Marietta Investment Partners Llc decreased its stake in Fiserv Inc (FISV) by 20.42% based on its latest 2019Q2 regulatory filing with the SEC. Marietta Investment Partners Llc sold 13,000 shares as the company’s stock rose 22.69% . The institutional investor held 50,660 shares of the technology company at the end of 2019Q2, valued at $4.62M, down from 63,660 at the end of the previous reported quarter. Marietta Investment Partners Llc who had been investing in Fiserv Inc for a number of months, seems to be less bullish one the $70.74B market cap company. The stock decreased 0.79% or $0.83 during the last trading session, reaching $104.08. About 6.64M shares traded or 30.33% up from the average. Fiserv, Inc. (NASDAQ:FISV) has risen 41.59% since September 23, 2018 and is uptrending. It has outperformed by 41.59% the S&P500. Some Historical FISV News: 01/05/2018 - Fiserv Continues to Expect Internal Rev Growth of at Least 4.5 % for the Year; 04/04/2018 - Convenient Cardless Access to Cash Available at More Retail ATMs; 24/05/2018 - Fiserv Inc: EBAday 2018; 27/04/2018 - Allied Irish Bank Wins Celent Model Bank Award for Payments Transformation with Dovetail Payments Platform from Fiserv; 06/03/2018 - MGIC Announces Enhancement to Fiserv Inc.’s PCLender; 01/05/2018 - Fiserv 1Q EPS $1.00; 11/04/2018 - Fiserv Names Kim Crawford Goodman Card Services Presdent; 07/05/2018 - Fiserv Introduces Innovation in Early Breach Detection with Rippleshot Partnership; 24/04/2018 - Matt: BREAKING: Sources tell SoccerBallNews™ that Brookfield-based Fiserv, Inc. will purchase naming rights for the new M…; 12/04/2018 - Farmers & Merchants Savings Bank Moves to Fiserv to Drive Growth with an Enhanced Customer Experience

Martin Currie Ltd increased its stake in Align Technology Inc (ALGN) by 5.47% based on its latest 2019Q2 regulatory filing with the SEC. Martin Currie Ltd bought 2,860 shares as the company’s stock declined 34.93% . The institutional investor held 55,167 shares of the health care company at the end of 2019Q2, valued at $15.10M, up from 52,307 at the end of the previous reported quarter. Martin Currie Ltd who had been investing in Align Technology Inc for a number of months, seems to be bullish on the $14.90 billion market cap company. The stock increased 3.43% or $6.18 during the last trading session, reaching $186.54. About 2.80M shares traded or 99.64% up from the average. Align Technology, Inc. (NASDAQ:ALGN) has declined 40.02% since September 23, 2018 and is downtrending. It has underperformed by 40.02% the S&P500. Some Historical ALGN News: 25/04/2018 - Align Technology Says Will Oppose and Defend Itself in Proceedings; 25/04/2018 - ALIGN TECHNOLOGY 1Q NET REV. $436.9M, EST. $408.3M; 23/05/2018 - ALIGN TECHNOLOGY INC - LATEST AUTHORIZATION IS IN ADDITION TO EXISTING $300 MLN AUTHORIZATION ANNOUNCED IN APRIL 2016; 15/05/2018 - Sands Capital Management Buys 3.4% Position in Align Technology; 25/04/2018 - Align Technology 1Q Net $95.9M; 25/04/2018 - Align Technology Provides Update Regarding SmileDirectClub (SDC) Dispute; 25/04/2018 - Align Technology 1Q Rev $436.9M; 25/04/2018 - ALIGN - SDC ENTITIES SEEKING TO ALLOW IT TO HAVE A RIGHT TO REPURCHASE CO’S SDC FINANCIAL MEMBERSHIP INTERESTS FOR PRICE OF CO’S CURRENT CAPITAL ACCOUNT BALANCE; 04/04/2018 - Align Technology Expands lnvisalign® Product Portfolio With New Options and Greater Flexibility to Treat a Broader Range of Patients; 25/04/2018 - ALIGN TECHNOLOGY INC - QTRLY SHR $1.17

More notable recent Fiserv, Inc. (NASDAQ:FISV) news were published by: Nasdaq.com which released: “Why Is Fiserv (FISV) Up 8.6% Since Last Earnings Report? - Nasdaq” on August 24, 2019, also Finance.Yahoo.com with their article: “These 4 Measures Indicate That Fiserv (NASDAQ:FISV) Is Using Debt Reasonably Well - Yahoo Finance” published on September 16, 2019, Finance.Yahoo.com published: “Is Fiserv, Inc.’s (NASDAQ:FISV) High P/E Ratio A Problem For Investors? - Yahoo Finance” on July 17, 2019. More interesting news about Fiserv, Inc. (NASDAQ:FISV) were released by: Seekingalpha.com and their article: “KeyBanc goes bullish on FIS, Fiserv - Seeking Alpha” published on September 05, 2019 as well as Finance.Yahoo.com‘s news article titled: “Read This Before Buying Fiserv, Inc. (NASDAQ:FISV) Shares - Yahoo Finance” with publication date: May 08, 2019.

