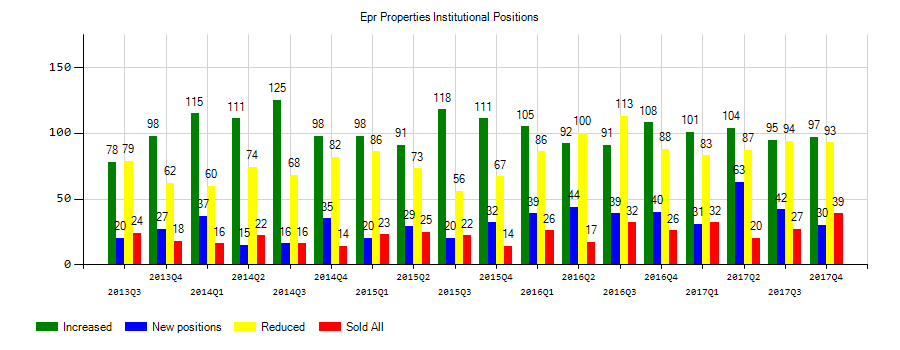

Epr Properties (EPR) investors sentiment decreased to 1.33 in Q1 2019. It’s down -0.08, from 1.41 in 2018Q4. The ratio turned negative, as 161 active investment managers increased and started new equity positions, while 121 cut down and sold holdings in Epr Properties. The active investment managers in our database now own: 62.05 million shares, down from 62.10 million shares in 2018Q4. Also, the number of active investment managers holding Epr Properties in top ten equity positions was flat from 2 to 2 for the same number . Sold All: 27 Reduced: 94 Increased: 108 New Position: 53.

ADT Inc (NYSE:ADT) is expected to pay $0.04 on Oct 2, 2019. (NYSE:ADT) shareholders before Sep 10, 2019 will receive the $0.04 dividend. ADT Inc’s current price of $4.94 translates into 0.71% yield. ADT Inc’s dividend has Sep 11, 2019 as record date. Aug 6, 2019 is the announcement. The stock increased 3.56% or $0.17 during the last trading session, reaching $4.94. About 1.26 million shares traded. ADT Inc. (NYSE:ADT) has declined 27.68% since September 5, 2018 and is downtrending. It has underperformed by 27.68% the S&P500. Some Historical ADT News: 15/03/2018 - ADT 4Q Net $638M; 07/05/2018 - SK Telecom, Macquarie to Pay Carlyle $1.2 Billion for ADT Caps; 15/03/2018 - ADT 4Q Adj Loss/Shr 6c; 08/05/2018 - S&PGRBulletin: SKT Rtg Unaffected By ADT Cap Acquisition; 15/03/2018 - ADT INC 4Q ADJ LOSS/SHR 6.0C; 09/05/2018 - ADT INC - QTRLY NET LOSS PER SHARE BASIC AND DILUTED $0.22; 07/05/2018 - S.KOREA’S SK TELECOM SAYS TO BUY 702 BLN WON WORTH STAKE IN OWNER OF SECURITY FIRM ADT CAPS; 06/03/2018 ADT Announces Appointment of Matt Winter to Board of Directors; 06/03/2018 - ADT Announces Appointment of Matt Winter to Bd of Directors; 13/04/2018 - ADT Brings Home “Installer of the Year” and “Integrated Installation of the Year” Awards for Commercial and Multi-Site Security

More notable recent EPR Properties (NYSE:EPR) news were published by: Finance.Yahoo.com which released: “Why Fundamental Investors Might Love EPR Properties (NYSE:EPR) - Yahoo Finance” on August 15, 2019, also Seekingalpha.com with their article: “EPR Properties prices $500M notes offering - Seeking Alpha” published on August 08, 2019, Businesswire.com published: “EPR Properties Declares Monthly Dividend for Common Shareholders - Business Wire” on August 13, 2019. More interesting news about EPR Properties (NYSE:EPR) were released by: Businesswire.com and their article: “EPR Properties Announces Tender Offer for Any and All of Its Outstanding 5.750% Senior Notes Due 2022 - Business Wire” published on August 08, 2019 as well as Businesswire.com‘s news article titled: “EPR Properties Announces Pricing of Tender Offer for Any and All of Its Outstanding 5.750% Senior Notes Due 2022 - Business Wire” with publication date: August 14, 2019.

