Aflac Inc (NYSE:AFL) is expected to pay $0.27 on Sep 3, 2019. (NYSE:AFL) shareholders before Aug 20, 2019 will receive the $0.27 dividend. Aflac Inc’s current price of $52.88 translates into 0.51% yield. Aflac Inc’s dividend has Aug 21, 2019 as record date. Jul 25, 2019 is the announcement. The stock increased 1.48% or $0.77 during the last trading session, reaching $52.88. About 2.90M shares traded. Aflac Incorporated (NYSE:AFL) has risen 13.62% since August 9, 2018 and is uptrending. It has outperformed by 13.62% the S&P500. Some Historical AFL News: 02/04/2018 - S&PGR Rates Aflac Life Insurance Japan ‘A+’; Otlk Stable; 17/05/2018 - Aflac, Commonwealth Bank of Australia, Google, and Liberty Global Join PegaWorld 2018 Keynote Lineup; 16/04/2018 - S&PGR Revises Aflac Outlook To Pos From Stable, Affirms Rtgs; 17/04/2018 - Country Music Star Chris Young Joins Aflac to Present First-Ever Aflac ACM Lifting Lives Honor for Excellence in Music Therapy; 25/04/2018 - Aflac 1Q Adj EPS $1.05; 03/04/2018 - Aflac Names J. Todd Daniels as EVP; Principal Financial Officer, Aflac Japan and Albert A. Riggieri as SVP, Global Chief Risk Officer and Chief Actuary, Aflac Incorporated; 03/04/2018 - Aflac Names J. Todd Daniels as EVP; Principal Fincl Officer, Aflac Japan and Albert a. Riggieri as SVP, Global Chief Risk Officer and Chief Actuary, Aflac Inc; 25/04/2018 - AFLAC REPORTS 1Q RESULTS, AFFIRMS 2018 OUTLOOK, DECLARES 2Q; 25/04/2018 - AFLAC 1Q ADJ. EPS EX-YEN IMPACT $1.02; 17/05/2018 - Aflac Delivers Contemporary Solutions to Improve Care for Today’s Cancer Patients

Cidara Therapeutics Inc (NASDAQ:CDTX) had an increase of 8.62% in short interest. CDTX’s SI was 949,700 shares in August as released by FINRA. Its up 8.62% from 874,300 shares previously. With 145,400 avg volume, 7 days are for Cidara Therapeutics Inc (NASDAQ:CDTX)’s short sellers to cover CDTX’s short positions. The stock decreased 2.26% or $0.03 during the last trading session, reaching $1.3. About 87,296 shares traded. Cidara Therapeutics, Inc. (NASDAQ:CDTX) has declined 65.37% since August 9, 2018 and is downtrending. It has underperformed by 65.37% the S&P500. Some Historical CDTX News: 21/03/2018 - Cidara Therapeutics Provides Clinical Data Updates for its Lead Antifungal Rezafungin; 21/03/2018 - CDTX: STRIVE PHASE 2 CLINICAL TRIAL CONFIRM POSITIVE EFFICACY; 19/03/2018 - CIDARA THERAPEUTICS - FAVORABLE SAFETY,TOLERABILITY,EFFICACY OBSERVED IN ONCE-WEEKLY ECHINOCANDIN FOR DIFFICULT-TO-TREAT INVASIVE FUNGAL INFECTIONS; 19/03/2018 - CIDARA THERAPEUTICS INC - PHASE 3 STUDIES FOR BOTH TREATMENT AND PREVENTION ON TRACK TO START MID-2018; 19/03/2018 - CIDARA THERAPEUTICS INC - STRIVE MET ALL OF ITS PRIMARY OBJECTIVES; 10/05/2018 - Cidara Therapeutics 1Q Loss $16.7M; 10/05/2018 - Cidara Therapeutics 1Q R&D Expenses $13.2 Million; 04/04/2018 - Cidara Therapeutics to Present Rezafungin Data at the European Congress of Clinical Microbiology and Infectious Diseases 2018; 19/03/2018 - CIDARA THERAPEUTICS-THERE WERE 2 SERIOUS ADVERSE EVENTS POSSIBLY RELATED TO STUDY DRUG: ONE IN GROUP 2, ONE IN GROUP 3; BOTH PATIENTS FULLY RECOVERED; 29/05/2018 - Rounds Report: TransEnterix Rallied While Cidara Enjoyed Significant Insider Purchases

More notable recent Cidara Therapeutics, Inc. (NASDAQ:CDTX) news were published by: Nasdaq.com which released: “Cidara Provides Corporate Update and Reports Second Quarter 2019 Financial Results - Nasdaq” on August 08, 2019, also Seekingalpha.com with their article: “Cidara up 13% on positive rezafungin data - Seeking Alpha” published on July 29, 2019, Finance.Yahoo.com published: “The Week Ahead In Biotech: Focus On Earnings Deluge, Mid-Year Clinical Trial Readouts - Yahoo Finance” on August 03, 2019. More interesting news about Cidara Therapeutics, Inc. (NASDAQ:CDTX) were released by: Benzinga.com and their article: “35 Stocks Moving In Monday’s Pre-Market Session - Benzinga” published on July 29, 2019 as well as Finance.Yahoo.com‘s news article titled: “Imagine Owning Cidara Therapeutics (NASDAQ:CDTX) And Trying To Stomach The 85% Share Price Drop - Yahoo Finance” with publication date: June 19, 2019.

