Knott David M decreased its stake in Biodelivery Sciences International Inc. (BDSI) by 19.95% based on its latest 2019Q1 regulatory filing with the SEC. Knott David M sold 99,800 shares as the company’s stock rose 4.18% with the market. The institutional investor held 400,500 shares of the health care company at the end of 2019Q1, valued at $2.12 million, down from 500,300 at the end of the previous reported quarter. Knott David M who had been investing in Biodelivery Sciences International Inc. for a number of months, seems to be less bullish one the $385.45M market cap company. The stock decreased 0.45% or $0.02 during the last trading session, reaching $4.41. About 624,693 shares traded. BioDelivery Sciences International, Inc. (NASDAQ:BDSI) has risen 131.22% since June 11, 2018 and is uptrending. It has outperformed by 126.79% the S&P500. Some Historical BDSI News: 15/03/2018 - BioDelivery Sciences 4Q Loss/Shr 29c; 07/05/2018 - BioDelivery Sciences Appoints Herm Cukier as CEO; 03/05/2018 - BIODELIVERY SCIENCES - RECENTLY ENGAGED IN ONGOING DIALOGUE WITH BROADFIN REGARDING VARIOUS MATTERS & INTEND TO CONTINUE DIALOGUE; 10/04/2018 - BROADFIN CAPITAL, LLC - INTEND TO ENGAGE IN DISCUSSIONS WITH BIODELIVERY SCIENCES INTERNATIONAL REGARDING BOARD STRUCTURE AND COMPOSITION; 07/05/2018 - BioDelivery Sciences : Former President and CEO Mark Sirgo to Continue as Vice Chairman of the Board; 17/05/2018 - BIODELIVERY SCIENCES INTERNATIONAL INC - $50 MLN EQUITY FINANCING IS BEING LED BY BROADFIN CAPITAL; 10/04/2018 - BROADFIN CAPITAL - WAS INFORMED BIODELIVERY SCIENCES NOMINATING COMMITTEE DECIDED NOT TO PROCEED WITH APPOINTMENT OF STOCKHOLDER REPRESENTATIVE; 17/05/2018 - BIODELIVERY SCIENCES INTERNATIONAL INC - FOUR CURRENT INDEPENDENT DIRECTORS RETIRING; 17/05/2018 - BIODELIVERY SCIENCES INTERNATIONAL INC - AMENDS SENIOR CREDIT FACILITY WITH CRG; 17/05/2018 - BIODELIVERY SCIENCES INTERNATIONAL INC - AMENDS SENIOR CREDIT FACILITY WITH CRG, WHICH INCLUDES PUSHING OUT PRINCIPAL DEBT REPAYMENT TO 2021

