Analysts expect Bryn Mawr Bank Corporation (NASDAQ:BMTC) to report $0.78 EPS on October, 17.They anticipate $0.06 EPS change or 7.14% from last quarter’s $0.84 EPS. BMTC’s profit would be $15.70M giving it 11.72 P/E if the $0.78 EPS is correct. After having $0.78 EPS previously, Bryn Mawr Bank Corporation’s analysts see 0.00% EPS growth. The stock increased 0.19% or $0.07 during the last trading session, reaching $36.56. About 27,665 shares traded. Bryn Mawr Bank Corporation (NASDAQ:BMTC) has declined 23.94% since September 29, 2018 and is downtrending. It has underperformed by 23.94% the S&P500. Some Historical BMTC News: 01/05/2018 - Bryn Mawr Trust Acquires Domenick & Associates; 19/04/2018 - BRYN MAWR BANK CORP BMTC.O SETS QUARTERLY DIVIDEND OF $0.22/SHR; 20/04/2018 - BRYN MAWR BANK CORP BMTC.O : KBW RAISES TARGET PRICE TO $56 FROM $54; 19/04/2018 - Bryn Mawr Bank 1Q EPS 75c; 02/04/2018 - Local Blogger, Bryn Nowell, Three Time Finalist for International Pet Industry Award; 19/04/2018 - Bryn Mawr Bank 1Q Net Interest Income $37.4 Million; 19/04/2018 - Bryn Mawr Bank 1Q Net $15.3M; 09/04/2018 - Bryn Mawr Bank Closes Below 200-Day Moving Average: Technicals; 05/03/2018 Bryn Mawr Bank Closes Above 50-Day Moving Average: Technicals; 19/04/2018 - DJ Bryn Mawr Bank Corporation, Inst Holders, 1Q 2018 (BMTC)

Kinder Morgan Inc (KMI) investors sentiment decreased to 1.2 in 2019 Q2. It’s down -0.08, from 1.28 in 2019Q1. The ratio dropped, as 385 institutional investors started new or increased equity positions, while 320 decreased and sold their holdings in Kinder Morgan Inc. The institutional investors in our database now possess: 1.34 billion shares, down from 1.36 billion shares in 2019Q1. Also, the number of institutional investors holding Kinder Morgan Inc in top ten equity positions decreased from 43 to 38 for a decrease of 5. Sold All: 42 Reduced: 278 Increased: 294 New Position: 91.

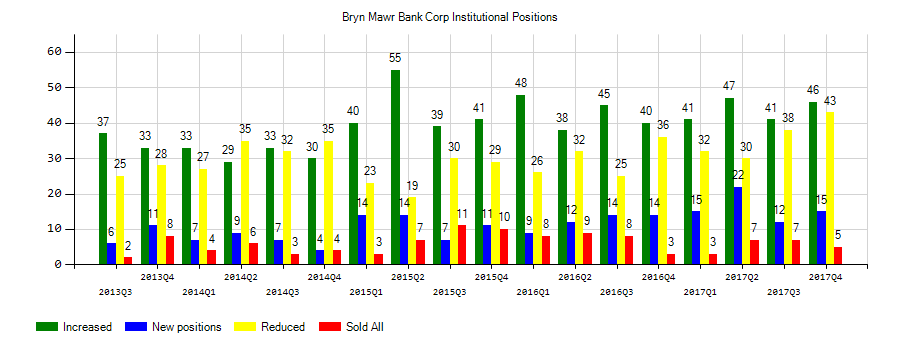

Investors sentiment increased to 1.33 in 2019 Q2. Its up 0.25, from 1.08 in 2019Q1. It is positive, as 11 investors sold Bryn Mawr Bank Corporation shares while 37 reduced holdings. 21 funds opened positions while 43 raised stakes. 14.92 million shares or 0.29% more from 14.88 million shares in 2019Q1 were reported. D E Shaw And Inc has 0% invested in Bryn Mawr Bank Corporation (NASDAQ:BMTC) for 16,111 shares. First Mercantile holds 1,189 shares or 0% of its portfolio. Philadelphia Tru holds 0.4% or 122,865 shares in its portfolio. Bryn Mawr Tru Company owns 96,941 shares or 0.2% of their US portfolio. Alphaone Investment Service Limited Liability Corporation has invested 0.5% in Bryn Mawr Bank Corporation (NASDAQ:BMTC). Coho Prtnrs Ltd invested 0.01% in Bryn Mawr Bank Corporation (NASDAQ:BMTC). Btim, a Massachusetts-based fund reported 220,492 shares. State Board Of Administration Of Florida Retirement Sys, Florida-based fund reported 5,958 shares. Geode Capital Mngmt Ltd Liability Co accumulated 256,920 shares or 0% of the stock. 5,825 are owned by Janney Montgomery Scott Ltd Liability Company. Citadel Advsr Lc accumulated 13,038 shares or 0% of the stock. Parametric Associates Lc accumulated 24,405 shares. Goldman Sachs Group accumulated 0.01% or 623,876 shares. 67,752 are owned by Cadence Capital Mgmt Limited Liability Co. Alps Advsr has 9,958 shares.

