Navellier & Associates Inc increased its stake in Fortinet Inc. (FTNT) by 101.31% based on its latest 2019Q1 regulatory filing with the SEC. Navellier & Associates Inc bought 75,742 shares as the company’s stock declined 1.66% while stock markets rallied. The hedge fund held 150,501 shares of the technology company at the end of 2019Q1, valued at $12.64 million, up from 74,759 at the end of the previous reported quarter. Navellier & Associates Inc who had been investing in Fortinet Inc. for a number of months, seems to be bullish on the $14.17 billion market cap company. The stock decreased 2.81% or $2.4 during the last trading session, reaching $82.96. About 1.92 million shares traded or 22.57% up from the average. Fortinet, Inc. (NASDAQ:FTNT) has risen 36.10% since July 30, 2018 and is uptrending. It has outperformed by 31.67% the S&P500. Some Historical FTNT News: 15/05/2018 - Fortinet Presenting at JPMorgan Conference Tomorrow; 15/05/2018 - Blue Harbour Adds Fortinet, Exits Zayo Group: 13F; 17/04/2018 - Fortinet Now Part of IBM Security’s New X-Force Threat Management Services; 13/04/2018 - Fortinet Presenting at RSA Conference Apr 18; 29/05/2018 - CRN Exclusive: Fortinet Makes Managed Security More Accessible To Small Partners With New Tier, Pricing; 15/05/2018 - BLUE HARBOUR ADDED FTNT, JACK IN 1Q: 13F; 03/05/2018 - Fortinet 1Q Adj EPS 33c; 03/05/2018 - FORTINET INC FTNT.O FY2018 SHR VIEW $1.42, REV VIEW $1.71 BLN — THOMSON REUTERS l/B/E/S; 15/03/2018 - Fortinet Receives Recommended Rating in NSS Labs Data Center Intrusion Prevention System Test Report; 03/05/2018 - FORTINET 1Q REV. $399.0M, EST. $390.4M

