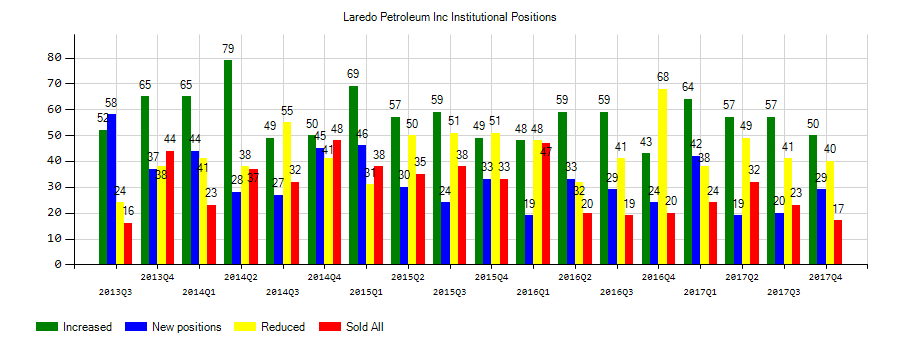

Laredo Petroleum Inc (LPI) investors sentiment decreased to 1 in 2019 Q1. It’s down -0.10, from 1.1 in 2018Q4. The ratio worsened, as 80 hedge funds increased and opened new positions, while 80 decreased and sold their holdings in Laredo Petroleum Inc. The hedge funds in our database now own: 223.03 million shares, down from 229.88 million shares in 2018Q4. Also, the number of hedge funds holding Laredo Petroleum Inc in top ten positions was flat from 2 to 2 for the same number . Sold All: 29 Reduced: 51 Increased: 50 New Position: 30.

Analysts expect Titan Mining Corporation (TSE:TI) to report $-0.03 EPS on August, 13.They anticipate $0.01 EPS change or 25.00% from last quarter’s $-0.04 EPS. After having $-0.01 EPS previously, Titan Mining Corporation’s analysts see 200.00% EPS growth. The stock decreased 11.76% or $0.06 during the last trading session, reaching $0.45. About 66,155 shares traded or 16.53% up from the average. Titan Mining Corporation (TSE:TI) has 0.00% since August 3, 2018 and is . It has by 0.00% the S&P500. Some Historical TI News: 19/04/2018 - URGENT-Hedge fund Elliott issues new attack on Vivendi over Telecom Italia; 25/05/2018 - Italy - Factors to watch on May 25; 06/03/2018 - BRAZIL’S TIM PARTICIPACOES PROJECTS OPERATIONAL EXPENDITURES TO GROW BENEATH INFLATION; 14/03/2018 - Yahoo! UK: Exclusive - Vivendi CEO could suspend powers as Telecom Italia chairman after activist move; 08/03/2018 - TELECOM ITALIA TLIT.Ml : BARCLAYS RAISES TARGET PRICE TO 0.95 EUROS FROM 0.90 EUROS; 09/04/2018 - PROXY ADVISER ISS SAYS TELECOM ITALIA’S TOP SHAREHOLDER VIVENDI “APPEARS TO BE MORE OF A LIABILITY THAN AN ASSET” FOR THE GROUP, HAS NOT HELPED STABILITY; 16/03/2018 - VIVENDI: NOT SURE ELLIOTT PLAN CREATES VALUE FOR TELECOM ITALIA; 26/04/2018 - ELLIOTT ADVISORS (UK) LTD - SENDS LETTER TO TELECOM ITALIA SHAREHOLDERS AHEAD OF MAY 4(TH) VOTE; 24/04/2018 - TELECOM ITALIA SHAREHOLDERS APPROVE APPOINTMENT OF CEO AMOS GENISH AS BOARD DIRECTOR; 13/04/2018 - JP MORGAN HELD A 5.932 PCT INDIRECT STAKE IN TELECOM ITALIA AS OF APRIL 6, WITH NO VOTING RIGHTS - FILING

Titan Mining Corporation, a natural resources company, engages in the acquisition, exploration, and development of mineral properties. The company has market cap of $45.89 million. The firm explores for zinc ores and base metals. It currently has negative earnings. The Company’s principal asset is the Empire State Mine project that is located in Northern New York State, the United States.

