Ohio Valley Financial Group decreased its stake in Boeing Co (BA) by 20.29% based on its latest 2019Q2 regulatory filing with the SEC. Ohio Valley Financial Group sold 1,075 shares as the company’s stock declined 9.45% . The institutional investor held 4,222 shares of the aerospace company at the end of 2019Q2, valued at $1.54M, down from 5,297 at the end of the previous reported quarter. Ohio Valley Financial Group who had been investing in Boeing Co for a number of months, seems to be less bullish one the $213.49B market cap company. The stock decreased 1.31% or $5.05 during the last trading session, reaching $379.39. About 6.85M shares traded or 52.81% up from the average. The Bcing Company (NYSE:BA) has declined 2.81% since September 23, 2018 and is downtrending. It has underperformed by 2.81% the S&P500. Some Historical BA News: 16/03/2018 - Boeing: Duberstein to Serve Additional Year From 2018 to 2019 to Aid in Transition; 27/04/2018 - EMBRAER EXECUTIVE SAYS CO IS CAUTIOUSLY OPTIMISTIC ABOUT OPPORTUNITY FOR SUPER TUCANO SALES TO U.S. AIR FORCE; 03/04/2018 - India’s Jet Airways agrees to buy 75 Boeing 737 MAX jets worth $8.8 bln; 02/05/2018 - BOEING A COUPLE OF MTHS BEHIND SCHEDULE ON 777X: QATAR AIR CEO; 02/05/2018 - SPR PREDICTS `LARGE SPIKE’ IN 2Q 737 SHIPMENTS TO BOEING; 17/04/2018 - One dead after engine explodes on Southwest flight; 13/04/2018 - FAA TO REDUCE MAX SINGLE-ENGINE FLYING TIME FOR ROLLS ROYCE-POWERED BOEING 787 JETS; 23/03/2018 - End to Boeing trade case good news for aerospace: Bombardier; 06/03/2018 - ATLAS AIR WORLDWIDE BUYS TWO BOEING 777 FREIGHTERS FOR ACMI; 06/04/2018 - Boeing, American Airlines Sign Major Order for 47 787 Dreamliners

Apg Asset Management Nv decreased its stake in American Express Co (AXP) by 9.74% based on its latest 2019Q2 regulatory filing with the SEC. Apg Asset Management Nv sold 302,300 shares as the company’s stock rose 6.28% . The institutional investor held 2.80 million shares of the consumer services company at the end of 2019Q2, valued at $303.67 million, down from 3.10 million at the end of the previous reported quarter. Apg Asset Management Nv who had been investing in American Express Co for a number of months, seems to be less bullish one the $96.91 billion market cap company. The stock decreased 0.84% or $0.99 during the last trading session, reaching $116.8. About 5.34 million shares traded or 56.39% up from the average. American ExpreS Company (NYSE:AXP) has risen 23.32% since September 23, 2018 and is uptrending. It has outperformed by 23.32% the S&P500. Some Historical AXP News: 07/03/2018 American Express Joins Chorus Declaring Gender Pay Parity; 19/04/2018 - AMERICAN EXPRESS CO AXP.N : RBC RAISES TARGET PRICE TO $86 FROM $81; 10/05/2018 - Parallel North IP Expands Licensing Business with NEC and American Express Patent Portfolios Owned by Strategic Partner,; 14/05/2018 - AMERICAN EXPRESS CANADA - RENEWED CONTRACT EXTENDS THROUGH TO JUNE 29, 2020, TO BE COTERMINOUS WITH AIR CANADA’S PARTICIPATION IN AEROPLAN; 16/04/2018 - FITBIT INC - FITBIT PAY ADDS CHASE TO EXISTING BANK AND CARD ISSUERS AMERICAN EXPRESS, BANK OF AMERICA, CAPITAL ONE, U.S. BANK AND WELLS FARGO IN U.S; 15/05/2018 - mSlGNlA, Inc. Announces Patent Office Victory in Continued Patent Enforcement Efforts against American Express® Company Subsidiary lnAuth, Inc; 21/05/2018 - Fitch Rates American Express Credit Account Master Trust, Series 2018-4 & 2018-5; 15/05/2018 - American Express USCS Card Member Average Loans for April Were $52.9 Billion; 18/04/2018 - American Express 1Q Rev $9.7B; 26/03/2018 - Fitch Affirms American Express Credit Account Master Trust

Apg Asset Management Nv, which manages about $58.29B US Long portfolio, upped its stake in Houlihan Lokey Inc by 62,800 shares to 259,900 shares, valued at $10.16M in 2019Q2, according to the filing. It also increased its holding in Danaher Corporation (NYSE:DHR) by 52,600 shares in the quarter, for a total of 195,547 shares, and has risen its stake in Yum Brands Inc (NYSE:YUM).

More notable recent American ExpreS Company (NYSE:AXP) news were published by: Finance.Yahoo.com which released: “Read This Before Buying American Express Company (NYSE:AXP) Shares - Yahoo Finance” on June 12, 2019, also Seekingalpha.com with their article: “Stocks To Watch: Amazon, Alibaba And Peloton In Focus - Seeking Alpha” published on September 21, 2019, Finance.Yahoo.com published: “Should You Be Tempted To Sell American Express Company (NYSE:AXP) Because Of Its P/E Ratio? - Yahoo Finance” on August 29, 2019. More interesting news about American ExpreS Company (NYSE:AXP) were released by: Finance.Yahoo.com and their article: “A Look At American Express Company’s (NYSE:AXP) Exceptional Fundamentals - Yahoo Finance” published on May 09, 2019 as well as Finance.Yahoo.com‘s news article titled: “Kraft Shares Tumble as Buffett Partner 3G Capital Cuts Stake - Yahoo Finance” with publication date: September 18, 2019.

