Analysts expect Western Midstream Partners, LP (NYSE:WES) to report $0.64 EPS on July, 30.They anticipate $0.33 EPS change or 106.45% from last quarter’s $0.31 EPS. WES’s profit would be $289.91M giving it 12.39 P/E if the $0.64 EPS is correct. After having $0.30 EPS previously, Western Midstream Partners, LP’s analysts see 113.33% EPS growth. The stock increased 0.79% or $0.25 during the last trading session, reaching $31.73. About 216,685 shares traded. Western Midstream Partners, LP (NYSE:WES) has declined 15.80% since July 14, 2018 and is downtrending. It has underperformed by 20.23% the S&P500. Some Historical WES News: 03/05/2018 - DCP MIDSTREAM - ENTERPRISE PRODUCTS PARTNERS, WESTERN GAS PARTNERS, CO, ANNOUNCED BINDING OPEN SEASON FOR ADDITIONAL CAPACITY ON FRONT RANGE PIPELINE; 19/04/2018 - DJ Western Gas Partners LP, Inst Holders, 1Q 2018 (WES); 15/03/2018 Financial Review: #BREAKING: @Wesfarmers to spin off @Coles into separate ASX company.$WES #ausbiz; 03/05/2018 - Enterprise, Enbridge, Western Gas Partners and DCP Midstream Conduct Open Season for Texas Express Expansion; 17/04/2018 - WESTERN GAS REPORTS 1Q DISTRIBUTION OF $0.9350/UNIT; 03/05/2018 - DCP MIDSTREAM LP - ENTERPRISE WILL BE RESPONSIBLE FOR CONSTRUCTING EXPANSION, WHICH WILL CONSIST OF ADDING PUMPING CAPACITY ALONG 583-MILE ROUTE; 03/05/2018 - Enterprise, Western Gas Partners, and DCP Midstream Seek to Expand the Front Range Pipeline; 13/05/2018 - WESTERN GAS NAMES GENNIFER F. KELLY AS NEW COO; 15/03/2018 - James Thornhill: BREAKING: Wesfarmers $WES to de-merge Coles business, will retain a 20% stake. Shareholders will get new Coles; 03/05/2018 - WESTERN GAS PARTNERS LP WES.N : CITIGROUP RAISES TARGET PRICE TO $53 FROM $46