Among 2 analysts covering Titan Mining Corporation (TSE:TI), 1 have Buy rating, 0 Sell and 1 Hold. Therefore 50% are positive. Titan Mining Corporation had 3 analyst reports since February 21, 2019 according to SRatingsIntel. The stock of Titan Mining Corporation (TSE:TI) has “Hold” rating given on Thursday, February 21 by Scotia Capital. On Friday, March 22 the stock rating was maintained by Scotia Capital with “Hold”. Canaccord Genuity maintained Titan Mining Corporation (TSE:TI) on Monday, February 25 with “Buy” rating.

More notable recent Titan Mining Corporation (TSE:TI) news were published by: Finance.Yahoo.com which released: “What Happened in the Stock Market Today - Yahoo Finance” on July 24, 2019, also Finance.Yahoo.com with their article: “At US$73.05, Is It Time To Put Albemarle Corporation (NYSE:ALB) On Your Watch List? - Yahoo Finance” published on July 17, 2019, Fool.com published: “Another Semiconductor Bellwether Points to Chip Strength in the Second Half - Motley Fool” on July 26, 2019. More interesting news about Titan Mining Corporation (TSE:TI) were released by: Finance.Yahoo.com and their article: “The Chemours Company Reports Second Quarter 2019 Results - Yahoo Finance” published on August 01, 2019 as well as Seekingalpha.com‘s news article titled: “Chemours misses Q2 number, guides full-year earnings below consensus - Seeking Alpha” with publication date: August 01, 2019.

The stock decreased 3.48% or $0.11 during the last trading session, reaching $3.05. About 9.46M shares traded or 72.01% up from the average. Laredo Petroleum, Inc. (LPI) has declined 65.02% since August 3, 2018 and is downtrending. It has underperformed by 65.02% the S&P500. Some Historical LPI News: 07/05/2018 - LAREDO PETROLEUM INC LPI.N : KLR GROUP RAISES TARGET PRICE BY $1 TO $12; 06/04/2018 - Laredo Petroleum Closes Below 50-Day Moving Average: Technicals; 02/05/2018 - LAREDO PETROLEUM 1Q ADJ EPS 24C, EST. 26C; 03/05/2018 - Laredo Petroleum Volume Jumps More Than Eight Times Average; 26/04/2018 - LPI Capital Bhd 1Q Net MYR72.5M; 12/03/2018 LAREDO PETROLEUM SEES COMPLETING 60-65 NET WELLS IN 2018; 26/04/2018 - LPI CAPITAL 1Q REV. 381.0M RINGGIT; 09/04/2018 - Laredo Petroleum at Non-Deal Roadshow Hosted By KLR Group Today; 12/03/2018 - LAREDO PETROLEUM COMMENTS IN SLIDESHOW; 26/04/2018 - LPI Capital Bhd 1Q Rev MYR381M

More notable recent Laredo Petroleum, Inc. (NYSE:LPI) news were published by: Seekingalpha.com which released: “Laredo Petroleum, Inc. (LPI) CEO Randy Foutch on Q2 2019 Results - Earnings Call Transcript - Seeking Alpha” on August 01, 2019, also Benzinga.com with their article: “16 Energy Stocks Moving In Wednesday’s After-Market Session - Benzinga” published on August 01, 2019, Finance.Yahoo.com published: “Investors Who Bought Laredo Petroleum (NYSE:LPI) Shares Five Years Ago Are Now Down 88% - Yahoo Finance” on May 08, 2019. More interesting news about Laredo Petroleum, Inc. (NYSE:LPI) were released by: Benzinga.com and their article: “Benzinga’s Top Upgrades, Downgrades For July 10, 2019 - Benzinga” published on July 10, 2019 as well as Finance.Yahoo.com‘s news article titled: “Here’s What Hedge Funds Think About Laredo Petroleum Inc (LPI) - Yahoo Finance” with publication date: May 05, 2019.

Sailingstone Capital Partners Llc holds 7.63% of its portfolio in Laredo Petroleum, Inc. for 37.44 million shares. Warburg Pincus Llc owns 51.17 million shares or 5.52% of their US portfolio. Moreover, Ws Management Lllp has 0.67% invested in the company for 3.56 million shares. The Connecticut-based Corecommodity Management Llc has invested 0.66% in the stock. Luminus Management Llc, a New York-based fund reported 2.77 million shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.