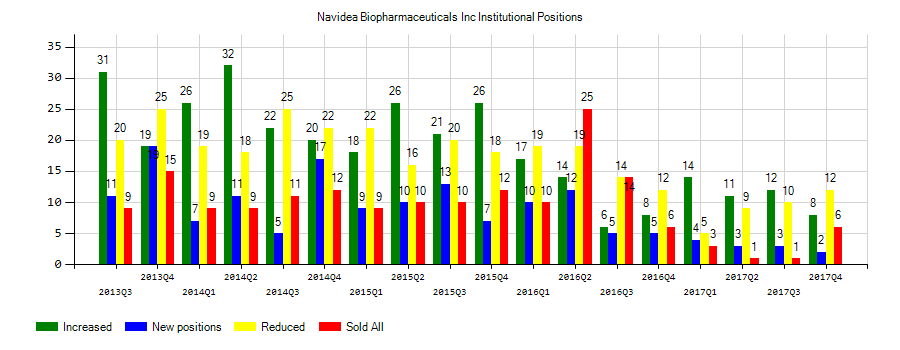

Navidea Biopharmaceuticals Inc (NAVB) investors sentiment decreased to 0.91 in 2019 Q1. It’s down -0.31, from 1.22 in 2018Q4. The ratio has dropped, as 10 funds increased or opened new positions, while 11 cut down and sold equity positions in Navidea Biopharmaceuticals Inc. The funds in our database now own: 9.76 million shares, up from 9.35 million shares in 2018Q4. Also, the number of funds holding Navidea Biopharmaceuticals Inc in top ten positions was flat from 0 to 0 for the same number . Sold All: 8 Reduced: 3 Increased: 6 New Position: 4.

Adelante Capital Management Llc decreased Alexandria Real Estate Equit (ARE) stake by 7.21% reported in 2019Q1 SEC filing. Adelante Capital Management Llc sold 53,161 shares as Alexandria Real Estate Equit (ARE)’s stock rose 3.08%. The Adelante Capital Management Llc holds 684,470 shares with $97.58 million value, down from 737,631 last quarter. Alexandria Real Estate Equit now has $16.43B valuation. The stock decreased 0.46% or $0.67 during the last trading session, reaching $144.87. About 493,636 shares traded. Alexandria Real Estate Equities, Inc. (NYSE:ARE) has risen 19.17% since August 3, 2018 and is uptrending. It has outperformed by 19.17% the S&P500. Some Historical ARE News: 19/04/2018 - DJ Alexandria Real Estate Equities In, Inst Holders, 1Q 2018 (ARE); 21/03/2018 - ARE NAMES DEAN A. SHIGENAGA, THOMAS J. ANDREWS AS CO-PRESIDENTS; 07/05/2018 - ALEXANDRIA REAL ESTATE EQUITIES INC ARE.N : BARCLAYS RAISES TARGET PRICE TO $132 FROM $129; 22/03/2018 - ALEXANDRIA REAL ESTATE NAMES RICHARDSON, MOGLIA AS CO-CEOS; 22/03/2018 - ALEXANDRIA REAL ESTATE EQUITIES, NAMES CO-CHIEF EXECUTIVE; 22/03/2018 - Alexandria Real Estate Equities, Inc. Announces the Elevation of Joel S. Marcus to Full-Time Executive Chairman; 12/04/2018 - Alexandria LaunchLabs, the Premier Life Science Startup Platform, to Open in Fall 2018 at the Alexandria Center at One Kendall Square in the Heart of East Cambridge; 22/03/2018 - Alexandria Real Estate : Moglia Will Continue His Responsibilities as Chief Investment Officer; 22/03/2018 - ALEXANDRIA REAL ESTATE EQUITIES INC - MOGLIA WILL CONTINUE HIS RESPONSIBILITIES AS CHIEF INVESTMENT OFFICER; 30/03/2018 - Dir Richardson Gifts 250 Of Alexandria Real Estate Equities Inc

The stock decreased 4.35% or $0.025 during the last trading session, reaching $0.55. About 119,494 shares traded. Navidea Biopharmaceuticals, Inc. (NAVB) has declined 82.23% since August 3, 2018 and is downtrending. It has underperformed by 82.23% the S&P500. Some Historical NAVB News: 16/04/2018 - NAVIDEA BIOPHARMACEUTICALS - AS A RESULT OF AGREEMENT, LITIGATION INITIATED BY BEIJING SINOTAU MEDICAL RESEARCH CO., LTD WILL BE DISMISSED; 23/04/2018 - DJ Navidea Biopharmaceuticals Inc, Inst Holders, 1Q 2018 (NAVB); 03/04/2018 - Navidea Biopharmaceuticals Schedules Call to Discuss Future Outlook and Outcomes of Court Trial; 08/03/2018 Navidea Biopharm 4Q Loss/Shr 3c; 16/04/2018 - NAVIDEA BIOPHARMACEUTICALS INC - ANNOUNCED IT HAS SIGNED A DEAL TO PROVIDE MEILLEUR TECHNOLOGIES WORLDWIDE RIGHTS TO CONDUCT RESEARCH USING NAV4694; 03/04/2018 - Navidea Biopharmaceuticals Schedules Conference Call to Discuss Future Outlook and Outcomes of Court Trial; 08/05/2018 - Navidea Biopharm 1Q Loss $6.74M; 16/04/2018 - Navidea Signs Deal to Sublicense NAV4694 Worldwide Development Rights; 28/05/2018 - Navidea Conference Scheduled By Edison for Jun. 4-6; 08/05/2018 - Navidea Biopharm 1Q Loss/Shr 4c

