Analysts expect Werner Enterprises, Inc. (NASDAQ:WERN) to report $0.61 EPS on October, 17.They anticipate $0.05 EPS change or 7.58% from last quarter’s $0.66 EPS. WERN’s profit would be $41.89 million giving it 14.08 P/E if the $0.61 EPS is correct. After having $0.63 EPS previously, Werner Enterprises, Inc.’s analysts see -3.17% EPS growth. The stock decreased 0.03% or $0.01 during the last trading session, reaching $34.35. About 294,627 shares traded. Werner Enterprises, Inc. (NASDAQ:WERN) has risen 2.48% since September 24, 2018 and is uptrending. It has outperformed by 2.48% the S&P500. Some Historical WERN News: 18/03/2018 - IMF’S WERNER: BARRING TRADE WAR, EM COUNTRIES SHOULD BE OK; 19/04/2018 - CORRECT: WERN 1Q EPS 38C, MAY NOT COMPARE WITH EST. 36C; 05/03/2018 Tennessee DOL: Real TN Stories: Cindy Cameron Ogle + Mike Werner; 18/03/2018 - NOT ENOUGH RISK-SHARING IN GLOBAL SAFETY NETWORK: WERNER; 13/03/2018 - Werner Enterprises Earns Four 2017 Carrier Awards; 18/05/2018 - WERNER ENTERPRISES INC - COMPANY CURRENTLY IS UNABLE TO DETERMINE POTENTIAL LIABILITY RELATED TO THE VERDICT; 01/05/2018 - Werner Recognized at Guard and Reserve Event; 19/04/2018 - MARQUEE RESOURCES - SIGNS AGREEMENT WITH MINK CREEK DRILLING; MINK CREEK TO PERFORM DIAMOND DRILLING AND OTHER SERVICES AT WERNER LAKE COBALT PROJECT; 19/04/2018 - WERNER ENTERPRISES INC QTRLY TOTAL REVENUES $562.7 MLN VS $501.2 MLN; 04/04/2018 - Werner Enterprises Opens New Joliet Terminal

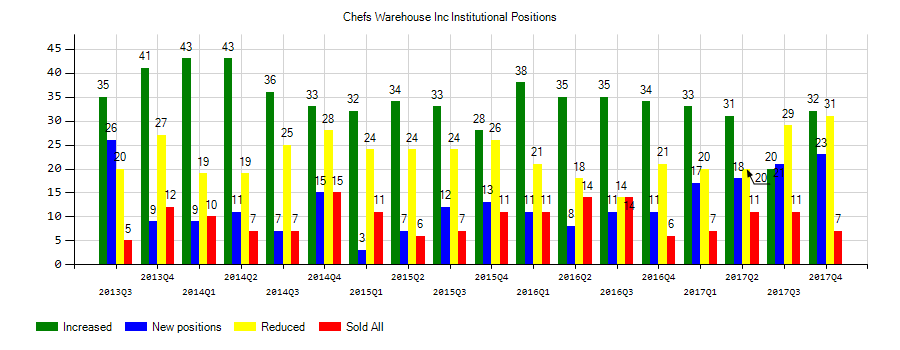

Chefs Warehouse Inc (CHEF) investors sentiment increased to 1.19 in Q2 2019. It’s up 0.26, from 0.93 in 2019Q1. The ratio has improved, as 75 institutional investors opened new and increased positions, while 63 reduced and sold stakes in Chefs Warehouse Inc. The institutional investors in our database now possess: 27.65 million shares, up from 24.34 million shares in 2019Q1. Also, the number of institutional investors holding Chefs Warehouse Inc in top ten positions was flat from 0 to 0 for the same number . Sold All: 22 Reduced: 41 Increased: 52 New Position: 23.

Among 2 analysts covering Werner Enterprises (NASDAQ:WERN), 2 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. Werner Enterprises has $42 highest and $4000 lowest target. $41.33’s average target is 20.32% above currents $34.35 stock price. Werner Enterprises had 6 analyst reports since April 2, 2019 according to SRatingsIntel. Buckingham Research maintained Werner Enterprises, Inc. (NASDAQ:WERN) on Tuesday, April 2 with “Buy” rating. The stock of Werner Enterprises, Inc. (NASDAQ:WERN) earned “Buy” rating by Citigroup on Tuesday, September 3.

Werner Enterprises, Inc., a transportation and logistics company, engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, Canada, China, and Australia. The company has market cap of $2.36 billion. It operates through two divisions, Truckload Transportation Services and Werner Logistics. It has a 13.44 P/E ratio. The Truckload Transportation Services segment operates medium-to-long-haul van fleet, which transports various consumer nondurable products and other commodities in truckload quantities using dry van trailers; the expedited fleet that offers time-sensitive truckload services using driver teams; and regional short-haul fleet, which provides comparable truckload van service in the United States.

Investors sentiment increased to 1.12 in Q2 2019. Its up 0.06, from 1.06 in 2019Q1. It improved, as 18 investors sold Werner Enterprises, Inc. shares while 65 reduced holdings. 38 funds opened positions while 55 raised stakes. 45.70 million shares or 1.49% more from 45.03 million shares in 2019Q1 were reported. Aperio Group Ltd Liability Co holds 0.05% of its portfolio in Werner Enterprises, Inc. (NASDAQ:WERN) for 416,621 shares. Burney reported 15,277 shares. Charles Schwab Mgmt reported 480,289 shares stake. First Advsr Lp, a Illinois-based fund reported 176,317 shares. Creative Planning accumulated 18,660 shares. 10,000 are held by Arrowgrass Cap Prtn (Us) L P. Natl Bank Of Ny Mellon holds 0.02% in Werner Enterprises, Inc. (NASDAQ:WERN) or 2.72 million shares. Keybank National Association Oh owns 35,950 shares or 0.01% of their US portfolio. Numerixs Inv stated it has 2,292 shares or 0.02% of all its holdings. Glenmede Tru Na holds 10,991 shares. State Treasurer State Of Michigan has invested 0% in Werner Enterprises, Inc. (NASDAQ:WERN). Massachusetts-based State Street Corp has invested 0% in Werner Enterprises, Inc. (NASDAQ:WERN). Geode Capital Mngmt Limited Liability Com accumulated 606,817 shares or 0% of the stock. Oregon Employees Retirement Fund has 0.01% invested in Werner Enterprises, Inc. (NASDAQ:WERN). Deutsche Bank & Trust Ag stated it has 0% of its portfolio in Werner Enterprises, Inc. (NASDAQ:WERN).