Bryn Mawr Bank Corporation operates as the bank holding firm for The Bryn Mawr Trust Company that provides commercial and retail banking services to individuals and businesses. The company has market cap of $736.12 million. It accepts deposit products, such as non-interest-bearing demand deposits, savings, NOW accounts, and market rate accounts. It has a 12.31 P/E ratio. The companyÂ’s loan and lease portfolio comprises commercial and residential mortgage construction, commercial and industrial, and consumer loans, as well as home equity lines and loans; and leasing services.

More notable recent Bryn Mawr Bank Corporation (NASDAQ:BMTC) news were published by: Finance.Yahoo.com which released: “Does Bryn Mawr Bank (NASDAQ:BMTC) Deserve A Spot On Your Watchlist? - Yahoo Finance” on September 20, 2019, also Finance.Yahoo.com with their article: “What To Know Before Buying Bryn Mawr Bank Corporation (NASDAQ:BMTC) For Its Dividend - Yahoo Finance” published on July 09, 2019, Finance.Yahoo.com published: “Do Directors Own Bryn Mawr Bank Corporation (NASDAQ:BMTC) Shares? - Yahoo Finance” on June 12, 2019. More interesting news about Bryn Mawr Bank Corporation (NASDAQ:BMTC) were released by: Globenewswire.com and their article: “Bryn Mawr Trust Updates Web Address to BMT.com - GlobeNewswire” published on June 17, 2019 as well as Globenewswire.com‘s news article titled: “Kathryn Bittner Joins BMT as Senior Vice President and Sales Strategy & Development Manager - GlobeNewswire” with publication date: July 11, 2019.

Richmond Hill Investments Llc holds 15.43% of its portfolio in Kinder Morgan, Inc. for 1.07 million shares. Fpr Partners Llc owns 26.72 million shares or 13.33% of their US portfolio. Moreover, Richmond Hill Investment Co. Lp has 12.02% invested in the company for 396,101 shares. The Pennsylvania-based Quaker Capital Investments Llc has invested 10.08% in the stock. Penn Davis Mcfarland Inc, a Texas-based fund reported 1.08 million shares.

More notable recent Kinder Morgan, Inc. (NYSE:KMI) news were published by: Fool.com which released: “Why These 3 Stocks Anchor My Portfolio - The Motley Fool” on September 28, 2019, also Fool.com with their article: “Better Buy: Kinder Morgan vs. Enterprise Products Partners - The Motley Fool” published on September 21, 2019, Seekingalpha.com published: “The Kinder Buying Spree Resumes - Seeking Alpha” on September 05, 2019. More interesting news about Kinder Morgan, Inc. (NYSE:KMI) were released by: Fool.com and their article: “Why Energy Transfer Investors Should Be Excited About 2020 - Motley Fool” published on September 14, 2019 as well as Seekingalpha.com‘s news article titled: “Workers return to Kinder Morgan’s Elba LNG plant after storm shutdown - Seeking Alpha” with publication date: September 06, 2019.

Kinder Morgan, Inc. operates as an energy infrastructure firm in North America. The company has market cap of $46.79 billion. It operates through Natural Gas Pipelines, CO2, Terminals, Products Pipelines, and Kinder Morgan Canada divisions. It has a 20.71 P/E ratio. The Natural Gas Pipelines segment owns and operates interstate and intrastate natural gas pipeline and storage systems; natural gas and crude oil gathering systems, and natural gas processing and treating facilities; natural gas liquids fractionation facilities and transportation systems; and liquefied natural gas facilities.

The stock increased 0.73% or $0.15 during the last trading session, reaching $20.67. About 7.23 million shares traded. Kinder Morgan, Inc. (KMI) has risen 16.17% since September 29, 2018 and is uptrending. It has outperformed by 16.17% the S&P500. Some Historical KMI News: 19/04/2018 - Canada’s Caisse pension fund reveals stake in Kinder Morgan; 16/05/2018 - KINDER MORGAN CANADA SAYS TALKS ARE ONGOING ON TRANS MOUNTAIN; 19/04/2018 - DJ Kinder Morgan Inc Class P, Inst Holders, 1Q 2018 (KMI); 29/05/2018 - Kinder Morgan: Canada Agreed to Fund Resumption of TMEP Planning and Construction Work; 10/04/2018 - Investors back Kinder Morgan Canada’s Trans Mountain move; 29/05/2018 - ANALYSIS-Pipeline move a risk for Canada’s Trudeau, but inaction worse; 16/05/2018 - Kinder Morgan Has Said Will Scrap Trans Mountain Expansion by May 31 Unless Political Uncertainty Removed; 18/04/2018 - Kinder Morgan Canada’s quarterly profit down 5 pct on lower transported volumes; 29/05/2018 - KINDER MORGAN INC - FOR KMI STILL EXPECT TO MEET OR EXCEED 2018 DISTRIBUTABLE CASH FLOW PER SHARE TARGET; 15/05/2018 - CANADA’S TRUDEAU SAYS LOTS OF FACTORS WILL AFFECT GOVERNMENT’S DECISION ON POSSIBLE AID TO KINDER MORGAN; “EVERYTHING IS ON THE TABLE”

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.