Lonestar Capital Management Llc increased Pg&E Corp (PCG) stake by 45.45% reported in 2019Q2 SEC filing. Lonestar Capital Management Llc acquired 100,000 shares as Pg&E Corp (PCG)’s stock declined 16.45%. The Lonestar Capital Management Llc holds 320,000 shares with $7.33M value, up from 220,000 last quarter. Pg&E Corp now has $5.16B valuation. The stock decreased 2.45% or $0.24 during the last trading session, reaching $9.76. About 2.79 million shares traded. PG&E Corporation (NYSE:PCG) has declined 58.05% since October 1, 2018 and is downtrending. It has underperformed by 58.05% the S&P500. Some Historical PCG News: 25/05/2018 - PG&E Notes Vegetation Management Program, Enhanced Measures Implemented After Jaunary 2014 Drought Proclamation; 22/05/2018 - Bernie Sanders Headlines Rage For Justice Awards In Honor Of Retiring Nurses Leader RoseAnn DeMoro; PG&E Fire Watchdog Frank Pi; 16/04/2018 - PACIFIC GAS AND ELECTRIC CO SAYS OBTAINED A $350 MLN UNSECURED TERM LOAN UNDER A LOAN AGREEMENT - SEC FILING; 21/05/2018 - MOODY’S DOWNGRADES THE RATING ON CROCKETT COGENERATION’S SENIOR SECURED BONDS TO B1; OUTLOOK REVISED TO STABLE; 22/05/2018 - CORRECTING and REPLACING PG&E Highlights Importance of Reforming Wildfire Liability Policies as Part of California’s Focus on; 03/05/2018 - PG&E FILED TO RECOVER EXCESSIVE FIRE INSURANCE PREMIUMS; 22/03/2018 - PG&E COMMENTS IN EMAIL STATEMENT; 17/05/2018 - PG&E `Wishfully Thinking’ It Can Toss Key Claim Over Wildfires; 11/04/2018 - Cal EMA Spills: SPILL Report - PG&E - 04/11/2018 12:10 PM; 14/05/2018 - Tobam Adds Expedia, Exits Dr Pepper Snapple, Buys More PG&E: 13F

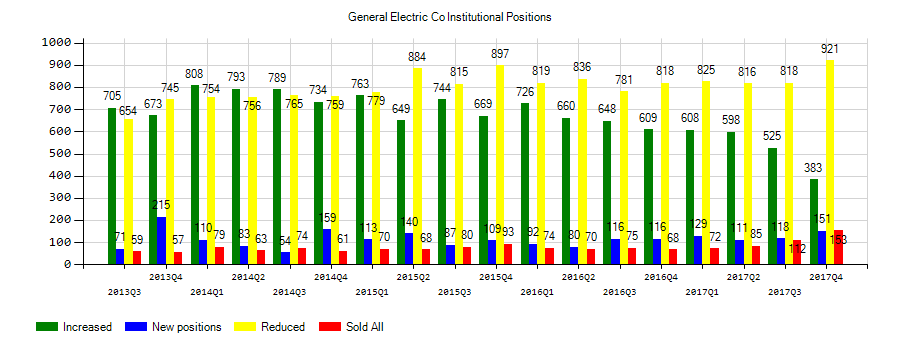

Analysts expect General Electric Company (NYSE:GE) to report $0.13 EPS on October, 29.They anticipate $0.01 EPS change or 7.14% from last quarter’s $0.14 EPS. GE’s profit would be $1.13B giving it 16.58 P/E if the $0.13 EPS is correct. After having $0.17 EPS previously, General Electric Company’s analysts see -23.53% EPS growth. The stock decreased 3.58% or $0.32 during the last trading session, reaching $8.62. About 28.17M shares traded. General Electric Company (NYSE:GE) has declined 17.39% since October 1, 2018 and is downtrending. It has underperformed by 17.39% the S&P500. Some Historical GE News: 14/03/2018 - GE begins flight trials for GE9X engine after delays; 21/05/2018 - WABTEC - WABTEC CHAIRMAN, ALBERT J. NEUPAVER HAS BEEN RE-APPOINTED EXECUTIVE CHAIRMAN; 23/05/2018 - GE CEO JOHN FLANNERY COMMENTS AT EPG CONFERENCE; 04/04/2018 - GE’s Advanced Gas Path Upgrades Generate $775 Million in Total Customer Value Annually; 16/05/2018 - CORRECT: GE ANNOUNCES NEW AGP ORDER W/ OHGISHIMA POWER; 17/04/2018 - Zinc and GE Digital Announce Integrated Solution for Contextual, Real-Time Communication in the Field; 18/04/2018 - French investigators to assist probe into Southwest Airlines engine explosion; 30/05/2018 - WANMA TECHNOLOGY 300698.SZ SAYS UNIT SIGNS STRATEGIC AGREEMENT WITH GENERAL ELECTRIC’S GE.N MEDICAL UNIT IN CHINA ON BREAST CANCER SCREENING SOLUTIONS; 16/05/2018 - GENERAL ELECTRIC CO - GE ANNOUNCES THREE NEW AGP ORDERS GLOBALLY WITH SAUDI CEMENT, DUBAI ELECTRICITY & WATER AUTHORITY AND OHGISHMA POWER CO LTD; 24/05/2018 - Gloom for GE investors as hopes of quick fix fade

Among 3 analysts covering Pacific Gas & Electric (NYSE:PCG), 0 have Buy rating, 0 Sell and 3 Hold. Therefore 0 are positive. Pacific Gas & Electric has $2300 highest and $400 lowest target. $16’s average target is 63.93% above currents $9.76 stock price. Pacific Gas & Electric had 11 analyst reports since May 11, 2019 according to SRatingsIntel. The firm has “Equal-Weight” rating by Morgan Stanley given on Monday, July 15. As per Monday, August 19, the company rating was downgraded by Citigroup. Citigroup upgraded PG&E Corporation (NYSE:PCG) on Monday, September 16 to “Neutral” rating. UBS maintained the shares of PCG in report on Tuesday, August 20 with “Neutral” rating. The firm has “Hold” rating by UBS given on Friday, June 21.

