Analysts expect EchoStar Corporation (NASDAQ:SATS) to report $0.11 EPS on August, 6.They anticipate $0.01 EPS change or 8.33% from last quarter’s $0.12 EPS. SATS’s profit would be $10.53 million giving it 103.09 P/E if the $0.11 EPS is correct. After having $0.15 EPS previously, EchoStar Corporation’s analysts see -26.67% EPS growth. The stock decreased 0.85% or $0.39 during the last trading session, reaching $45.36. About 104,993 shares traded. EchoStar Corporation (NASDAQ:SATS) has declined 22.31% since July 18, 2018 and is downtrending. It has underperformed by 26.74% the S&P500. Some Historical SATS News: 10/05/2018 - EchoStar 1Q Adj EPS 16c; 23/04/2018 - DJ EchoStar Corporation Class A, Inst Holders, 1Q 2018 (SATS); 13/03/2018 - Hughes Selected by Leading Oil Well Services Company to Provide Next Gen Rapid Deploy Communications Hub; 13/03/2018 - Hughes Ships First Gateways for the Ground Network to Support OneWeb’s Low Earth Orbit Constellation; 02/04/2018 - Hughes Selected to Support Commonwealth Network (COPANET) Contract, Offering Managed Network Services to Agencies across Pennsylvania; 10/05/2018 - EchoStar 1Q Rev $501.8M; 10/05/2018 - EchoStar 1Q Adjusted Ebitda $202.4M; 10/05/2018 - EchoStar 1Q Loss/Shr 22c; 07/05/2018 - Hughes Awarded Contract to Prototype Multi-Modem Adaptor for DoD Wideband SATCOM Architectural Analysis; 21/03/2018 - 4-H Names Cassandra lvie as the 2018 National 4-H Youth in Action Winner

DFDS A /S COPENHAGEN ORDINARY SHARES DE (OTCMKTS:DFDDF) had an increase of 373.33% in short interest. DFDDF’s SI was 35,500 shares in July as released by FINRA. Its up 373.33% from 7,500 shares previously. With 100 avg volume, 355 days are for DFDS A /S COPENHAGEN ORDINARY SHARES DE (OTCMKTS:DFDDF)’s short sellers to cover DFDDF’s short positions. It closed at $41.63 lastly. It is up 0.00% since July 18, 2018 and is . It has underperformed by 4.43% the S&P500.

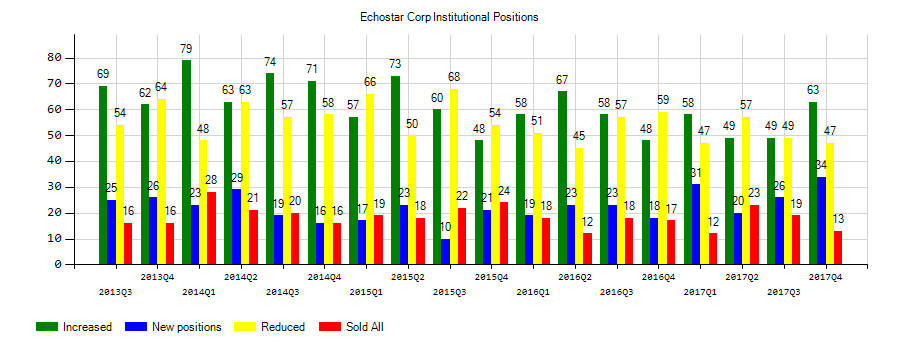

Investors sentiment increased to 1.06 in 2019 Q1. Its up 0.01, from 1.05 in 2018Q4. It increased, as 28 investors sold EchoStar Corporation shares while 44 reduced holdings. 29 funds opened positions while 47 raised stakes. 42.89 million shares or 1.52% more from 42.25 million shares in 2018Q4 were reported. Millennium Limited Liability Corp reported 0.02% of its portfolio in EchoStar Corporation (NASDAQ:SATS). First Manhattan Company reported 700 shares. Ubs Asset Mngmt Americas stated it has 60,182 shares or 0% of all its holdings. Aperio Gp Ltd Llc holds 0% in EchoStar Corporation (NASDAQ:SATS) or 12,684 shares. First Personal Financial Services reported 0% of its portfolio in EchoStar Corporation (NASDAQ:SATS). Baystate Wealth Mngmt Ltd Liability Com reported 0% stake. Lazard Asset Mgmt Limited Liability Corp has invested 0% in EchoStar Corporation (NASDAQ:SATS). Tci Wealth Advsrs reported 316 shares. 11,389 are owned by Trexquant Invest Limited Partnership. Aqr Cap Mgmt Lc holds 0.02% in EchoStar Corporation (NASDAQ:SATS) or 411,561 shares. Wallace Capital Inc reported 227,726 shares. Nordea Invest Mgmt Ab accumulated 253,300 shares or 0.02% of the stock. Quantbot Tech L P owns 0.05% invested in EchoStar Corporation (NASDAQ:SATS) for 14,700 shares. Parametric Port Associate Ltd Liability Corp invested in 0% or 62,818 shares. Royal Bankshares Of Canada accumulated 2,685 shares.

More notable recent EchoStar Corporation (NASDAQ:SATS) news were published by: Prnewswire.com which released: “Hughes Wins NASPO Contract to Provide Internet Solutions for Participating States - PRNewswire” on July 16, 2019, also Prnewswire.com with their article: “Hughes JUPITER System Selected to Power New Indonesian High-Throughput Satellite - PRNewswire” published on July 01, 2019, Prnewswire.com published: “Hughes JUPITER System Chosen by Five Service Providers to Power Satellite Broadband Services throughout Indonesia - PRNewswire” on June 18, 2019. More interesting news about EchoStar Corporation (NASDAQ:SATS) were released by: Finance.Yahoo.com and their article: “Before You Buy EchoStar Corporation (NASDAQ:SATS), Consider Its Volatility - Yahoo Finance” published on May 07, 2019 as well as Finance.Yahoo.com‘s news article titled: “Did Hedge Funds Drop The Ball On Echostar Corporation (SATS) ? - Yahoo Finance” with publication date: June 10, 2019.

Among 2 analysts covering EchoStar (NASDAQ:SATS), 2 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. EchoStar had 3 analyst reports since February 27, 2019 according to SRatingsIntel. Citigroup maintained EchoStar Corporation (NASDAQ:SATS) on Wednesday, February 27 with “Buy” rating. The stock has “Strong Buy” rating by Raymond James on Tuesday, May 21.

EchoStar Corporation offers satellite operations, video delivery solutions, digital set-top boxes, and broadband satellite technologies and services for home and small office clients worldwide. The company has market cap of $4.34 billion. The firm operates in three divisions: Hughes, EchoStar Technologies, and EchoStar Satellite Services. It currently has negative earnings. The Hughes segment provides satellite broadband Internet access and satellite technologies to North American consumer market; and broadband network technologies, managed services, equipment, and communications solutions to enterprise and government customers.

DFDS A/S provides ferry shipping services and transport solutions in Europe. The company has market cap of $2.36 billion. The firm operates through two divisions, Shipping and Logistics. It has a 10.26 P/E ratio. The Shipping division operates ro-ro and ro-pax tonnage ships, and passenger ships, as well as offers port terminal services.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.