More notable recent Navidea Biopharmaceuticals, Inc. (NYSEAMERICAN:NAVB) news were published by: Finance.Yahoo.com which released: “Navidea Biopharmaceuticals Schedules Second Quarter 2019 Earnings Conference Call and Business Update - Yahoo Finance” on August 01, 2019, also Businesswire.com with their article: “Navidea Biopharmaceuticals Announces Reverse Stock Split - Business Wire” published on April 19, 2019, Finance.Yahoo.com published: “Navidea Biopharmaceuticals Announces Closing of Public Offering of Common Stock - Yahoo Finance” on June 18, 2019. More interesting news about Navidea Biopharmaceuticals, Inc. (NYSEAMERICAN:NAVB) were released by: Finance.Yahoo.com and their article: “Navidea Biopharmaceuticals Prices $6.0 Million Public Offering of Common Stock - Yahoo Finance” published on June 13, 2019 as well as Businesswire.com‘s news article titled: “Navidea Biopharmaceuticals Receives FDA Feedback Regarding Rheumatoid Arthritis Clinical Trial Design and Provides Business Updates - Business Wire” with publication date: April 08, 2019.

Advisory Services Network Llc holds 0% of its portfolio in Navidea Biopharmaceuticals, Inc. for 5,000 shares. Bailard Inc. owns 10,000 shares or 0% of their US portfolio. Moreover, Bank Of America Corp De has 0% invested in the company for 25,603 shares. The New York-based Bank Of New York Mellon Corp has invested 0% in the stock. Blackrock Inc., a New York-based fund reported 2.50 million shares.

Navidea Biopharmaceuticals, Inc., a biopharmaceutical company, focuses on the development and commercialization of precision immunodiagnostic agents and immunotherapeutics. The company has market cap of $9.93 million. The firm develops Manocept platform to target the CD206 mannose receptor expressed on activated macrophages; and NAV4694, a fluorine-18 labeled positron emission tomography imaging agent for use as an aid in the imaging and evaluation of patients with signs or symptoms of Alzheimers disease and mild cognitive impairment. It currently has negative earnings. It is also developing NAV5001, an Iodine-123 labeled single photon emission computed tomography imaging agent that is used as an aid in the diagnosis of Parkinsons disease and other movement disorders with potential use as a diagnostic aid in dementia; diagnostic substances, including technetium 99m tilmanocept and other diagnostic applications; and therapeutic development programs, such as therapeutic applications of its Manocept platform, as well as various development programs and therapeutics.

Since January 1, 0001, it had 2 buys, and 0 selling transactions for $6,162 activity.

Investors sentiment increased to 1.36 in 2019 Q1. Its up 0.20, from 1.16 in 2018Q4. It is positive, as 27 investors sold ARE shares while 116 reduced holdings. 47 funds opened positions while 147 raised stakes. 108.20 million shares or 0.02% less from 108.22 million shares in 2018Q4 were reported. Mufg Americas Corporation reported 135 shares or 0% of all its holdings. Signaturefd Ltd Liability Corp owns 454 shares. Washington Trust Bank & Trust owns 2 shares for 0% of their portfolio. 1832 Asset Mngmt Ltd Partnership holds 49,100 shares. Sei Investments Co has invested 0.06% of its portfolio in Alexandria Real Estate Equities, Inc. (NYSE:ARE). Jpmorgan Chase And has invested 0.03% in Alexandria Real Estate Equities, Inc. (NYSE:ARE). Vident Invest Advisory Ltd Company has invested 0.09% in Alexandria Real Estate Equities, Inc. (NYSE:ARE). Westwood Grp Inc accumulated 1% or 672,644 shares. Moreover, Parametric Portfolio Assocs Lc has 0.02% invested in Alexandria Real Estate Equities, Inc. (NYSE:ARE) for 144,760 shares. Toronto Dominion Bancorporation, a Ontario - Canada-based fund reported 105,455 shares. Cadence Capital Mgmt Limited Liability Com stated it has 1,875 shares or 0.02% of all its holdings. Alliancebernstein LP holds 454,861 shares or 0.04% of its portfolio. Cibc World Markets Corp holds 15,581 shares. Prudential Incorporated, a New Jersey-based fund reported 363,840 shares. Ls Inv Advsr Ltd Liability has 11,801 shares for 0.1% of their portfolio.

Since February 7, 2019, it had 0 insider buys, and 6 sales for $4.82 million activity. 5,000 shares valued at $661,300 were sold by Cunningham John H on Monday, February 11. MARCUS JOEL S sold $1.30M worth of stock. Banks Jennifer sold 5,000 shares worth $659,600. RICHARDSON JAMES H sold 5,000 shares worth $660,150. $874,435 worth of Alexandria Real Estate Equities, Inc. (NYSE:ARE) was sold by CIRUZZI VINCENT.

Adelante Capital Management Llc increased Simon Property Group Inc. (NYSE:SPG) stake by 75,891 shares to 1.07M valued at $194.84 million in 2019Q1. It also upped Camden Property Trust (NYSE:CPT) stake by 181,678 shares and now owns 729,058 shares. Essex Property Trust Inc. (NYSE:ESS) was raised too.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.