Among 6 analysts covering SBA Communications Corporation (NASDAQ:SBAC), 4 have Buy rating, 0 Sell and 2 Hold. Therefore 67% are positive. SBA Communications Corporation has $29200 highest and $204 lowest target. $243’s average target is -6.83% below currents $260.8 stock price. SBA Communications Corporation had 18 analyst reports since March 4, 2019 according to SRatingsIntel. The rating was maintained by KeyBanc Capital Markets with “Overweight” on Tuesday, July 30. On Friday, June 7 the stock rating was downgraded by UBS to “Neutral”. RBC Capital Markets maintained the stock with “Buy” rating in Monday, March 4 report. Morgan Stanley maintained the shares of SBAC in report on Monday, May 20 with “Overweight” rating. As per Monday, August 19, the company rating was maintained by KeyBanc Capital Markets. The stock of SBA Communications Corporation (NASDAQ:SBAC) has “Buy” rating given on Friday, March 22 by Citigroup. Morgan Stanley maintained the stock with “Overweight” rating in Monday, March 11 report. KeyBanc Capital Markets maintained SBA Communications Corporation (NASDAQ:SBAC) on Monday, July 15 with “Overweight” rating. KeyBanc Capital Markets maintained SBA Communications Corporation (NASDAQ:SBAC) rating on Tuesday, April 30. KeyBanc Capital Markets has “Overweight” rating and $21500 target. JP Morgan downgraded the stock to “Neutral” rating in Thursday, August 1 report. See SBA Communications Corporation (NASDAQ:SBAC) latest ratings:

19/08/2019 Broker: KeyBanc Capital Markets Rating: Overweight Old Target: $259.0000 New Target: $292.0000 Maintain

01/08/2019 Broker: JP Morgan Old Rating: Overweight New Rating: Neutral Old Target: $220.0000 New Target: $270.0000 Downgrade

30/07/2019 Broker: KeyBanc Capital Markets Rating: Overweight Old Target: $252.0000 New Target: $259.0000 Maintain

15/07/2019 Broker: Bank of America Old Rating: Buy New Rating: Neutral Downgrade

15/07/2019 Broker: KeyBanc Capital Markets Rating: Overweight Old Target: $215.0000 New Target: $252.0000 Maintain

08/07/2019 Broker: Moffett Nathanson Old Rating: Buy New Rating: Neutral Downgrade

07/06/2019 Broker: UBS Old Rating: Buy New Rating: Neutral Old Target: $209 New Target: $240.0000 Downgrade

20/05/2019 Broker: Morgan Stanley Rating: Overweight Old Target: $204.0000 New Target: $222.0000 Maintain

10/05/2019 Broker: BidaskScore Rating: Buy Upgrade

01/05/2019 Broker: Raymond James Old Rating: Outperform New Rating: Market Perform Downgrade

