Stone Ridge Asset Management Llc decreased its stake in Ugi Corp New (UGI) by 62.59% based on its latest 2019Q1 regulatory filing with the SEC. Stone Ridge Asset Management Llc sold 35,200 shares as the company’s stock declined 5.51% . The hedge fund held 21,037 shares of the natural gas distribution company at the end of 2019Q1, valued at $1.17 million, down from 56,237 at the end of the previous reported quarter. Stone Ridge Asset Management Llc who had been investing in Ugi Corp New for a number of months, seems to be less bullish one the $10.16 billion market cap company. The stock decreased 0.15% or $0.07 during the last trading session, reaching $48. About 1.70M shares traded or 0.70% up from the average. UGI Corporation (NYSE:UGI) has declined 2.65% since September 7, 2018 and is downtrending. It has underperformed by 2.65% the S&P500. Some Historical UGI News: 02/05/2018 - UGI 2Q EPS $1.57; 02/05/2018 - UGI SEES FY ADJ EPS $2.70 TO $2.80, EST. $2.67; 22/05/2018 - UGI: Deliveries Will Begin in Fall 2018 With Balance of Capacity Available in Fall 2019; 02/05/2018 - UGI 2Q Rev $2.81B; 24/04/2018 - UGI CORP UGI.N INCREASES QUARTERLY DIVIDEND BY 4 PCT TO $0.26/SHR; 06/03/2018 UGI Corporation Elects Alan N. Harris to its Board of Directors; 12/03/2018 - UGI Corp. - Undisclosed SEC investigation again confirmed - 6th time since Oct-2012. (published 30-Jan); 24/04/2018 - UGI Raises Dividend to 26c; 16/05/2018 - UGI at American Gas Association Financial Forum May 21; 22/05/2018 - UGI ADDS 2 COMPRESSOR STATIONS TO AUBURN GATHERING SYSTEM

Aperio Group Llc decreased its stake in Eog Res Inc (EOG) by 9.09% based on its latest 2019Q1 regulatory filing with the SEC. Aperio Group Llc sold 29,489 shares as the company’s stock declined 6.57% . The institutional investor held 294,826 shares of the energy company at the end of 2019Q1, valued at $28.06M, down from 324,315 at the end of the previous reported quarter. Aperio Group Llc who had been investing in Eog Res Inc for a number of months, seems to be less bullish one the $43.56 billion market cap company. The stock increased 1.11% or $0.84 during the last trading session, reaching $76.44. About 3.73 million shares traded or 4.13% up from the average. EOG Resources, Inc. (NYSE:EOG) has declined 33.91% since September 7, 2018 and is downtrending. It has underperformed by 33.91% the S&P500. Some Historical EOG News: 03/05/2018 - EOG RESOURCES 1Q ADJ EPS $1.19, EST. $1.01; 03/05/2018 - EOG RESOURCES INC - QTRLY OPERATING REVENUES AND OTHER $3,681.2 MLN VS $2,610.6 MLN; 03/05/2018 - EOG to Accelerate Dividend Growth as Shale Becomes Cash Machine; 13/03/2018 - Something curious between EOG Resources, Inc. and the SEC (published 30-Jan). $EOG; 21/05/2018 - EOG RESOURCES INC EOG.N : SIMMONS RAISES TARGET PRICE TO $138 FROM $123; 04/05/2018 - EOG BELIEVES ITS DIVIDEND SUSTAINABLE THROUGH COMMODITY CYCLES; 14/05/2018 - VP Donaldson Gifts 914 Of EOG Resources Inc; 27/03/2018 - EOG RESOURCES INC EOG.N CHIEF EXECUTIVE BILL THOMAS SAYS HAS LOCKED IN 60 PCT OF OILFIELD SERVICE NEEDS FOR 2018; 03/05/2018 - EOG Resources 1Q Adj EPS $1.19; 25/04/2018 - EnerCom’s The Oil & Gas Conference® Coming to Denver Aug. 19-22, 2018

Aperio Group Llc, which manages about $7.06 billion and $23.17B US Long portfolio, upped its stake in Cadence Design System Inc (NASDAQ:CDNS) by 13,020 shares to 340,272 shares, valued at $21.61 million in 2019Q1, according to the filing. It also increased its holding in V F Corp (NYSE:VFC) by 4,771 shares in the quarter, for a total of 211,073 shares, and has risen its stake in Ultrapar Participacoes S A (NYSE:UGP).

Analysts await EOG Resources, Inc. (NYSE:EOG) to report earnings on November, 7. They expect $1.24 EPS, down 29.14% or $0.51 from last year’s $1.75 per share. EOG’s profit will be $706.59 million for 15.41 P/E if the $1.24 EPS becomes a reality. After $1.31 actual EPS reported by EOG Resources, Inc. for the previous quarter, Wall Street now forecasts -5.34% negative EPS growth.

