Mastrapasqua Asset Management Inc decreased Microsoft Corp (MSFT) stake by 1.77% reported in 2019Q2 SEC filing. Mastrapasqua Asset Management Inc sold 3,437 shares as Microsoft Corp (MSFT)’s stock rose 6.56%. The Mastrapasqua Asset Management Inc holds 190,236 shares with $25.48M value, down from 193,673 last quarter. Microsoft Corp now has $ valuation. The stock increased 1.35% or $1.84 during the last trading session, reaching $138.12. About 23.84 million shares traded. Microsoft Corporation (NASDAQ:MSFT) has risen 29.33% since October 6, 2018 and is uptrending. It has outperformed by 29.33% the S&P500. Some Historical MSFT News: 14/03/2018 - Terrestrial Energy Signs Fuel Testing Contract with European Commission Joint Research Centre; 05/03/2018 - MICROSOFT: TEAM INVESTIGATING, WORKING TO MITIGATE; 12/04/2018 - Octopai One of Nine Innovative Cloud-Based Startups Selected for Microsoft ScaleUp 2018; 11/04/2018 - MSFT BEGINS NEW EU PARENTAL VERIFICATIONS FOR CHILDREN ACCOUNTS; 08/05/2018 - Microsoft CEO Satya Nadella says that despite threats of a trade war, the relationship between China and the U.S. will define the next 30 years; 26/04/2018 - MICROSOFT - QTRLY DILUTED EARNINGS PER SHARE WAS $0.95 AND INCREASED 36%; 23/05/2018 - The Morning Download: Microsoft, Google Reveal AI Efforts to Go ‘Full Duplex’; 26/04/2018 - Microsoft earnings press release available on Investor Relations website; 27/04/2018 - MICROSOFT SAYS SUPPORTS LEGITIMATE REFURBISHERS & RECYCLERS; 02/05/2018 - DELL, MICROSOFT PARTNER TO OFFER IOT SOLUTIONS FOR BUSINESSES

Analysts expect Aptose Biosciences Inc. (NASDAQ:APTO) to report $-0.13 EPS on November, 5.They anticipate $0.03 EPS change or 18.75% from last quarter’s $-0.16 EPS. After having $-0.13 EPS previously, Aptose Biosciences Inc.’s analysts see 0.00% EPS growth. The stock increased 5.83% or $0.12 during the last trading session, reaching $2.18. About 321,985 shares traded or 9.38% up from the average. Aptose Biosciences Inc. (NASDAQ:APTO) has declined 12.80% since October 6, 2018 and is downtrending. It has underperformed by 12.80% the S&P500. Some Historical APTO News: 17/05/2018 - Aptose to Present New CG’806 Data at the 23rd Congress of the European Hematology Association; 16/04/2018 - OHSU and Aptose Present New CG’806 Preclinical Data at 2018 AACR Annual Meeting; 31/05/2018 - APTOSE Enters into US$20 Million Common Share Purchase Agreement with Aspire Capital Fund, LLC; 16/04/2018 - Aptose Presents New Preclinical Data on CG’806 Pan-FLT3/ Pan-BTK Inhibitor at 2018 AACR Annual Meeting; 07/05/2018 - APTOSE BIOSCIENCES INC - CO OWNS GLOBAL RIGHTS TO DEVELOP AND COMMERCIALIZE CG-806 FOR ALL INDICATIONS OUTSIDE OF KOREA AND CHINA - LICENSED TERRITORY; 17/04/2018 - Aptose Presents Preclinical Data on APTO-253 at 2018 AACR Annual Meeting; 31/05/2018 - APTOSE Enters Into US$20 Million Common Share-Purchase Agreement With Aspire Cap Fund LLC; 07/05/2018 - APTOSE BIOSCIENCES- CRYSTALGENOMICS ELIGIBLE FOR REGULATORY AND SALES MILESTONE PAYMENTS, AS WELL AS ROYALTIES ON PRODUCT SALES IN LICENSED TERRITORY; 25/04/2018 - Aptose Biosciences Board of Directors Now Includes Seven Members; 28/03/2018 - APTOSE BIOSCIENCES INC - NEW AT-THE-MARKET FACILITY REPLACES PREVIOUS ATM THAT EXPIRED IN DECEMBER 2017

More notable recent Aptose Biosciences Inc. (NASDAQ:APTO) news were published by: Benzinga.com which released: “22 Healthcare Stocks Moving In Tuesday’s Pre-Market Session - Benzinga” on September 10, 2019, also Finance.Yahoo.com with their article: “Aptose to Participate in Oppenheimer Fall Summit Focused on Specialty Pharma and Rare Disease Companies - Yahoo Finance” published on September 16, 2019, Globenewswire.com published: “Aptose to Present at the Jefferies 2019 Healthcare Conference - GlobeNewswire” on May 31, 2019. More interesting news about Aptose Biosciences Inc. (NASDAQ:APTO) were released by: Globenewswire.com and their article: “Aptose Biosciences Establishes New At-The-Market Facility - GlobeNewswire” published on May 24, 2019 as well as Globenewswire.com‘s news article titled: “Aptose Announces Proposed Public Offering of Common Shares - GlobeNewswire” with publication date: May 29, 2019.

Aptose Biosciences Inc., a clinical-stage biotechnology company, discovers and develops personalized therapies addressing unmet medical needs in oncology in Canada. The company has market cap of $130.50 million. The Company’s lead clinical program is APTO-253, which is a Phase I clinical trial for the treatment of patients with relapsed or refractory hematologic malignancies. It currently has negative earnings. The firm has an agreement with CrystalGenomics, Inc. to research, develop, and commercialize CG026806, a non-covalent small molecule therapeutic agent, which is in preclinical stage for the treatment of acute myeloid leukemia and chronic lymphocytic leukemia/mantle cell lymphoma.