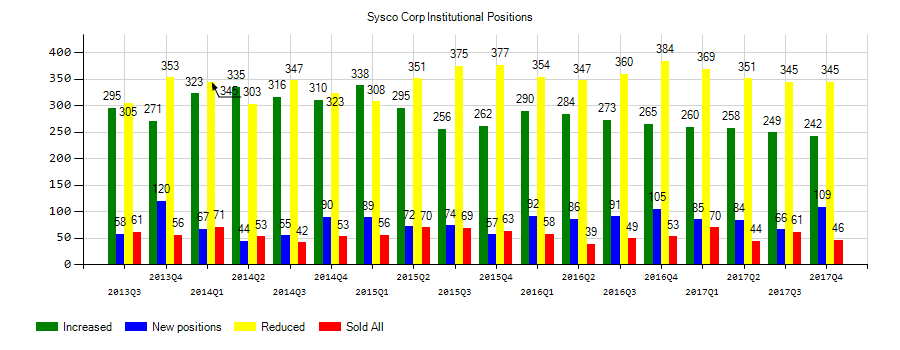

Meiji Yasuda Asset Management Company Ltd decreased Sysco Corp (SYY) stake by 49.66% reported in 2019Q1 SEC filing. Meiji Yasuda Asset Management Company Ltd sold 19,859 shares as Sysco Corp (SYY)’s stock rose 11.08%. The Meiji Yasuda Asset Management Company Ltd holds 20,129 shares with $1.34M value, down from 39,988 last quarter. Sysco Corp now has $37.31B valuation. The stock increased 0.85% or $0.61 during the last trading session, reaching $72.59. About 2.20 million shares traded. Sysco Corporation (NYSE:SYY) has risen 17.49% since July 14, 2018 and is uptrending. It has outperformed by 13.06% the S&P500. Some Historical SYY News: 09/05/2018 - Five Prominent Gaming CEOs in Showcase Event at 22nd Annual East Coast Gaming Congress, June 13-14 in Atlantic City; 16/05/2018 - Sysco “Delivering in a Big Way” Upon Return to the National Restaurant Association Show 2018; 22/03/2018 - Sysco Raises Previously Announced Tender Cap From $200M to $230.5M; 13/04/2018 - SYSCO INDUSTRIES LTD SYSC.BO SAYS STATE BANK OF INDIA HAS RECLASSIFIED CO’S CREDIT ACCOUNTS AS NPA; 06/04/2018 - SYSCO INDUSTRIES LTD SYSC.BO - NO LOSS OR INJURY TO HUMAN LIFE DUE TO FIRE; 22/03/2018 - SYSCO REPORTS UPSIZING OF PENDING CASH TENDER OFFER; 07/05/2018 - Sysco Presenting at Conference Jun 6; 24/05/2018 - Sysco Declares Quarterly Dividend Payment; 22/05/2018 - Sysco Presenting at Goldman Sachs Conference Jun 5; 07/05/2018 - SYSCO 3Q ADJ EPS 67C

More notable recent Western Midstream Partners, LP (NYSE:WES) news were published by: Nasdaq.com which released: “This High-Yield Stock Could Become a High-Profile Acquisition Target - Nasdaq” on June 25, 2019, also Prnewswire.com with their article: “Saddlehorn Pipeline to Expand and Add New Ft. Laramie Origin, Launches Open Season - PRNewswire” published on July 01, 2019, Seekingalpha.com published: “Occidental eyes stake sale in Anadarko’s Western Midstream - Bloomberg - Seeking Alpha” on June 25, 2019. More interesting news about Western Midstream Partners, LP (NYSE:WES) were released by: Benzinga.com and their article: “Benzinga’s Top Upgrades, Downgrades For June 14, 2019 - Benzinga” published on June 14, 2019 as well as Seekingalpha.com‘s news article titled: “Midstream Leads At Midpoint - Seeking Alpha” with publication date: June 30, 2019.

Among 4 analysts covering Western Gas (NYSE:WES), 1 have Buy rating, 0 Sell and 3 Hold. Therefore 25% are positive. Western Gas had 5 analyst reports since February 15, 2019 according to SRatingsIntel. On Friday, March 22 the stock rating was maintained by Barclays Capital with “Equal-Weight”. MUFG Securities Americas Inc upgraded the shares of WES in report on Friday, February 15 to “Hold” rating. The rating was maintained by Wells Fargo on Monday, February 18 with “Hold”. As per Tuesday, March 12, the company rating was maintained by RBC Capital Markets.

Western Gas Partners, LP acquires, develops, owns, and operates midstream energy assets in the Rocky Mountains, North-central Pennsylvania, and Texas. The company has market cap of $14.37 billion. It is involved in gathering, processing, compressing, treating, and transporting natural gas, condensate, natural gas liquids, and crude oil. It has a 21.2 P/E ratio. Western Gas Holdings, LLC serves as the general partner of Western Gas Partners, LP.

Investors sentiment decreased to 0.01 in Q1 2019. Its down 1.09, from 1.1 in 2018Q4. It worsened, as 147 investors sold Western Midstream Partners, LP shares while 0 reduced holdings. 1 funds opened positions while 1 raised stakes. 1.14 million shares or 98.68% less from 86.55 million shares in 2018Q4 were reported. Hite Hedge Asset holds 1.07M shares or 5.3% of its portfolio. Adams Asset Limited Company accumulated 19,177 shares or 0.08% of the stock. Janney Montgomery Scott Lc owns 0.01% invested in Western Midstream Partners, LP (NYSE:WES) for 27,925 shares.

Meiji Yasuda Asset Management Company Ltd increased General Mtrs Co (NYSE:GM) stake by 11,600 shares to 37,977 valued at $1.41M in 2019Q1. It also upped Cintas Corp (NASDAQ:CTAS) stake by 3,064 shares and now owns 6,401 shares. International Flavors&Fragra (NYSE:IFF) was raised too.