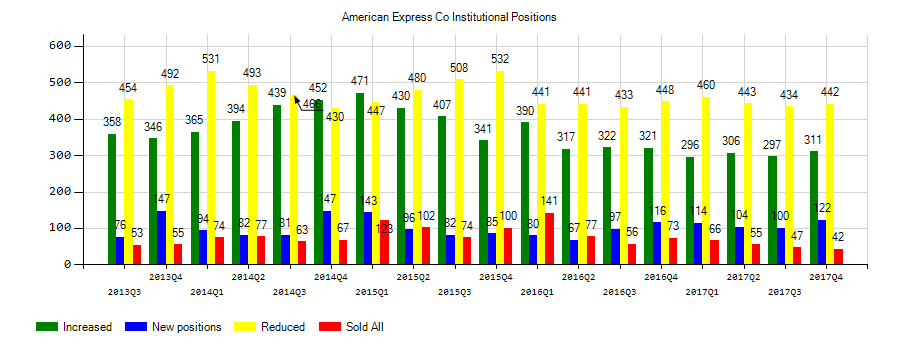

Investors sentiment decreased to 0.85 in Q2 2019. Its down 0.11, from 0.96 in 2019Q1. It dropped, as 49 investors sold AXP shares while 447 reduced holdings. 106 funds opened positions while 314 raised stakes. 679.88 million shares or 0.12% less from 680.70 million shares in 2019Q1 were reported. Silvercrest Asset Mngmt Ltd Liability Corp invested in 101,316 shares or 0.12% of the stock. Ny State Common Retirement Fund owns 1.73M shares. Allsquare Wealth Management Limited Co has 410 shares for 0.04% of their portfolio. Provise Mgmt Ltd stated it has 61,325 shares or 1.01% of all its holdings. Moreover, Benjamin F Edwards & Company Inc has 0.22% invested in American ExpreS Company (NYSE:AXP) for 21,208 shares. Brinker Capital Incorporated has 0.01% invested in American ExpreS Company (NYSE:AXP) for 1,800 shares. Moreover, Grassi Investment Mngmt has 0.42% invested in American ExpreS Company (NYSE:AXP) for 23,050 shares. Toth Advisory Corporation reported 2,159 shares or 0.06% of all its holdings. Qs Limited Liability owns 11,505 shares or 0.02% of their US portfolio. Mount Vernon Assoc Incorporated Md reported 3.09% of its portfolio in American ExpreS Company (NYSE:AXP). Griffin Asset Management holds 1.01% or 64,604 shares in its portfolio. Ballentine Ltd Limited Liability Company, a Massachusetts-based fund reported 6,115 shares. Regentatlantic Cap Limited Liability Corporation owns 0.05% invested in American ExpreS Company (NYSE:AXP) for 5,562 shares. Nomura stated it has 0.01% in American ExpreS Company (NYSE:AXP). 3,479 are owned by Central Commercial Bank And Tru.

Analysts await American ExpreS Company (NYSE:AXP) to report earnings on October, 17. They expect $2.08 earnings per share, up 10.64% or $0.20 from last year’s $1.88 per share. AXP’s profit will be $1.73 billion for 14.04 P/E if the $2.08 EPS becomes a reality. After $2.07 actual earnings per share reported by American ExpreS Company for the previous quarter, Wall Street now forecasts 0.48% EPS growth.

Investors sentiment increased to 0.97 in Q2 2019. Its up 0.05, from 0.92 in 2019Q1. It increased, as 77 investors sold BA shares while 562 reduced holdings. 131 funds opened positions while 487 raised stakes. 335.44 million shares or 1.17% less from 339.40 million shares in 2019Q1 were reported. Wedge Management L Limited Partnership Nc stated it has 0% of its portfolio in The Bcing Company (NYSE:BA). The New York-based Overbrook Mngmt Corporation has invested 1.52% in The Bcing Company (NYSE:BA). Fisher Asset Mgmt Limited Liability accumulated 270,316 shares. Mai Cap Mngmt, a Ohio-based fund reported 58,441 shares. Raab & Moskowitz Asset Mngmt invested in 11,859 shares or 1.91% of the stock. Bw Gestao De Investimentos Ltda has 0.75% invested in The Bcing Company (NYSE:BA). Professional Advisory invested in 0.25% or 3,590 shares. Moreover, Comm State Bank has 0.47% invested in The Bcing Company (NYSE:BA) for 114,369 shares. Bradley Foster & Sargent Ct holds 0.11% of its portfolio in The Bcing Company (NYSE:BA) for 9,013 shares. San Francisco Sentry Inv Gp (Ca) invested in 3,652 shares. Chatham Gru holds 2.08% in The Bcing Company (NYSE:BA) or 22,709 shares. Fcg Advsr Ltd Liability holds 0.1% of its portfolio in The Bcing Company (NYSE:BA) for 838 shares. Biltmore Wealth Mngmt Limited holds 0.1% of its portfolio in The Bcing Company (NYSE:BA) for 555 shares. State Common Retirement Fund stated it has 0.58% in The Bcing Company (NYSE:BA). Eaton Vance Mgmt has invested 1.08% in The Bcing Company (NYSE:BA).

Analysts await The Bcing Company (NYSE:BA) to report earnings on October, 23. They expect $2.33 EPS, down 34.92% or $1.25 from last year’s $3.58 per share. BA’s profit will be $1.31B for 40.71 P/E if the $2.33 EPS becomes a reality. After $2.92 actual EPS reported by The Bcing Company for the previous quarter, Wall Street now forecasts -20.21% negative EPS growth.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.