More notable recent Microsoft Corporation (NASDAQ:MSFT) news were published by: Finance.Yahoo.com which released: “Here is the Second Most Popular Stock Among Hedge Funds - Yahoo Finance” on October 01, 2019, also Nasdaq.com with their article: “Buy Microsoft (MSFT) Stock at Highs for More than Dividend and Buybacks - Nasdaq” published on September 19, 2019, Seekingalpha.com published: “Microsoft’s Focus And Stock Price Are In The Clouds - Seeking Alpha” on October 04, 2019. More interesting news about Microsoft Corporation (NASDAQ:MSFT) were released by: Seekingalpha.com and their article: “Microsoft Could See Multiple Expansion On Cloud Growth - Seeking Alpha” published on October 01, 2019 as well as Fool.com‘s news article titled: “Microsoft’s 2 Biggest Announcements on Wednesday - The Motley Fool” with publication date: October 03, 2019.

Analysts await Microsoft Corporation (NASDAQ:MSFT) to report earnings on October, 23. They expect $1.24 earnings per share, up 8.77% or $0.10 from last year’s $1.14 per share. After $1.37 actual earnings per share reported by Microsoft Corporation for the previous quarter, Wall Street now forecasts -9.49% negative EPS growth.

Among 15 analysts covering Microsoft (NASDAQ:MSFT), 13 have Buy rating, 1 Sell and 1 Hold. Therefore 87% are positive. Microsoft has $16300 highest and $90 lowest target. $149.53’s average target is 8.26% above currents $138.12 stock price. Microsoft had 24 analyst reports since April 12, 2019 according to SRatingsIntel. The firm has “Outperform” rating by Credit Suisse given on Friday, July 19. KeyBanc Capital Markets maintained Microsoft Corporation (NASDAQ:MSFT) rating on Friday, July 19. KeyBanc Capital Markets has “Overweight” rating and $15500 target. The stock of Microsoft Corporation (NASDAQ:MSFT) earned “Overweight” rating by Barclays Capital on Thursday, April 25. The stock has “Buy” rating by Deutsche Bank on Wednesday, June 19. The stock has “Underperform” rating by Jefferies on Tuesday, June 25. Morgan Stanley maintained the stock with “Overweight” rating in Thursday, April 25 report. The firm has “Overweight” rating by Morgan Stanley given on Friday, July 19. As per Thursday, April 25, the company rating was maintained by Nomura. Raymond James maintained Microsoft Corporation (NASDAQ:MSFT) rating on Friday, July 19. Raymond James has “Strong Buy” rating and $16300 target. Stifel Nicolaus maintained Microsoft Corporation (NASDAQ:MSFT) on Friday, July 19 with “Buy” rating.

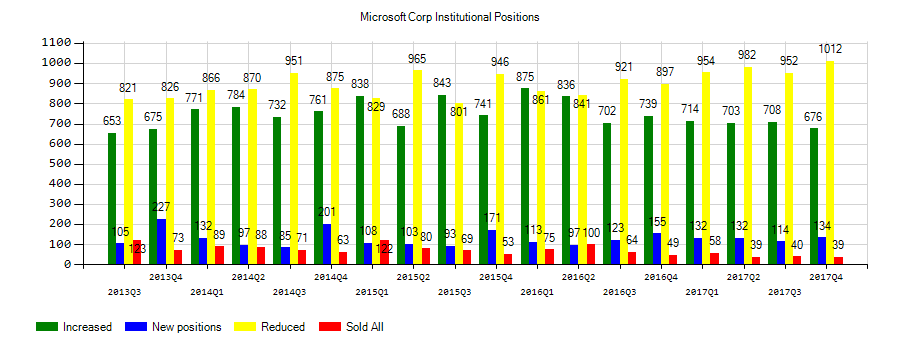

Investors sentiment decreased to 0.77 in Q2 2019. Its down 0.14, from 0.91 in 2019Q1. It turned negative, as 47 investors sold MSFT shares while 999 reduced holdings. 139 funds opened positions while 664 raised stakes. 5.28 billion shares or 2.38% less from 5.41 billion shares in 2019Q1 were reported. Plancorp Limited Com has 1.38% invested in Microsoft Corporation (NASDAQ:MSFT) for 26,048 shares. Texas Permanent School Fund holds 1.48 million shares or 3.08% of its portfolio. Bollard Limited Liability invested 1.36% in Microsoft Corporation (NASDAQ:MSFT). Northstar Investment Advsrs reported 156,677 shares stake. Paradigm Financial Ltd reported 0.3% of its portfolio in Microsoft Corporation (NASDAQ:MSFT). Fcg Ltd Liability Corp holds 24,656 shares or 1.04% of its portfolio. Haverford Financial Svcs holds 3.78% or 81,173 shares in its portfolio. Massachusetts-based Choate Inv Advsrs has invested 0.97% in Microsoft Corporation (NASDAQ:MSFT). Prelude Mgmt Ltd has 16,279 shares for 0.11% of their portfolio. Moreover, Harvest Capital Inc has 0.12% invested in Microsoft Corporation (NASDAQ:MSFT) for 3,206 shares. 11,601 were accumulated by Gemmer Asset Mgmt Lc. Highland Capital Mngmt Lc has 434,237 shares. Tributary Ltd Liability invested in 0.16% or 17,370 shares. Charles Schwab Investment Advisory has invested 0.7% in Microsoft Corporation (NASDAQ:MSFT). Pathstone Family Office Ltd Liability Corporation reported 34,626 shares or 0.55% of all its holdings.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.