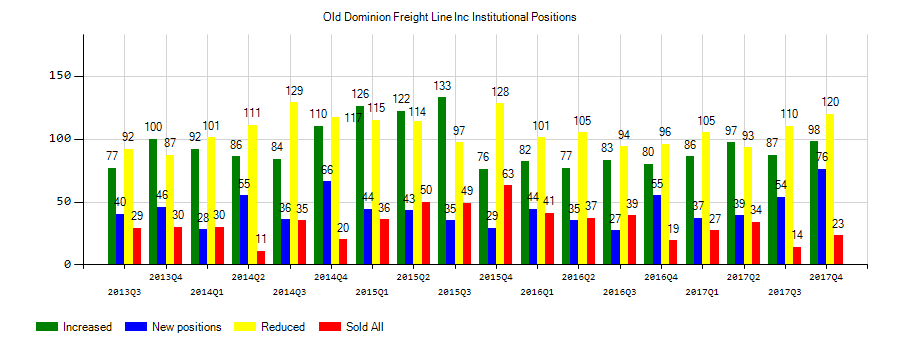

Agf Investments Inc decreased Old Dominion Freight Line Inc. (ODFL) stake by 3.26% reported in 2019Q1 SEC filing. Agf Investments Inc sold 14,342 shares as Old Dominion Freight Line Inc. (ODFL)’s stock rose 12.10%. The Agf Investments Inc holds 425,951 shares with $61.50 million value, down from 440,293 last quarter. Old Dominion Freight Line Inc. now has $12.87 billion valuation. The stock decreased 3.56% or $5.87 during the last trading session, reaching $158.93. About 436,230 shares traded. Old Dominion Freight Line, Inc. (NASDAQ:ODFL) has risen 16.78% since August 24, 2018 and is uptrending. It has outperformed by 16.78% the S&P500. Some Historical ODFL News: 09/03/2018 - OLD DOMINION FREIGHT LINE INC - EARL E. CONGDON TO BECOME SENIOR EXECUTIVE CHAIRMAN; 17/05/2018 - OLD DOMINION FREIGHT LINE: $0.13-SHR QTRLY CASH DIV, A NEW; 26/04/2018 - Old Dominion Freight 1Q EPS $1.33; 08/05/2018 - REG-Lindsay Goldberg considering a sale of its 49% stake in Odfjell Terminals B.V. Odfjell SE considering a tag along of its shareholding in Odfjell Terminals Rotterdam; 12/04/2018 - Billboard: Carrie Underwood, Old Dominion Set to Play Inaugural Live In The Vineyard Goes Country; 16/03/2018 - REG-Mandatory notification of trade; 26/04/2018 - OLD DOMINION FREIGHT LINE INC - QTRLY TOTAL REVENUE $925 MLN, UP 22.7 PCT; 26/04/2018 - OLD DOMINION FREIGHT LINE INC - QTRLY SHR $1.33; 08/05/2018 - Old Dominion Freight Line (ODFL) Gains Tied to Unconfirmed Rumors; 26/04/2018 - Old Dominion Freight Line Produces Strong First-Quarter Financial Results, with 22.7% Growth in Revenue and 66.3% Growth in Earnings Per Diluted Share

More notable recent SBA Communications Corporation (NASDAQ:SBAC) news were published by: Nasdaq.com which released: “First Week of SBAC October 18th Options Trading - Nasdaq” on August 20, 2019, also Nasdaq.com with their article: “SBA Communications (SBAC) Surpasses Q2 FFO and Revenue Estimates - Nasdaq” published on July 29, 2019, Nasdaq.com published: “SBA Communications (SBAC) Q2 AFFO & Revenues Beat, View Up - Nasdaq” on July 30, 2019. More interesting news about SBA Communications Corporation (NASDAQ:SBAC) were released by: Benzinga.com and their article: “KeyBanc: Tower Operators Are Key Beneficiaries Of 5G Networks - Benzinga” published on August 19, 2019 as well as Nasdaq.com‘s news article titled: “After-Hours Earnings Report for July 29, 2019 : ILMN, NXPI, NTR, SBAC, WCN, ARE, ACGL, SSNC, ITUB, VNO, RE, PKI - Nasdaq” with publication date: July 29, 2019.

The stock increased 0.10% or $0.27 during the last trading session, reaching $260.8. About 598,779 shares traded. SBA Communications Corporation (NASDAQ:SBAC) has risen 55.12% since August 24, 2018 and is uptrending. It has outperformed by 55.12% the S&P500. Some Historical SBAC News: 09/03/2018 Moody’s assigns definitive ratings to SBA Tower Trust wireless tower-backed securities; 12/04/2018 - SBA COMMUNICATIONS: REFI ADDED NEW $2.4B, 7-YR TERM LOAN; 12/04/2018 - SBA COMMUNICATIONS CORP - AMENDMENT ALSO PROVIDED FOR A NEW $2.4 BLN, SEVEN-YEAR SENIOR SECURED TERM LOAN UNDER CREDIT AGREEMENT; 12/04/2018 - SBA COMMUNICATIONS: REFI BOOSTED COMMITMENTS TO $1.25B VS $1B; 12/04/2018 - SBA COMMUNICATIONS - ON APRIL 11 UNIT ENTERED 2018 REFINANCING AMENDMENT TO SECONDED AMENDED AND RESTATED CREDIT AGREEMENT, DATED AS OF FEB 7, 2014; 19/04/2018 - DJ SBA Communications Corp Class A, Inst Holders, 1Q 2018 (SBAC); 12/04/2018 - SBA COMMUNICATIONS SAYS AMENDMENT INCREASED REVOLVING CREDIT COMMITMENTS UNDER REVOLVING CREDIT FACILITY TO $1.25 BLN - SEC FILING; 12/04/2018 - SBA COMMUNICATIONS CORP - TERM LOAN WILL MATURE ON APRIL 11, 2025; 30/04/2018 - SBA COMMS 1Q AFFO/SHR $1.85, EST. $1.83; 30/04/2018 - SBA COMMS SEES FY AFFO/SHR $7.25 TO $7.66, EST. $7.64

SBA Communications Corporation operates as a real estate investment trust. The company has market cap of $29.50 billion. The firm operates through two divisions, Site Leasing and Site Development. It has a 229.58 P/E ratio. It owns and operates wireless communications infrastructure, including tower structures, rooftop, and other structures that support antennas used for wireless communications.

