Alexandria Capital Llc increased its stake in Williams Cos Inc Del (WMB) by 25.81% based on its latest 2018Q4 regulatory filing with the SEC. Alexandria Capital Llc bought 18,945 shares as the company’s stock rose 8.13% with the market. The institutional investor held 92,340 shares of the public utilities company at the end of 2018Q4, valued at $2.04 million, up from 73,395 at the end of the previous reported quarter. Alexandria Capital Llc who had been investing in Williams Cos Inc Del for a number of months, seems to be bullish on the $34.92B market cap company. The stock increased 0.21% or $0.06 during the last trading session, reaching $28.82. About 4.72 million shares traded. The Williams Companies, Inc. (NYSE:WMB) has risen 0.07% since April 24, 2018 and is uptrending. It has underperformed by 4.30% the S&P500. Some Historical WMB News: 17/05/2018 - WILLIAMS COMPANIES INC - WILLIAMS WILL ACQUIRE ALL OF 256.0 MLN PUBLIC OUTSTANDING UNITS OF WILLIAMS PARTNERS; 16/03/2018 - WILLIAMS & WILLIAMS: FERC POLICY EFFECT ON PROSPECTIVE BASIS; 17/05/2018 - WILLIAMS COMPANIES INC - WILLIAMS PARTNERS CONFLICTS COMMITTEE APPROVED DEAL; 12/04/2018 - Williams Partners Seeks FERC Approval for Southeastern Trail Expansion Project to Serve Growing Demand for Natural Gas in Mid; 30/03/2018 - Fitch Affirms The Williams Companies, Inc. at ‘BB+’; 07/03/2018 CERAWEEK-Energy Transfer Partners exploring ‘partial’ shift to c-corp - CEO; 17/05/2018 - WILLIAMS TRANSACTION IS VALUED AT $10.5B; 17/05/2018 - Williams resubmits Northeast Supply natgas pipeline permit with N.Y; 12/04/2018 - Williams Partners Seeks FERC Approval for Southeastern Trail Expansion Project to Serve Growing Demand for Natural Gas in Mid-Atlantic and Southeastern U.S; 03/05/2018 - WILLIAMS: NORTHEAST PRODUCERS ARE FOCUSED ON LIQUID-RICH PLAYS

Ruggie Capital Group increased its stake in Alibaba Group (BABA) by 66.47% based on its latest 2018Q4 regulatory filing with the SEC. Ruggie Capital Group bought 4,088 shares as the company’s stock rose 17.52% with the market. The institutional investor held 10,238 shares of the business services company at the end of 2018Q4, valued at $1.40M, up from 6,150 at the end of the previous reported quarter. Ruggie Capital Group who had been investing in Alibaba Group for a number of months, seems to be bullish on the $485.49B market cap company. The stock increased 1.03% or $1.91 during the last trading session, reaching $187.29. About 10.29 million shares traded. Alibaba Group Holding Limited (NYSE:BABA) has risen 2.89% since April 24, 2018 and is uptrending. It has underperformed by 1.48% the S&P500. Some Historical BABA News: 15/03/2018 - Alibaba Cloud’s Indonesian Data Center Commences Operation; 17/04/2018 - KBS Fashion Group Limited Announces Signing of Cooperative Agreement to Open Amazon and Alibaba Express Online Stores; 31/05/2018 - MEDIA-China developing world’s largest civilian cargo drone - China Daily; 04/04/2018 - The deal consolidates the resources of the two firms, which are backed by Chinese gaming and social media giant Tencent, as Mobike faces off against Alibaba-backed Ofo; 29/05/2018 - Alibaba And Cainiao To Invest $1.38 Billion In Chinese Express Delivery Company ZTO — MarketWatch; 04/05/2018 - Alibaba revenues rise but Ant Financial makes a net loss; 23/03/2018 - Alibaba eyes China “listing” as early as mid-year - IFR; 28/03/2018 - NXP Semiconductors, Alibaba’s AliOS Enter Partnership for New In-Vehicle Experiences; 30/05/2018 - The e-payment battle for Southeast Asia swings Alibaba’s way; 29/05/2018 - Alibaba, Cainiao Lead $1.4 Billion Spend on Delivery-Firm Stake

Ruggie Capital Group, which manages about $285.65 million and $223.37 million US Long portfolio, decreased its stake in Wisdomtree Trust Us Midcp Earning Etf (EZM) by 14,826 shares to 23,432 shares, valued at $803,000 in 2018Q4, according to the filing. It also reduced its holding in Invesco Buyback by 26,492 shares in the quarter, leaving it with 44,672 shares, and cut its stake in Vanguard High (VYM).