More notable recent PG&E Corporation (NYSE:PCG) news were published by: Seekingalpha.com which released: “PG&E formalizes deal to resolve wildfire claims - Seeking Alpha” on September 23, 2019, also Seekingalpha.com with their article: “PG&E Finally Filed Their Ch.11 Reorganization Plan - Seeking Alpha” published on September 10, 2019, Seekingalpha.com published: “PG&E noteholders ready to invest $29.2B in reorg plan - Seeking Alpha” on September 26, 2019. More interesting news about PG&E Corporation (NYSE:PCG) were released by: Fool.com and their article: “Where Will PG&E Be in 10 Years? - The Motley Fool” published on September 21, 2019 as well as Finance.Yahoo.com‘s news article titled: “Why Shares of PG&E Lost Nearly Half Their Value in August - Yahoo Finance” with publication date: September 07, 2019.

Investors sentiment increased to 1.02 in 2019 Q2. Its up 0.65, from 0.37 in 2019Q1. It improved, as 39 investors sold PCG shares while 84 reduced holdings. 56 funds opened positions while 70 raised stakes. 438.18 million shares or 4.10% more from 420.90 million shares in 2019Q1 were reported. Moreover, Nomura Inc has 0.04% invested in PG&E Corporation (NYSE:PCG). Glenmede Trust Na holds 1,050 shares. San Francisco Sentry Investment Group (Ca) reported 0% of its portfolio in PG&E Corporation (NYSE:PCG). 1.82 million are owned by Jennison Assoc Limited Liability Com. Clearbridge Invs Lc owns 204 shares for 0% of their portfolio. Guggenheim Capital Limited Liability Corp owns 108,610 shares. Fmr Limited Liability Com accumulated 12.56 million shares or 0.03% of the stock. Principal Fincl Grp Inc owns 37,085 shares or 0% of their US portfolio. Amer Century Inc reported 106,633 shares or 0% of all its holdings. Destination Wealth Mngmt holds 0% or 1,203 shares in its portfolio. Next Financial Grp Inc Inc accumulated 0% or 1,896 shares. Bessemer Gru Inc holds 0% or 12,822 shares. 5,592 were reported by Exane Derivatives. Legal And General Group Incorporated Pcl holds 0.04% or 2.98 million shares in its portfolio. Mechanics Bank & Trust Department has invested 0.08% in PG&E Corporation (NYSE:PCG).

Since May 23, 2019, it had 7 insider purchases, and 0 selling transactions for $5.01 million activity. On Thursday, May 23 LAVIZZO-MOUREY RISA J bought $97,500 worth of General Electric Company (NYSE:GE) or 10,000 shares. $50,700 worth of stock was bought by Seidman Leslie on Friday, August 23. $994,752 worth of General Electric Company (NYSE:GE) was bought by Cox L Kevin. $3.00 million worth of General Electric Company (NYSE:GE) was bought by CULP H LAWRENCE JR. Another trade for 10,000 shares valued at $88,300 was bought by Timko Thomas S. Another trade for 34,836 shares valued at $279,036 was made by Strazik Scott on Thursday, August 15. HORTON THOMAS W also bought $498,337 worth of General Electric Company (NYSE:GE) shares.

More notable recent General Electric Company (NYSE:GE) news were published by: Fool.com which released: “Why This General Electric News Is Huge for CEO Larry Culp - The Motley Fool” on September 29, 2019, also Bizjournals.com with their article: “Culp hits one-year mark at GE: What’s happened, what’s ahead - Boston Business Journal” published on September 30, 2019, Investorplace.com published: “General Electric Stock Is on a Long, Slow Road to Redemption - Investorplace.com” on September 30, 2019. More interesting news about General Electric Company (NYSE:GE) were released by: Investorplace.com and their article: “It All Comes Down to Trust for General Electric Stock - Investorplace.com” published on September 27, 2019 as well as Fool.com‘s news article titled: “Why General Electric Is Still a Risky Conglomerate to Own - The Motley Fool” with publication date: September 25, 2019.

General Electric Company operates as an infrastructure and technology firm worldwide. The company has market cap of $75.23 billion. The Company’s Power segment offers gas and steam power systems; maintenance, service, and upgrade solutions; distributed power gas engines; water treatment, wastewater treatment, and process system solutions; and nuclear reactors, fuels, and support services. It currently has negative earnings. The companyÂ’s Renewable Energy segment provides wind turbine platforms, and hardware and software; onshore and offshore wind turbines; and solutions, products, and services to hydropower industry.

Among 4 analysts covering General Electric (NYSE:GE), 1 have Buy rating, 1 Sell and 2 Hold. Therefore 25% are positive. General Electric has $14 highest and $5 lowest target. $10.13’s average target is 17.52% above currents $8.62 stock price. General Electric had 8 analyst reports since April 8, 2019 according to SRatingsIntel. The rating was downgraded by UBS on Monday, July 15 to “Neutral”. The rating was downgraded by JP Morgan on Monday, April 8 to “Underweight”. Citigroup maintained General Electric Company (NYSE:GE) on Wednesday, June 19 with “Buy” rating.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.