or 0.23% more from 128.04 million shares in 2018Q4 were reported. Da Davidson & reported 0.02% in MDU Resources Group, Inc. (NYSE:MDU). Moreover, Gemmer Asset Mngmt Limited Liability Co has 0% invested in MDU Resources Group, Inc. (NYSE:MDU) for 124 shares. Blackrock Incorporated owns 18.92M shares or 0.02% of their US portfolio. Tiaa Cref Mngmt Llc reported 777,672 shares. First Citizens Bankshares reported 0.09% of its portfolio in MDU Resources Group, Inc. (NYSE:MDU). Credit Suisse Ag has 193,034 shares for 0% of their portfolio. Moreover, Davidson Invest Advsrs has 0.05% invested in MDU Resources Group, Inc. (NYSE:MDU) for 20,275 shares. Eqis has 0.02% invested in MDU Resources Group, Inc. (NYSE:MDU) for 9,834 shares. Captrust Financial Advsrs has 2,854 shares. Hennessy reported 400,407 shares or 0.48% of all its holdings. The Michigan-based Comerica National Bank & Trust has invested 0.03% in MDU Resources Group, Inc. (NYSE:MDU). Ameriprise Financial reported 529,464 shares stake. Invesco Limited has 2.12M shares for 0.02% of their portfolio. Ubs Asset Americas reported 287,352 shares. Paloma Ptnrs Mgmt Co holds 32,414 shares.

John G Ullman & Associates Inc, which manages about $1.08B and $552.32 million US Long portfolio, decreased its stake in Merck & Co Inc (NYSE:MRK) by 56,936 shares to 140,075 shares, valued at $11.65M in 2019Q1, according to the filing. It also reduced its holding in Xerox Corp by 10,975 shares in the quarter, leaving it with 95,739 shares, and cut its stake in Abbott Laboratories (NYSE:ABT).

More notable recent MDU Resources Group, Inc. (NYSE:MDU) news were published by: Fool.com which released: “MDU Resources Group Inc (MDU) Q3 2018 Earnings Conference Call Transcript - Motley Fool” on November 01, 2018, also Finance.Yahoo.com with their article: “Here is What Hedge Funds Really Think About Ceridian HCM Holding Inc. (CDAY) - Yahoo Finance” published on April 23, 2019, Zacks.com published: “MDU Resources (MDU) to Expand Bakken Natural Gas Project - Zacks.com” on January 29, 2019. More interesting news about MDU Resources Group, Inc. (NYSE:MDU) were released by: Prnewswire.com and their article: “MDU Resources Subsidiary Plans Retirement of Aging Generation Units; New Generation Build - PRNewswire” published on February 19, 2019 as well as Prnewswire.com‘s news article titled: “MDU Resources Reports First Quarter Earnings, Updates Guidance - PRNewswire” with publication date: April 30, 2019.

Since January 17, 2019, it had 2 insider buys, and 3 sales for $2.19 million activity. 20,000 UnitedHealth Group Incorporated (NYSE:UNH) shares with value of $4.64M were bought by WICHMANN DAVID S. BALLARD WILLIAM C JR also sold $1.33 million worth of UnitedHealth Group Incorporated (NYSE:UNH) shares. $1.50M worth of UnitedHealth Group Incorporated (NYSE:UNH) shares were bought by MCNABB FREDERICK WILLIAM III.

Investors sentiment increased to 1.2 in Q1 2019. Its up 0.10, from 1.1 in 2018Q4. It increased, as 63 investors sold UNH shares while 497 reduced holdings. 146 funds opened positions while 524 raised stakes. 782.62 million shares or 7.34% less from 844.66 million shares in 2018Q4 were reported. Shamrock Asset Mgmt Ltd Liability Corp, Texas-based fund reported 85 shares. Moody Bancorporation Division holds 0.69% in UnitedHealth Group Incorporated (NYSE:UNH) or 100,908 shares. Plante Moran Ltd Liability Corporation owns 2,027 shares for 0.16% of their portfolio. Peapack Gladstone Financial Corporation stated it has 0.15% in UnitedHealth Group Incorporated (NYSE:UNH). First City Cap Mgmt has invested 0.3% in UnitedHealth Group Incorporated (NYSE:UNH). Jackson Square Prtn Ltd Liability holds 2.87% or 2.12 million shares in its portfolio. 1.01 million are held by Hsbc Plc. Gamco Invsts Et Al has invested 0.05% in UnitedHealth Group Incorporated (NYSE:UNH). Hgk Asset Management Inc stated it has 26,535 shares. Stelliam Investment Mngmt Limited Partnership accumulated 1.59% or 31,100 shares. Alabama-based Fjarde Ap has invested 0.89% in UnitedHealth Group Incorporated (NYSE:UNH). Artemis Invest Mgmt Llp has 0.73% invested in UnitedHealth Group Incorporated (NYSE:UNH). Moneta Group Ltd Liability Corporation reported 12,262 shares. Front Barnett Assocs stated it has 1,265 shares. California-based First Republic Invest Mngmt Inc has invested 0.61% in UnitedHealth Group Incorporated (NYSE:UNH).

More notable recent UnitedHealth Group Incorporated (NYSE:UNH) news were published by: Finance.Yahoo.com which released: “UnitedHealth Group Incorporated (NYSE:UNH) Delivered A Better ROE Than Its Industry - Yahoo Finance” on May 31, 2019, also Finance.Yahoo.com with their article: “Here is the 27th Most Popular Stock Among Hedge Funds - Yahoo Finance” published on June 01, 2019, Finance.Yahoo.com published: “Is Verizon Communications Inc. (VZ) A Good Stock To Buy? - Yahoo Finance” on June 10, 2019. More interesting news about UnitedHealth Group Incorporated (NYSE:UNH) were released by: Finance.Yahoo.com and their article: “Is Cisco Systems, Inc. (CSCO) A Good Stock To Buy? - Yahoo Finance” published on June 10, 2019 as well as Finance.Yahoo.com‘s news article titled: “UnitedHealth Stock Is a Buy, but Keep an Eye on the External Risks - Yahoo Finance” with publication date: February 13, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.