American Research & Management increased its stake in Hingham Institution For Saving (HIFS) by 428.73% based on its latest 2019Q2 regulatory filing with the SEC. American Research & Management bought 4,909 shares as the company’s stock rose 3.54% . The institutional investor held 6,054 shares of the company at the end of 2019Q2, valued at $1.20 million, up from 1,145 at the end of the previous reported quarter. American Research & Management who had been investing in Hingham Institution For Saving for a number of months, seems to be bullish on the $404.75M market cap company. The stock increased 0.26% or $0.49 during the last trading session, reaching $189.69. About 53 shares traded. Hingham Institution for Savings (NASDAQ:HIFS) has declined 12.93% since September 27, 2018 and is downtrending. It has underperformed by 12.93% the S&P500. Some Historical HIFS News: 12/04/2018 - Hingham Institution Svgs 1Q EPS $4.08; 28/03/2018 - Hingham Institution Svgs Declares Dividend of 34c; 28/03/2018 Hingham Savings Declares Regular Dividend of $0.34 per Share; 19/04/2018 - DJ Hingham Institution for Savings, Inst Holders, 1Q 2018 (HIFS)

Hs Management Partners Llc increased its stake in American Express Co (AXP) by 12.12% based on its latest 2019Q2 regulatory filing with the SEC. Hs Management Partners Llc bought 66,075 shares as the company’s stock rose 6.28% . The institutional investor held 611,050 shares of the consumer services company at the end of 2019Q2, valued at $75.43M, up from 544,975 at the end of the previous reported quarter. Hs Management Partners Llc who had been investing in American Express Co for a number of months, seems to be bullish on the $98.84B market cap company. The stock increased 0.19% or $0.22 during the last trading session, reaching $119.13. About 108 shares traded. American Express Company (NYSE:AXP) has risen 23.32% since September 27, 2018 and is uptrending. It has outperformed by 23.32% the S&P500. Some Historical AXP News: 18/04/2018 - AXP SEES 2018 REV. UP AT LEAST 8% THIS YEAR, UP 7%-8%; 08/05/2018 - Box Founds Future of Work Council to Bring Together Leaders From Innovative Enterprises Like American Express, NIKE and Farmers lnsurance®; 18/04/2018 - CAMPBELL: AMEX EXPECTS TO CONTINUE GROWING ONLINE SAVINGS UNIT; 29/05/2018 - EXCLUSIVE-India resists lobbying by U.S. payment firms to ease local data storage rules; 18/04/2018 - AMERICAN EXPRESS CO RISE IN QTRLY EXPENSES PRIMARILY REFLECTED GROWTH IN REWARDS EXPENSES, OTHER COSTS ASSOCIATED WITH INCREASED CARD MEMBER SPENDING; 15/03/2018 - American Express: Feb. 28 U.S. Small Business Net Write-Off Rate 1.7%; 02/04/2018 - Moody’s: No Ratings Impact On American Express Card Abs Following Amendments To Trust Documents; 15/03/2018 - American Express: Feb. 28 U.S. Consumer Services 30-Days Past Due Loans 1.4% of Total; 18/04/2018 - American Express 1Q Book Value Per Common Share $20.96; 29/05/2018 - ♫ Reuters Insider - Global markets follow Italy in major retreat