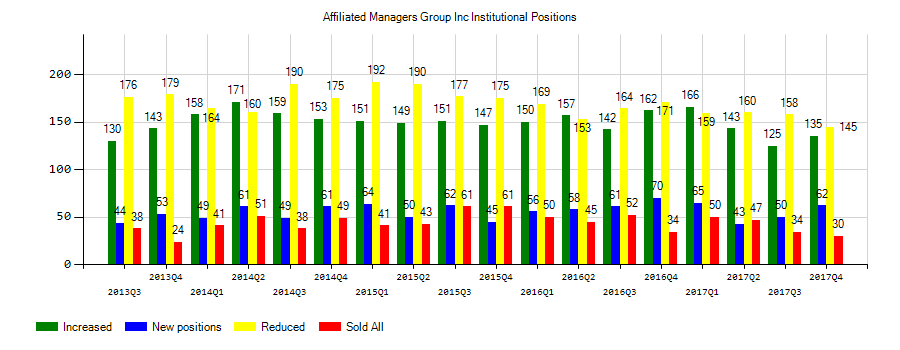

Kiltearn Partners Llp increased its stake in Affiliated Managers Group In (AMG) by 16.18% based on its latest 2019Q1 regulatory filing with the SEC. Kiltearn Partners Llp bought 135,400 shares as the company’s stock declined 14.32% while stock markets rallied. The institutional investor held 972,030 shares of the finance company at the end of 2019Q1, valued at $104.11M, up from 836,630 at the end of the previous reported quarter. Kiltearn Partners Llp who had been investing in Affiliated Managers Group In for a number of months, seems to be bullish on the $4.62 billion market cap company. The stock increased 1.01% or $0.9 during the last trading session, reaching $90.18. About 242,329 shares traded. Affiliated Managers Group, Inc. (NYSE:AMG) has declined 45.01% since June 11, 2018 and is downtrending. It has underperformed by 49.44% the S&P500. Some Historical AMG News: 30/04/2018 - Affiliated Managers 1Q EPS $2.77; 30/04/2018 - AFFILIATED MANAGERS 1Q ECONOMIC EPS $3.92, EST. $3.89; 14/03/2018 - ClinicalTrial US: Safety, Tolerability, Pharmacokinetics and Efficacy of AMG 397 in Subjects With Selected RR Hematological; 29/05/2018 - AMG ADVANCED METALLURGICAL GROUP NV AMG.AS - HAS TEMPORARILY SHUT DOWN CERTAIN TANTALUM MINING AND PROCESSING OPERATIONS IN BRAZIL AS A RESULT OF ONGOING NATIONAL TRUCKERS STRIKE; 10/04/2018 - AMG, CRITERION TALKS FOR SOLUTION FOR SPENT-CATALYST MGMT; 10/04/2018 - AMG ADVANCED METALLURGICAL GROUP NV AMG.AS - NEGOTIATIONS TO FORM PARTNERSHIP EXPANDING CO’S GLOBAL SPENT-CATALYST PROCESSING CAPACITY; 10/04/2018 - AMG, CRITERION TALKS FOR SPENT-CATALYST RECYCLING PARTNERSHIP; 10/04/2018 - AMG and Criterion Announce Negotiations to Form Spent-Catalyst Recycling Partnership; 17/04/2018 - ClinicalTrial US: AMG 334 20160172 Pediatric Migraine PK Study; 30/04/2018 - Affiliated Managers 1Q Net $153M

More notable recent Affiliated Managers Group, Inc. (NYSE:AMG) news were published by: Finance.Yahoo.com which released: “7 Stocks for You to Profit From (Legal) Insider Trading - Yahoo Finance” on May 31, 2019, also Prnewswire.com with their article: “Biotech Brief: Why 2019 is Projected to be Strong for Medical Device Market - PRNewswire” published on June 04, 2019, Globenewswire.com published: “AMG Names Jay C. Horgen as Chief Executive Officer - GlobeNewswire” on May 06, 2019. More interesting news about Affiliated Managers Group, Inc. (NYSE:AMG) were released by: Fool.com and their article: “Why PetMed Express, Chemours, and Affiliated Managers Group Slumped Today - Motley Fool” published on May 06, 2019 as well as Globenewswire.com‘s news article titled: “AMG Names Thomas M. Wojcik as Next Chief Financial Officer - GlobeNewswire” with publication date: March 20, 2019.

Investors sentiment increased to 0.96 in 2019 Q1. Its up 0.14, from 0.82 in 2018Q4. It increased, as 39 investors sold AMG shares while 119 reduced holdings. 44 funds opened positions while 107 raised stakes. 46.02 million shares or 2.69% less from 47.30 million shares in 2018Q4 were reported. Archford Capital Strategies Ltd Com stated it has 0% of its portfolio in Affiliated Managers Group, Inc. (NYSE:AMG). State Board Of Administration Of Florida Retirement has invested 0.02% in Affiliated Managers Group, Inc. (NYSE:AMG). Northern Corp holds 574,346 shares. First Hawaiian Bancorporation invested in 0% or 70 shares. State Treasurer State Of Michigan has invested 0.01% in Affiliated Managers Group, Inc. (NYSE:AMG). Cubic Asset Management holds 4,954 shares or 0.16% of its portfolio. Prelude Cap Lc holds 0% or 277 shares. Moreover, Arcadia Investment Mi has 1.02% invested in Affiliated Managers Group, Inc. (NYSE:AMG). Optimum Investment reported 27 shares. Rmb Cap Ltd Liability Corporation reported 9,441 shares. Bnp Paribas Arbitrage stated it has 0% of its portfolio in Affiliated Managers Group, Inc. (NYSE:AMG). The New York-based Stone Ridge Asset Management Limited Liability Company has invested 0.02% in Affiliated Managers Group, Inc. (NYSE:AMG). Td Asset Mgmt has 19,397 shares. Alliancebernstein Limited Partnership reported 0.01% stake. Brown Brothers Harriman has invested 0% in Affiliated Managers Group, Inc. (NYSE:AMG).