Investors sentiment decreased to 0.88 in 2019 Q2. Its down 0.10, from 0.98 in 2019Q1. It fall, as 32 investors sold FISV shares while 308 reduced holdings. 75 funds opened positions while 223 raised stakes. 396.87 million shares or 3.10% more from 384.95 million shares in 2019Q1 were reported. Moreover, Cibc World has 0.08% invested in Fiserv, Inc. (NASDAQ:FISV). First Citizens Natl Bank owns 22,652 shares. Great Lakes Advsrs Ltd Liability owns 34,841 shares. Tompkins Fincl accumulated 862 shares. Sumitomo Mitsui Trust Hldgs reported 1.66M shares. Atlanta Cap Mngmt L L C reported 1.84 million shares or 0.75% of all its holdings. Congress Asset Mngmt Com Ma has invested 0.02% in Fiserv, Inc. (NASDAQ:FISV). The New York-based National Asset Mgmt has invested 0.08% in Fiserv, Inc. (NASDAQ:FISV). Fulton Retail Bank Na accumulated 18,407 shares. Parallax Volatility Advisers Limited Partnership has 60 shares. First Business Serv has invested 1.6% in Fiserv, Inc. (NASDAQ:FISV). 15,671 were reported by Argent Trust Co. Hightower Advisors Ltd Liability reported 20,651 shares stake. Wespac Advsrs Limited Liability stated it has 3,207 shares or 0.22% of all its holdings. Kelly Lawrence W & Assocs Ca accumulated 205,967 shares.

Marietta Investment Partners Llc, which manages about $392.24M and $304.00 million US Long portfolio, upped its stake in Paypal Hldgs Inc by 14,658 shares to 60,132 shares, valued at $6.88 million in 2019Q2, according to the filing. It also increased its holding in Church & Dwight Inc (NYSE:CHD) by 10,302 shares in the quarter, for a total of 77,490 shares, and has risen its stake in Ametek Inc New (NYSE:AME).

Analysts await Fiserv, Inc. (NASDAQ:FISV) to report earnings on October, 30. They expect $0.93 EPS, up 24.00% or $0.18 from last year’s $0.75 per share. FISV’s profit will be $632.11 million for 27.98 P/E if the $0.93 EPS becomes a reality. After $0.82 actual EPS reported by Fiserv, Inc. for the previous quarter, Wall Street now forecasts 13.41% EPS growth.

More notable recent Align Technology, Inc. (NASDAQ:ALGN) news were published by: Nasdaq.com which released: “Nasdaq 100 Movers: NTAP, ALGN - Nasdaq” on August 02, 2019, also Finance.Yahoo.com with their article: “Stocks - Wall Street Gives up Early Gains on Trade Fight Worries - Yahoo Finance” published on September 19, 2019, Nasdaq.com published: “Is Align Technology a Buy? - Nasdaq” on June 22, 2019. More interesting news about Align Technology, Inc. (NASDAQ:ALGN) were released by: 247Wallst.com and their article: “Top Baird Health Care and Biotech Picks Have Massive Upside Potential - 24/7 Wall St.” published on August 27, 2019 as well as Nasdaq.com‘s news article titled: “ABC or ALGN: Which Is the Better Value Stock Right Now? - Nasdaq” with publication date: July 10, 2019.

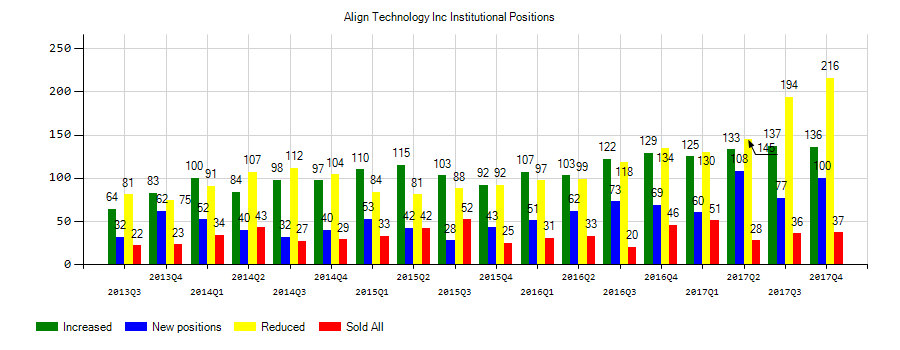

Investors sentiment increased to 1.26 in 2019 Q2. Its up 0.10, from 1.16 in 2019Q1. It improved, as 32 investors sold ALGN shares while 160 reduced holdings. 73 funds opened positions while 169 raised stakes. 67.58 million shares or 6.33% more from 63.56 million shares in 2019Q1 were reported. Mirae Asset Glob Invs Limited has invested 0.03% in Align Technology, Inc. (NASDAQ:ALGN). Texas Permanent School Fund reported 14,040 shares. Loring Wolcott Coolidge Fiduciary Advsr Llp Ma accumulated 69,229 shares. Wetherby Asset Mngmt invested in 0.04% or 1,305 shares. Pennsylvania Tru Com accumulated 0.08% or 6,706 shares. Amer Int Grp owns 0.04% invested in Align Technology, Inc. (NASDAQ:ALGN) for 32,481 shares. Alberta Mngmt stated it has 46,700 shares. Daiwa Secs Gru has invested 0.01% of its portfolio in Align Technology, Inc. (NASDAQ:ALGN). 867 are owned by Qcm Cayman Limited. Polar Llp holds 17,946 shares. 16,674 were reported by Qs Invsts Limited Co. 37,031 were reported by Pnc Financial Ser Group. Moreover, Stephens Investment Mgmt Gru Ltd Co has 0.44% invested in Align Technology, Inc. (NASDAQ:ALGN) for 84,636 shares. Bankshares Of America De holds 1.15M shares. Stevens Capital Mngmt Ltd Partnership owns 53,033 shares.

Martin Currie Ltd, which manages about $1.40 billion US Long portfolio, decreased its stake in Apple Inc (NASDAQ:AAPL) by 66,209 shares to 26,876 shares, valued at $5.32 million in 2019Q2, according to the filing. It also reduced its holding in Procter And Gamble Co (NYSE:PG) by 75,305 shares in the quarter, leaving it with 119,474 shares, and cut its stake in Cosan Ltd (NYSE:CZZ).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.