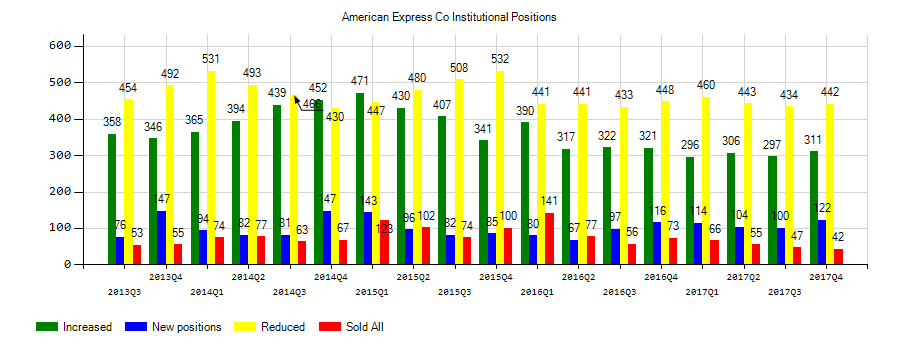

Investors sentiment decreased to 0.85 in Q2 2019. Its down 0.11, from 0.96 in 2019Q1. It turned negative, as 49 investors sold AXP shares while 447 reduced holdings. 106 funds opened positions while 314 raised stakes. 679.88 million shares or 0.12% less from 680.70 million shares in 2019Q1 were reported. Fdx Advisors invested 0.1% in American Express Company (NYSE:AXP). Arcadia Investment Mi holds 0.45% or 13,411 shares. Knightsbridge Asset Mngmt Ltd Liability Co owns 81,882 shares for 6.97% of their portfolio. Orrstown Finance accumulated 10,685 shares. Barton Invest Mngmt reported 3,870 shares or 0.07% of all its holdings. Shelton Cap Management reported 0.54% in American Express Company (NYSE:AXP). Matrix Asset Advisors New York accumulated 2,873 shares. Fort Washington Invest Advisors Oh owns 0.17% invested in American Express Company (NYSE:AXP) for 122,500 shares. 1St Source Bankshares holds 0.55% of its portfolio in American Express Company (NYSE:AXP) for 54,942 shares. Triangle Securities Wealth owns 0.18% invested in American Express Company (NYSE:AXP) for 2,891 shares. 19,518 are owned by Lourd Cap Limited Liability. Moreover, Asset Mgmt One Limited has 0.23% invested in American Express Company (NYSE:AXP) for 383,569 shares. Tctc Limited Liability owns 0.07% invested in American Express Company (NYSE:AXP) for 9,788 shares. Mackenzie Fin Corporation has invested 0% in American Express Company (NYSE:AXP). Lazard Asset Mngmt Ltd stated it has 0.1% in American Express Company (NYSE:AXP).

Hs Management Partners Llc, which manages about $2.39B and $2.98 billion US Long portfolio, decreased its stake in Williams Sonoma Inc (NYSE:WSM) by 102,600 shares to 2.67 million shares, valued at $173.42 million in 2019Q2, according to the filing. It also reduced its holding in Coca Cola Co (NYSE:KO) by 56,125 shares in the quarter, leaving it with 4.08 million shares, and cut its stake in Home Depot Inc (NYSE:HD).

More notable recent American Express Company (NYSE:AXP) news were published by: Businesswire.com which released: “American Express and Delta Air Lines Bring Fall Treats to Card Members Across the U.S. with Perktoberfest Tour - Business Wire” on September 04, 2019, also Seekingalpha.com with their article: “Stocks To Watch: Amazon, Alibaba And Peloton In Focus - Seeking Alpha” published on September 21, 2019, Finance.Yahoo.com published: “Trade of the Day: American Express Stock Points Lower for a Trade - Yahoo Finance” on September 04, 2019. More interesting news about American Express Company (NYSE:AXP) were released by: Seekingalpha.com and their article: “American Express declares $0.43 dividend - Seeking Alpha” published on September 23, 2019 as well as Fool.com‘s news article titled: “Yes, Buffett Has Marijuana and Cryptocurrency Exposure - Motley Fool” with publication date: September 24, 2019.

American Research & Management, which manages about $343.97M and $334.24M US Long portfolio, decreased its stake in Automatic Data Processing (NASDAQ:ADP) by 3,175 shares to 21,340 shares, valued at $3.53 million in 2019Q2, according to the filing. It also reduced its holding in Fiserv (NASDAQ:FISV) by 4,375 shares in the quarter, leaving it with 112,975 shares, and cut its stake in John Wiley & Sons Inc Cl A (NYSE:JW.A).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.