The stock increased 0.61% or $0.48 during the last trading session, reaching $79.04. About 421,780 shares traded. EPR Properties (EPR) has risen 12.43% since September 5, 2018 and is uptrending. It has outperformed by 12.43% the S&P500. Some Historical EPR News: 09/04/2018 - Fitch Rates EPR Properties’ Senior Unsecured Bonds due 2028 ‘BBB-‘; 08/05/2018 - EPR Properties Had Seen 2018 Adj FFO/Share $5.23-$5.38; 08/05/2018 - EPR Properties Increases 2018 Earnings Guidance; 29/03/2018 - EPR Properties: Chief Investment Officer Morgan G. Earnest II to Transition to Non-officer Role of Executive Advisor; 07/03/2018 CHINA TO COMPLETE CONSTRUCTION OF FIRST UNIT OF AREVA EPR NUCLEAR REACTOR IN TAISHAN THIS YEAR -ENERGY ADMINISTRATION; 22/05/2018 - SIX FLAGS ENTERTAINMENT - ENTERED PURCHASE AGREEMENT WITH PREMIER PARKS’ AFFILIATES TO BUY LEASE RIGHTS TO OPERATE FIVE PARKS OWNED BY EPR PROPERTIES; 29/03/2018 - EPR Properties Announces Executive Transition; 08/05/2018 - EPR Properties 1Q Adj FFO/Share $1.26; 08/05/2018 - EPR Properties Backs 2018 Investment Spending $400M-$700M; 21/05/2018 - EPR PROPERTIES EPR.N : BOFA MERRILL RAISES PRICE OBJECTIVE TO $62.25 FROM $58

Legg Mason Inc. holds 4.2% of its portfolio in EPR Properties for 726 shares. Denali Advisors Llc owns 146,700 shares or 1.69% of their US portfolio. Moreover, Torch Wealth Management Llc has 1.48% invested in the company for 31,105 shares. The Ohio-based Randolph Co Inc has invested 1.41% in the stock. Wedge Capital Management L L P Nc, a North Carolina-based fund reported 1.60 million shares.

EPR Properties is a real estate investment trust. The company has market cap of $6.13 billion. It invests in the real estate markets of United States and Canada. It has a 23.34 P/E ratio. The firm develops, owns, leases and finances properties in select market divisions primarily related to entertainment, education and recreation.

Analysts await EPR Properties (NYSE:EPR) to report earnings on November, 4. They expect $1.35 earnings per share, down 14.56% or $0.23 from last year’s $1.58 per share. EPR’s profit will be $104.70M for 14.64 P/E if the $1.35 EPS becomes a reality. After $1.36 actual earnings per share reported by EPR Properties for the previous quarter, Wall Street now forecasts -0.74% negative EPS growth.

More notable recent ADT Inc. (NYSE:ADT) news were published by: Finance.Yahoo.com which released: “Why Shares of ADT Are Down 10% Today - Yahoo Finance” on August 07, 2019, also Globenewswire.com with their article: “ADT Reports Second Quarter 2019 Results NYSE:ADT - GlobeNewswire” published on August 06, 2019, Finance.Yahoo.com published: “ADT Inc. (ADT) Q2 2019 Earnings Call Transcript - Yahoo Finance” on August 07, 2019. More interesting news about ADT Inc. (NYSE:ADT) were released by: Seekingalpha.com and their article: “ADT: Not Cheap Enough - Seeking Alpha” published on August 28, 2019 as well as Gurufocus.com‘s news article titled: “Value Idea Contest: ADT, a Distressed Play on the Traditional Security Industry - GuruFocus.com” with publication date: August 25, 2019.

Among 6 analysts covering ADT (NYSE:ADT), 4 have Buy rating, 0 Sell and 2 Hold. Therefore 67% are positive. ADT has $12 highest and $700 lowest target. $9.71’s average target is 96.56% above currents $4.94 stock price. ADT had 8 analyst reports since March 13, 2019 according to SRatingsIntel. The stock of ADT Inc. (NYSE:ADT) earned “Buy” rating by RBC Capital Markets on Tuesday, March 12. The stock of ADT Inc. (NYSE:ADT) has “Buy” rating given on Monday, March 11 by Barclays Capital. The rating was downgraded by Morgan Stanley to “Equal-Weight” on Monday, May 13. The stock of ADT Inc. (NYSE:ADT) has “Outperform” rating given on Thursday, August 8 by Imperial Capital. The firm has “Buy” rating by Morgan Stanley given on Wednesday, March 13. The firm has “Buy” rating by Credit Suisse given on Tuesday, March 12. Imperial Capital maintained ADT Inc. (NYSE:ADT) rating on Friday, March 15. Imperial Capital has “Buy” rating and $12 target. Citigroup downgraded ADT Inc. (NYSE:ADT) on Wednesday, March 13 to “Neutral” rating.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.