More notable recent EOG Resources, Inc. (NYSE:EOG) news were published by: Finance.Yahoo.com which released: “Did You Manage To Avoid EOG Resources’s (NYSE:EOG) 25% Share Price Drop? - Yahoo Finance” on May 29, 2019, also Fool.com with their article: “This Oil Stock’s Ambition Is to Become an Attractive Dividend Stock - Motley Fool” published on August 24, 2019, Seekingalpha.com published: “An Interesting Subject To Analyze: EOG Resources - Seeking Alpha” on September 02, 2019. More interesting news about EOG Resources, Inc. (NYSE:EOG) were released by: Finance.Yahoo.com and their article: “Bill Nygren Drills Into Permian Basin Oil - Yahoo Finance” published on August 22, 2019 as well as Finance.Yahoo.com‘s news article titled: “Why EOG Resources, Acuity Brands, and BlackLine Slumped Today - Yahoo Finance” with publication date: July 02, 2019.

Investors sentiment increased to 1.2 in 2019 Q1. Its up 0.25, from 0.95 in 2018Q4. It increased, as 52 investors sold EOG shares while 274 reduced holdings. 98 funds opened positions while 294 raised stakes. 486.39 million shares or 1.74% less from 495.00 million shares in 2018Q4 were reported. American Century Cos holds 0.39% in EOG Resources, Inc. (NYSE:EOG) or 4.02M shares. Field & Main Fincl Bank accumulated 5,325 shares. Hudson Bay Lp owns 6,500 shares. Adams Natural Res Fund holds 4.54% of its portfolio in EOG Resources, Inc. (NYSE:EOG) for 281,600 shares. Taylor Asset Mngmt holds 6,400 shares or 0.4% of its portfolio. Cwm Ltd Liability Company reported 239,713 shares or 0.46% of all its holdings. British Columbia Invest Mgmt Corp reported 110,442 shares. Scotia holds 32,907 shares. Pictet Asset Mngmt Ltd holds 0.06% of its portfolio in EOG Resources, Inc. (NYSE:EOG) for 264,614 shares. Wills Financial Group invested 1.03% in EOG Resources, Inc. (NYSE:EOG). Fifth Third State Bank reported 218,405 shares. 68,242 are owned by Pinebridge Invests L P. Amer Insurance Tx has 87,250 shares for 0.44% of their portfolio. 2,484 are owned by Ballentine Partners Ltd Liability Company. First Retail Bank reported 0.1% in EOG Resources, Inc. (NYSE:EOG).

Stone Ridge Asset Management Llc, which manages about $3.70B and $1.75 billion US Long portfolio, upped its stake in Walgreens Boots Alliance Inc by 5,400 shares to 118,270 shares, valued at $7.48M in 2019Q1, according to the filing. It also increased its holding in Pbf Energy Inc (NYSE:PBF) by 47,000 shares in the quarter, for a total of 68,788 shares, and has risen its stake in Wells Fargo Co New (NYSE:WFC).

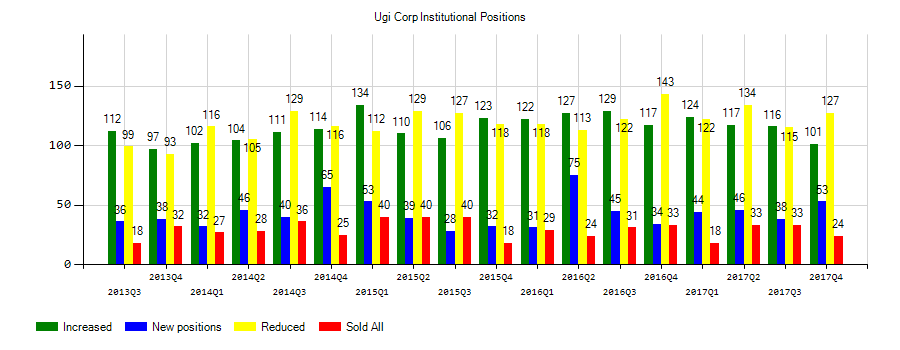

Investors sentiment decreased to 1.17 in Q1 2019. Its down 0.08, from 1.25 in 2018Q4. It worsened, as 26 investors sold UGI shares while 120 reduced holdings. 57 funds opened positions while 114 raised stakes. 134.04 million shares or 1.82% less from 136.51 million shares in 2018Q4 were reported. Argyle Cap Mngmt, Pennsylvania-based fund reported 26,650 shares. Teachers Retirement Sys Of The State Of Kentucky reported 119,520 shares or 0.08% of all its holdings. Natixis stated it has 0.08% of its portfolio in UGI Corporation (NYSE:UGI). Amundi Pioneer Asset Mgmt accumulated 391,094 shares. British Columbia Inv Mgmt, a British Columbia - Canada-based fund reported 78,626 shares. Carnegie Cap Asset Limited Com accumulated 10,500 shares. Teacher Retirement Sys Of Texas reported 617,113 shares. Panagora Asset Mgmt accumulated 0% or 9,585 shares. Evercore Wealth Mngmt Limited Liability stated it has 0.01% of its portfolio in UGI Corporation (NYSE:UGI). Axa holds 0.03% or 155,400 shares in its portfolio. Thrivent Fincl For Lutherans reported 0.04% stake. Acadian Asset Management Ltd Liability Corp invested 0.05% of its portfolio in UGI Corporation (NYSE:UGI). Nuveen Asset Mgmt Ltd Co has 21,893 shares. Comerica Bancshares holds 226,668 shares or 0.1% of its portfolio. Private Advisor Group Incorporated Limited Liability has invested 0.01% in UGI Corporation (NYSE:UGI).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.