More notable recent Werner Enterprises, Inc. (NASDAQ:WERN) news were published by: Finance.Yahoo.com which released: “Evaluating Werner Enterprises, Inc.’s (NASDAQ:WERN) Investments In Its Business - Yahoo Finance” on September 23, 2019, also Finance.Yahoo.com with their article: “Werner Enterprises, Inc. (NASDAQ:WERN) Delivered A Better ROE Than Its Industry - Yahoo Finance” published on September 03, 2019, Globenewswire.com published: “Werner Enterprises Earns 2019 Dedicated Carrier of the Year Award - GlobeNewswire” on September 17, 2019. More interesting news about Werner Enterprises, Inc. (NASDAQ:WERN) were released by: Nasdaq.com and their article: “Bullish Two Hundred Day Moving Average Cross - WERN - Nasdaq” published on August 30, 2019 as well as Globenewswire.com‘s news article titled: “Werner Enterprises Celebrates National Truck Driver Appreciation Week - GlobeNewswire” with publication date: September 05, 2019.

Conestoga Capital Advisors Llc holds 1.2% of its portfolio in The Chefs' Warehouse, Inc. for 1.37 million shares. Eagle Boston Investment Management Inc owns 24,475 shares or 0.98% of their US portfolio. Moreover, Aristotle Capital Boston Llc has 0.91% invested in the company for 536,059 shares. The California-based Kayne Anderson Rudnick Investment Management Llc has invested 0.69% in the stock. Monroe Bank & Trust Mi, a Michigan-based fund reported 34,040 shares.

The ChefsÂ’ Warehouse, Inc., together with its subsidiaries, distributes specialty food products in the United States and Canada. The company has market cap of $1.21 billion. The Company’s product portfolio includes approximately 43,000 stock-keeping units comprising specialty food products, such as artisan charcuterie, specialty cheeses, unique oils and vinegars, truffles, caviar, chocolate, and pastry products. It has a 54.43 P/E ratio. The firm also offers a line of center-of-the-plate products, including custom cut beef, seafood, and hormone-free poultry, as well as food products, such as cooking oils, butter, eggs, milk, and flour.

The stock decreased 1.28% or $0.52 during the last trading session, reaching $39.95. About 123,366 shares traded. The Chefs' Warehouse, Inc. (CHEF) has risen 34.82% since September 24, 2018 and is uptrending. It has outperformed by 34.82% the S&P500. Some Historical CHEF News: 09/05/2018 - CHEFS’ WAREHOUSE INC CHEF.O SEES FY 2018 SALES $1.4 BLN TO $1.44 BLN; 09/05/2018 - Chefs’ Warehouse Sees FY18 Sales $1.40B-$1.44B; 11/05/2018 - Elk Creek Partners Buys New 1.3% Position in Chefs’ Warehouse; 14/05/2018 - Chefs’ Warehouse at Bank of Montreal Conference May 17; 09/05/2018 - CHEFS” WAREHOUSE SEES FY ADJ PROFORMA EPS 69C TO 78C, EST. 74C; 20/04/2018 - Chefs’ Warehouse Says Vacant Board Seat Won’t Be Refilled; Board to Be fixed at 10 Directors; 19/03/2018 - Food and Wine: Exclusive: Here Are All the Chefs in ‘Chef’s Table: Pastry’; 09/05/2018 - Chefs’ Warehouse 1Q Adj EPS 3c; 09/05/2018 - Chefs’ Warehouse Sees FY18 EPS 68c-EPS 77c; 20/04/2018 - Chefs’ Warehouse Says John DeBenedetti Has Resigned From Its Board of Directors

Since January 1, 0001, it had 1 insider purchase, and 0 sales for $29,874 activity.

More notable recent The Chefs' Warehouse, Inc. (NASDAQ:CHEF) news were published by: Finance.Yahoo.com which released: “Why The Chefs’ Warehouse, Inc.’s (NASDAQ:CHEF) Return On Capital Employed Might Be A Concern - Yahoo Finance” on September 14, 2019, also Finance.Yahoo.com with their article: “Is Now The Time To Look At Buying The Chefs’ Warehouse, Inc. (NASDAQ:CHEF)? - Yahoo Finance” published on August 27, 2019, Globenewswire.com published: “The Chefs’ Warehouse, Inc. to Present at Upcoming Investor Conferences - GlobeNewswire” on September 09, 2019. More interesting news about The Chefs' Warehouse, Inc. (NASDAQ:CHEF) were released by: Seekingalpha.com and their article: “Chefs’ Warehouse Continues To Grow, But It’s Expensive - Seeking Alpha” published on September 20, 2019 as well as Finance.Yahoo.com‘s news article titled: “Introducing Chefs’ Warehouse (NASDAQ:CHEF), The Stock That Zoomed 121% In The Last Three Years - Yahoo Finance” with publication date: May 29, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.