More notable recent Alibaba Group Holding Limited (NYSE:BABA) news were published by: Fool.com which released: “Alibaba and Tencent Join Forces in a New Joint Venture - The Motley Fool” on March 30, 2019, also Benzinga.com with their article: “Alibaba (NYSE:BABA) Analysts Stay Bullish After Q3 Print - Benzinga” published on February 04, 2019, Benzinga.com published: “Amazon.com, Inc. (NASDAQ:AMZN), Alibaba (NYSE:BABA) - e-Commerce Is The Hot Topic For Air Cargo At The Upcoming CNS Partnership Conference - Benzinga” on April 22, 2019. More interesting news about Alibaba Group Holding Limited (NYSE:BABA) were released by: Seekingalpha.com and their article: “Alibaba’s Stock Isn’t Finished Climbing - Seeking Alpha” published on February 14, 2019 as well as Seekingalpha.com‘s news article titled: “Alibaba Is A Pone Stock - Seeking Alpha” with publication date: April 18, 2019.

Alexandria Capital Llc, which manages about $427.81 million and $615.32M US Long portfolio, decreased its stake in Goldman Sachs Group Inc (NYSE:GS) by 3,960 shares to 24,138 shares, valued at $4.03 million in 2018Q4, according to the filing. It also reduced its holding in Spirit Airls Inc (NASDAQ:SAVE) by 7,600 shares in the quarter, leaving it with 37,090 shares, and cut its stake in Apple Inc (NASDAQ:AAPL).

Since November 2, 2018, it had 5 insider buys, and 1 insider sale for $807,659 activity. Shares for $644,283 were bought by CREEL MICHAEL A. Shares for $259,422 were bought by CHANDLER JOHN D on Friday, November 2. Zamarin Chad J. had bought 2,500 shares worth $64,218 on Tuesday, November 6. $25,750 worth of stock was bought by Wilson Terrance Lane on Friday, November 2. Dunn Micheal G. bought $63,842 worth of stock.

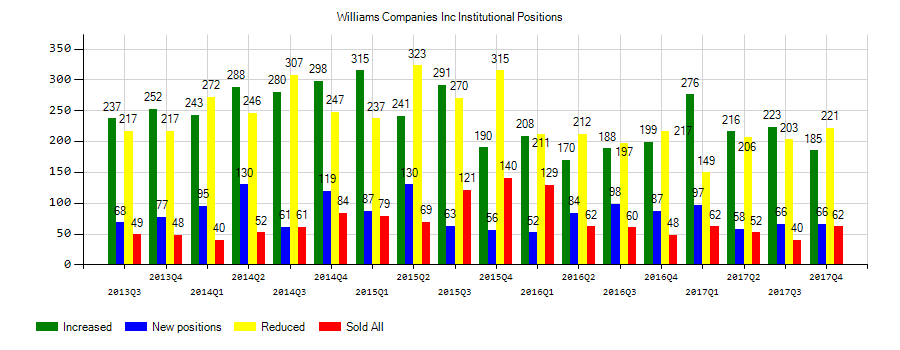

Investors sentiment decreased to 1.05 in Q4 2018. Its down 2.51, from 3.56 in 2018Q3. It fall, as 65 investors sold WMB shares while 212 reduced holdings. 73 funds opened positions while 217 raised stakes. 1.05 billion shares or 50.49% less from 2.12 billion shares in 2018Q3 were reported. Commonwealth Of Pennsylvania Pub School Empls Retrmt stated it has 3.2% of its portfolio in The Williams Companies, Inc. (NYSE:WMB). Sumitomo Life Ins owns 73,800 shares for 0.23% of their portfolio. First Mercantile Trust Com stated it has 22,238 shares. Moreover, Fca Corporation Tx has 0.62% invested in The Williams Companies, Inc. (NYSE:WMB) for 49,110 shares. Gulf State Bank (Uk) stated it has 0.12% in The Williams Companies, Inc. (NYSE:WMB). Cls Limited Company invested in 0% or 77 shares. Hanson Mcclain holds 0% or 750 shares. Shell Asset stated it has 68,057 shares or 0.04% of all its holdings. Commerzbank Aktiengesellschaft Fi reported 0.11% stake. Rothschild Il owns 15,365 shares. Tarbox Family Office Incorporated reported 557 shares. E&G Advsrs Lp reported 19,704 shares or 0.2% of all its holdings. Gam Holding Ag reported 300,013 shares. Cap Innovations Limited Co invested in 11,020 shares. Massachusetts-based Par Management Inc has invested 0.65% in The Williams Companies, Inc. (NYSE:WMB).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.