Cidara Therapeutics, Inc., a biopharmaceutical company, focuses on the discovery, development, and commercialization of novel anti-infectives for the treatment of various diseases. The company has market cap of $34.12 million. The Company’s lead product candidate is CD101 IV, a novel molecule in the echinocandin class of antifungals for the treatment and prevention of serious, invasive fungal infections. It currently has negative earnings. The firm also develops CD201, a novel bispecific antimicrobial immunotherapy for the treatment of multidrug-resistant gram-negative bacterial infections, including those caused by pathogens harboring the mcr-1 plasmid.

Among 3 analysts covering Cidara Therapeutics (NASDAQ:CDTX), 3 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. Cidara Therapeutics has $15 highest and $7 lowest target. $10.75’s average target is 726.92% above currents $1.3 stock price. Cidara Therapeutics had 11 analyst reports since February 24, 2019 according to SRatingsIntel. The company was maintained on Thursday, February 28 by Cantor Fitzgerald. On Thursday, March 7 the stock rating was maintained by Cantor Fitzgerald with “Buy”. The stock of Cidara Therapeutics, Inc. (NASDAQ:CDTX) has “Outperform” rating given on Friday, March 1 by Wedbush. As per Friday, March 1, the company rating was maintained by Needham.

Aflac Incorporated, through its subsidiary, American Family Life Assurance Company of Columbus, provides supplemental health and life insurance products. The company has market cap of $39.72 billion. It operates through two divisions, Aflac Japan and Aflac U.S. It has a 12.89 P/E ratio. The Aflac Japan segment offers various voluntary supplemental insurance products, including cancer plans, general medical indemnity plans, medical/sickness riders, care plans, living benefit life plans, ordinary life insurance plans, and annuities in Japan.

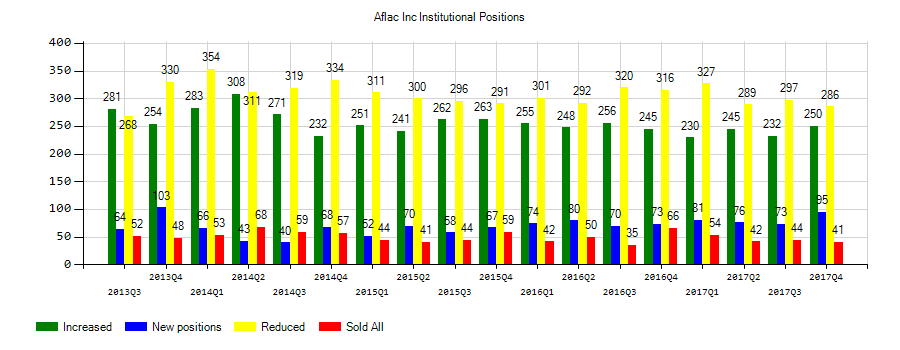

Investors sentiment decreased to 0.81 in Q1 2019. Its down 0.06, from 0.87 in 2018Q4. It dropped, as 42 investors sold Aflac Incorporated shares while 320 reduced holdings. 87 funds opened positions while 206 raised stakes. 471.73 million shares or 2.76% less from 485.14 million shares in 2018Q4 were reported. Nj State Employees Deferred Compensation Plan holds 30,000 shares or 0.27% of its portfolio. Wetherby Asset Mngmt invested 0.14% in Aflac Incorporated (NYSE:AFL). Palisade Cap Mgmt Lc Nj holds 10,800 shares. Nomura Asset Ltd has invested 0.09% of its portfolio in Aflac Incorporated (NYSE:AFL). Guardian Life Of America holds 2,164 shares or 0.01% of its portfolio. Lazard Asset Ltd Com reported 0.03% of its portfolio in Aflac Incorporated (NYSE:AFL). Glenmede Na invested in 0.28% or 1.24 million shares. Bp Pcl reported 134,000 shares. Bokf Na owns 58,196 shares. Nordea Mgmt accumulated 0.19% or 1.85M shares. Telemus Cap Lc has 12,175 shares for 0.05% of their portfolio. Bkd Wealth Advisors Ltd Liability invested in 5,642 shares. Moreover, Aviva Public Limited Co has 0.09% invested in Aflac Incorporated (NYSE:AFL). Cetera Advsr Limited Liability Com reported 0.04% stake. Crawford Counsel Incorporated holds 20,408 shares or 0.03% of its portfolio.

Since March 22, 2019, it had 1 buying transaction, and 0 sales for $99,659 activity. On Friday, March 22 Lloyd Karole bought $99,659 worth of Aflac Incorporated (NYSE:AFL) or 2,000 shares.

Among 4 analysts covering Aflac (NYSE:AFL), 1 have Buy rating, 0 Sell and 3 Hold. Therefore 25% are positive. Aflac had 12 analyst reports since April 5, 2019 according to SRatingsIntel. Raymond James maintained Aflac Incorporated (NYSE:AFL) on Tuesday, April 30 with “Strong Buy” rating. The company was maintained on Tuesday, April 30 by UBS. Raymond James downgraded it to “Outperform” rating and $6200 target in Monday, July 29 report. Morgan Stanley maintained it with “Equal-Weight” rating and $5300 target in Wednesday, July 10 report. The firm earned “Equal-Weight” rating on Wednesday, May 22 by Barclays Capital. On Tuesday, June 18 the stock rating was maintained by Raymond James with “Strong Buy”. Morgan Stanley maintained Aflac Incorporated (NYSE:AFL) rating on Friday, July 26. Morgan Stanley has “Equal-Weight” rating and $5400 target.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.