Since January 31, 2019, it had 0 buys, and 2 sales for $5.28 million activity. $1.47M worth of Sysco Corporation (NYSE:SYY) was sold by CHARLTON ROBERT S. Libby Russell T. sold $3.81 million worth of stock or 60,156 shares.

Investors sentiment increased to 0.97 in 2019 Q1. Its up 0.12, from 0.85 in 2018Q4. It increased, as 44 investors sold SYY shares while 347 reduced holdings. 100 funds opened positions while 280 raised stakes. 388.50 million shares or 4.61% less from 407.27 million shares in 2018Q4 were reported. 362,234 are held by Los Angeles Cap Mngmt & Equity. Employees Retirement Association Of Colorado holds 93,689 shares. Loomis Sayles Lp holds 0% of its portfolio in Sysco Corporation (NYSE:SYY) for 1,960 shares. First Business Financial Services Incorporated reported 0.13% in Sysco Corporation (NYSE:SYY). Amundi Pioneer Asset Mngmt Inc holds 1.01 million shares or 0.1% of its portfolio. The Japan-based Sumitomo Mitsui Asset Management Limited has invested 0.04% in Sysco Corporation (NYSE:SYY). The New York-based Alliancebernstein Ltd Partnership has invested 0.07% in Sysco Corporation (NYSE:SYY). Veritable Limited Partnership holds 0.03% or 25,803 shares. Spectrum Mgmt Gru accumulated 24,245 shares. Woodmont Counsel, a Tennessee-based fund reported 17,355 shares. Moreover, Homrich And Berg has 0.04% invested in Sysco Corporation (NYSE:SYY) for 12,377 shares. The Virginia-based Burney has invested 0.07% in Sysco Corporation (NYSE:SYY). Asset Mgmt One owns 310,992 shares. State Of New Jersey Common Pension Fund D has invested 0.08% in Sysco Corporation (NYSE:SYY). Jane Street Group Ltd Limited Liability Company owns 129,049 shares for 0.01% of their portfolio.

Among 5 analysts covering Sysco (NYSE:SYY), 3 have Buy rating, 0 Sell and 2 Hold. Therefore 60% are positive. Sysco had 10 analyst reports since January 16, 2019 according to SRatingsIntel. Buckingham Research maintained Sysco Corporation (NYSE:SYY) rating on Tuesday, May 7. Buckingham Research has “Buy” rating and $8400 target. JP Morgan maintained Sysco Corporation (NYSE:SYY) on Tuesday, June 4 with “Overweight” rating. On Tuesday, May 7 the stock rating was maintained by Morgan Stanley with “Equal-Weight”. The company was maintained on Wednesday, February 20 by Credit Suisse. Bank of America downgraded Sysco Corporation (NYSE:SYY) on Wednesday, January 16 to “Neutral” rating.

Analysts await Sysco Corporation (NYSE:SYY) to report earnings on August, 12. They expect $1.07 earnings per share, up 13.83% or $0.13 from last year’s $0.94 per share. SYY’s profit will be $549.95 million for 16.96 P/E if the $1.07 EPS becomes a reality. After $0.79 actual earnings per share reported by Sysco Corporation for the previous quarter, Wall Street now forecasts 35.44% EPS growth.

More notable recent Sysco Corporation (NYSE:SYY) news were published by: Seekingalpha.com which released: “Americold Valuation Dilemma - Seeking Alpha” on June 16, 2019, also Seekingalpha.com with their article: “Wall Street Brunch - Seeking Alpha” published on June 16, 2019, Seekingalpha.com published: “Stocks To Watch: Spotlight On FOMC, Slack And Paris Air Show - Seeking Alpha” on June 15, 2019. More interesting news about Sysco Corporation (NYSE:SYY) were released by: Finance.Yahoo.com and their article: “Should You Be Adding Sysco (NYSE:SYY) To Your Watchlist Today? - Yahoo Finance” published on May 13, 2019 as well as Finance.Yahoo.com‘s news article titled: “Sysco Corporation (NYSE:SYY): Will The Growth Last? - Yahoo Finance” with publication date: May 31, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.