Investors sentiment decreased to 0 in Q1 2019. Its down Infinity, from Infinity in 2018Q4. It worsened, as 2 investors sold SBA Communications Corporation shares while 1 reduced holdings. 0 funds opened positions while 0 raised stakes. 2.48 million shares or 50.03% less from 4.96 million shares in 2018Q4 were reported. Cibc Ww Markets, a New York-based fund reported 14,909 shares. Akre Mngmt Llc invested in 2.47M shares.

Investors sentiment increased to 1.05 in 2019 Q1. Its up 0.34, from 0.71 in 2018Q4. It is positive, as 15 investors sold ODFL shares while 138 reduced holdings. 47 funds opened positions while 114 raised stakes. 56.77 million shares or 7.51% less from 61.39 million shares in 2018Q4 were reported. Manufacturers Life Insur The invested in 106,444 shares. Creative Planning reported 0% stake. Wedgewood Partners reported 2.6% in Old Dominion Freight Line, Inc. (NASDAQ:ODFL). Jag Management Lc reported 1.43% stake. Waverton Inv Management Limited holds 10,760 shares or 0.08% of its portfolio. 61,925 were accumulated by Weiss Multi. Landscape Cap Mgmt Lc invested in 1,511 shares. 35,353 were reported by Point72 Asset Mngmt L P. Paradigm Asset Management Co Limited Liability Co stated it has 0% in Old Dominion Freight Line, Inc. (NASDAQ:ODFL). Bridges Investment Management reported 87,811 shares. Timpani Capital Mgmt Ltd Liability reported 18,662 shares stake. Bb&T Lc holds 4,452 shares. Credit Agricole S A reported 14,422 shares stake. Amundi Pioneer Asset Management Inc holds 57,580 shares. Mackenzie Financial Corporation has 2,632 shares.

More notable recent Old Dominion Freight Line, Inc. (NASDAQ:ODFL) news were published by: Finance.Yahoo.com which released: “Why Old Dominion Freight Line, Inc. (NASDAQ:ODFL) Is An Attractive Investment To Consider - Yahoo Finance” on August 12, 2019, also Benzinga.com with their article: “Old Dominion Sees Continued Tonnage Weakness In July - Benzinga” published on August 08, 2019, Benzinga.com published: “Old Dominion Freight Line, Inc. (NASDAQ:ODFL), Saia, Inc. (NASDAQ:SAIA) - The LTL “Oligopoly” Drives On - Benzinga” on August 14, 2019. More interesting news about Old Dominion Freight Line, Inc. (NASDAQ:ODFL) were released by: Fool.com and their article: “Why Shares of Old Dominion Freight Line Climbed in July - Motley Fool” published on August 09, 2019 as well as Fool.com‘s news article titled: “Old Dominion Freight Line Earnings Overcome Waning Demand - The Motley Fool” with publication date: July 25, 2019.

Agf Investments Inc increased Kirkland Lake Gold Ltd. stake by 59,332 shares to 237,682 valued at $7.23 million in 2019Q1. It also upped Equinix Inc. Reit (NASDAQ:EQIX) stake by 3,244 shares and now owns 4,996 shares. Newmont Mining Corp. (NYSE:NEM) was raised too.

Analysts await Old Dominion Freight Line, Inc. (NASDAQ:ODFL) to report earnings on October, 24. They expect $2.17 EPS, up 2.36% or $0.05 from last year’s $2.12 per share. ODFL’s profit will be $175.66M for 18.31 P/E if the $2.17 EPS becomes a reality. After $2.16 actual EPS reported by Old Dominion Freight Line, Inc. for the previous quarter, Wall Street now forecasts 0.46% EPS growth.

Among 2 analysts covering Old Dominion Freight (NASDAQ:ODFL), 0 have Buy rating, 0 Sell and 2 Hold. Therefore 0 are positive. Old Dominion Freight has $16500 highest and $150 lowest target. $156.67’s average target is -1.42% below currents $158.93 stock price. Old Dominion Freight had 7 analyst reports since February 26, 2019 according to SRatingsIntel. The firm has “Neutral” rating given on Thursday, April 11 by Citigroup. The firm earned “Hold” rating on Thursday, June 20 by Bank of America. Bank of America downgraded the stock to “Neutral” rating in Tuesday, February 26 report.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.