Kiltearn Partners Llp, which manages about $3.16 billion and $3.52 billion US Long portfolio, decreased its stake in Alleghany Corp Del (NYSE:Y) by 60,300 shares to 74,280 shares, valued at $45.49M in 2019Q1, according to the filing. It also reduced its holding in Wells Fargo Co New (NYSE:WFC) by 201,400 shares in the quarter, leaving it with 1.61 million shares, and cut its stake in Baker Hughes A Ge Co.

Investors sentiment increased to 2.57 in 2019 Q1. Its up 1.54, from 1.03 in 2018Q4. It improved, as 4 investors sold BDSI shares while 17 reduced holdings. 26 funds opened positions while 28 raised stakes. 44.55 million shares or 37.69% more from 32.35 million shares in 2018Q4 were reported. Cadence Mgmt Limited Liability Company reported 529,229 shares stake. 144,900 are owned by Advisory Service Ntwk Limited Liability Com. Federated Pa reported 0% stake. Blair William And Il holds 0.03% in BioDelivery Sciences International, Inc. (NASDAQ:BDSI) or 857,595 shares. Verition Fund Mngmt Ltd Liability holds 37,965 shares or 0.01% of its portfolio. 1.75 million were accumulated by Morgan Stanley. Prelude Cap Management Limited Liability Com owns 74,500 shares or 0.02% of their US portfolio. State Street holds 82,266 shares or 0% of its portfolio. Ellington Mngmt holds 12,500 shares or 0.01% of its portfolio. The Missouri-based First Allied Advisory Svcs has invested 0% in BioDelivery Sciences International, Inc. (NASDAQ:BDSI). Pnc Group Inc, Pennsylvania-based fund reported 45,000 shares. 266,919 were accumulated by Barclays Public Limited Co. Tower Rech Cap Ltd (Trc) has invested 0% in BioDelivery Sciences International, Inc. (NASDAQ:BDSI). Janney Montgomery Scott Llc holds 0% or 37,158 shares. Cortina Asset Ltd reported 0.43% of its portfolio in BioDelivery Sciences International, Inc. (NASDAQ:BDSI).

Since December 27, 2018, it had 0 insider purchases, and 4 insider sales for $127,775 activity. The insider Sirgo Mark A sold 10,000 shares worth $29,100.

More notable recent BioDelivery Sciences International, Inc. (NASDAQ:BDSI) news were published by: Globenewswire.com which released: “BioDelivery Sciences to Report Third Quarter 2018 Financial Results on November 8, 2018 - GlobeNewswire” on October 23, 2018, also Seekingalpha.com with their article: “BioDelivery Sciences: Buy The Dip - Seeking Alpha” published on August 06, 2018, Seekingalpha.com published: “FDA Ad Com tomorrow on utility of higher-dose opioids - Seeking Alpha” on June 10, 2019. More interesting news about BioDelivery Sciences International, Inc. (NASDAQ:BDSI) were released by: Nasdaq.com and their article: “What’s in the Cards for Novavax (NVAX) This Earnings Season? - Nasdaq” published on March 04, 2019 as well as Seekingalpha.com‘s news article titled: “Updated Investment Case On BioDelivery Sciences - Seeking Alpha” with publication date: July 19, 2018.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.