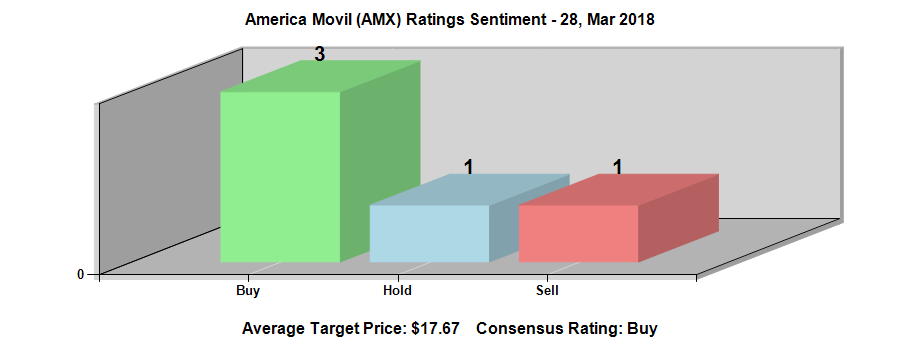

Wellington Management Group Llp decreased its stake in America Movil Sab De Cv (AMX) by 69.57% based on its latest 2019Q1 regulatory filing with the SEC. Wellington Management Group Llp sold 649,263 shares as the company’s stock declined 3.28% while stock markets rallied. The institutional investor held 283,923 shares of the public utilities company at the end of 2019Q1, valued at $4.05M, down from 933,186 at the end of the previous reported quarter. Wellington Management Group Llp who had been investing in America Movil Sab De Cv for a number of months, seems to be less bullish one the $47.50B market cap company. The stock increased 2.26% or $0.32 during the last trading session, reaching $14.49. About 1.46M shares traded. América Móvil, S.A.B. de C.V. (NYSE:AMX) has declined 16.77% since July 30, 2018 and is downtrending. It has underperformed by 21.20% the S&P500. Some Historical AMX News: 14/03/2018 - AMERICA MOVIL’S HAJJ SAYS INVESTMENT CAPACITY OF SEPARATE FIXED LINE UNIT WILL DEPEND ON ITS OWN FINANCIAL VIABILITY; 25/04/2018 - AMERICA MOVIL ON TRACK TO ACCOMPLISH $8B BUDGET FOR CAPEX: HAJJ; 24/04/2018 - MEXICO’S AMERICA MOVIL SAYS 1Q REVENUE 253.4 BLN PESOS; 14/03/2018 - AMERICA MOVIL CEO DANIEL HAJJ SPEAKS IN MEXICO CITY; 24/04/2018 - AMERICA MOVIL 1Q REV. MXN253.4B VS EST. MXN253.4B; 24/04/2018 - America Movil 1Q Revenue Down 3.7% on Year to MXN254.4 Billion; 19/04/2018 - IGNORE: AMERICA MOVIL POSTED 4Q EARNINGS FEB. 13; 19/04/2018 - AMERICA MOVIL 4Q OPER INCOME MXN28.56B; 24/04/2018 - America Movil 1Q Net Profit Down 51% on Year to MXN17.7 Billion; 20/03/2018 - AMERICA MOVIL APPROVED SHARE BUYBACK FUND OF MXN3B

Analysts await América Móvil, S.A.B. de C.V. (NYSE:AMX) to report earnings on October, 15. They expect $0.34 earnings per share, up 13.33% or $0.04 from last year’s $0.3 per share. AMX’s profit will be $1.11 billion for 10.65 P/E if the $0.34 EPS becomes a reality. After $0.22 actual earnings per share reported by América Móvil, S.A.B. de C.V. for the previous quarter, Wall Street now forecasts 54.55% EPS growth.

More notable recent América Móvil, S.A.B. de C.V. (NYSE:AMX) news were published by: Seekingalpha.com which released: “América Móvil readies loan market return with $2.5B refinancing plan - Reuters - Seeking Alpha” on May 20, 2019, also Benzinga.com with their article: “9 US-Traded Mexico-Based Stocks To Keep An Eye On - Benzinga” published on May 31, 2019, Seekingalpha.com published: “ILF: Exposure To Large-Cap Latam - Seeking Alpha” on January 14, 2019. More interesting news about América Móvil, S.A.B. de C.V. (NYSE:AMX) were released by: Finance.Yahoo.com and their article: “Is ING Groep N.V. (ING) A Good Stock To Buy ? - Yahoo Finance” published on June 29, 2019 as well as Fool.com‘s news article titled: “2 Top Mexican Stocks to Consider Buying Now - The Motley Fool” with publication date: January 24, 2018.

Wellington Management Group Llp, which manages about $441.54 billion US Long portfolio, upped its stake in Baxter Intl Inc (NYSE:BAX) by 206,714 shares to 32.44M shares, valued at $2.64B in 2019Q1, according to the filing. It also increased its holding in Pra Group Inc (NASDAQ:PRAA) by 114,052 shares in the quarter, for a total of 2.13 million shares, and has risen its stake in Louisiana Pac Corp (NYSE:LPX).

More notable recent Fortinet, Inc. (NASDAQ:FTNT) news were published by: Nasdaq.com which released: “Here is Why Growth Investors Should Buy Fortinet (FTNT) Now - Nasdaq” on April 19, 2019, also Nasdaq.com with their article: “What Makes Fortinet (FTNT) a Strong Momentum Stock: Buy Now? - Nasdaq” published on March 11, 2019, Nasdaq.com published: “Is It Time to Buy the Dip in Fortinet After a Solid Q1? - Nasdaq” on June 03, 2019. More interesting news about Fortinet, Inc. (NASDAQ:FTNT) were released by: Nasdaq.com and their article: “Fortinet to Secure Canadian Government’s Perimeter Services - Nasdaq” published on July 16, 2019 as well as Nasdaq.com‘s news article titled: “3 Reasons Why Fortinet (FTNT) Is a Great Growth Stock - Nasdaq” with publication date: May 06, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.