Analysts expect Metropolitan Bank Holding Corp. (NYSE:MCB) to report $0.90 EPS on July, 24.They anticipate $0.20 EPS change or 28.57% from last quarter’s $0.7 EPS. MCB’s profit would be $7.49 million giving it 12.21 P/E if the $0.90 EPS is correct. After having $1.01 EPS previously, Metropolitan Bank Holding Corp.’s analysts see -10.89% EPS growth. The stock decreased 0.36% or $0.16 during the last trading session, reaching $43.96. About 10,222 shares traded. Metropolitan Bank Holding Corp. (NYSE:MCB) has declined 14.50% since July 14, 2018 and is downtrending. It has underperformed by 18.93% the S&P500. Some Historical MCB News: 29/05/2018 - Metropolitan Bank Holding Corp. Names William Reinhardt Chairman of the Board of Directors; 29/05/2018 - METROPOLITAN BANK HOLDING CORP - DAVID M. GAVRIN TO REMAIN ON BOARD; 29/05/2018 - Metropolitan Bank: David M. Gavrin to Remain on the Board; 12/03/2018 Metropolitan Bank Holding Closes Below 50-D-MA: Technicals; 15/05/2018 - Millennium Management Buys Into Metropolitan Bank Holding Corp; 30/04/2018 - Metropolitan Bank Holding Corp. Names Scott Lublin Chief Lending Officer; 29/05/2018 - METROPOLITAN BANK NAMES WILLIAM REINHARDT CHAIRMAN OF BOARD; 21/04/2018 - DJ Metropolitan Bank Holding Corp, Inst Holders, 1Q 2018 (MCB); 29/05/2018 - Metropolitan Bank Names William Reinhardt as Chairman; 25/04/2018 - Metropolitan Bank 1Q EPS 75c

Brown Brothers Harriman & Co decreased Us Bancorp (USB) stake by 3.51% reported in 2019Q1 SEC filing. Brown Brothers Harriman & Co sold 506,263 shares as Us Bancorp (USB)’s stock declined 0.24%. The Brown Brothers Harriman & Co holds 13.93 million shares with $671.29 million value, down from 14.44M last quarter. Us Bancorp now has $85.33 billion valuation. The stock increased 0.24% or $0.13 during the last trading session, reaching $53.6. About 4.15 million shares traded. U.S. Bancorp (NYSE:USB) has declined 0.76% since July 14, 2018 and is downtrending. It has underperformed by 5.19% the S&P500. Some Historical USB News: 18/04/2018 - US BANCORP: 1Q 2018 LINE SCHEDULES - PDF VERSION; 07/03/2018 - Pymnts.com: U.S. Bancorp Hoping For Regulation Lift By End Of Year; 09/05/2018 - Moody’s Confirms U.S. Bancorp (senior unsecured A1); 18/04/2018 - US Bancorp 1Q Net Interest Income $3.17B; 09/05/2018 - U.S. BANCORP OUTLOOK STABLE BY MOODY’S; 18/04/2018 - US Bancorp 1Q EPS 96c; 24/04/2018 - U.S. Bancorp Bond Trading 4x Average; Clients Net Sellers; 24/04/2018 - Elavon Gives Customers and Partners Enhanced Protection from Data Breaches with PCI Point-to-Point Encryption (P2PE) Validation; 18/04/2018 - US Bancorp 1Q Provision for Credit Losses $341M; 25/04/2018 - U.S. Bank Streamlines Automated Insurance Payment Process with Enservio’s Paysurance®

Among 3 analysts covering US Bancorp (NYSE:USB), 1 have Buy rating, 1 Sell and 1 Hold. Therefore 33% are positive. US Bancorp had 6 analyst reports since January 28, 2019 according to SRatingsIntel. The stock of U.S. Bancorp (NYSE:USB) has “Underweight” rating given on Tuesday, July 9 by JP Morgan. The firm earned “Outperform” rating on Tuesday, March 26 by Oppenheimer. The stock has “Neutral” rating by Robert W. Baird on Monday, January 28.

More notable recent U.S. Bancorp (NYSE:USB) news were published by: Seekingalpha.com which released: “Stocks To Watch: Prime Day And FAANGs Out In DC - Seeking Alpha” on July 13, 2019, also Fool.com with their article: “A Foolish Take: Bank Dividends Are Soaring - The Motley Fool” published on July 08, 2019, Seekingalpha.com published: “U.S. Bancorp acquisition of Regions would be `compelling’ - Raymond James - Seeking Alpha” on July 02, 2019. More interesting news about U.S. Bancorp (NYSE:USB) were released by: Streetinsider.com and their article: “US Bancorp (USB) to Raise Dividend 13.5% Following CCAR; $3B Buyback - StreetInsider.com” published on June 27, 2019 as well as Forbes.com‘s news article titled: “U.S. Bancorp’s Shareholder Payout Will Cross $5 Billion For The First Time Ever This Year - Forbes” with publication date: July 09, 2019.

Analysts await U.S. Bancorp (NYSE:USB) to report earnings on July, 17 before the open. They expect $1.07 EPS, up 4.90% or $0.05 from last year’s $1.02 per share. USB’s profit will be $1.70B for 12.52 P/E if the $1.07 EPS becomes a reality. After $1.00 actual EPS reported by U.S. Bancorp for the previous quarter, Wall Street now forecasts 7.00% EPS growth.

Brown Brothers Harriman & Co increased Western Alliance Bancorp (NYSE:WAL) stake by 10,000 shares to 135,353 valued at $5.56 million in 2019Q1. It also upped Wayfair Inc (NYSE:W) stake by 7,170 shares and now owns 7,720 shares. W/I was raised too.

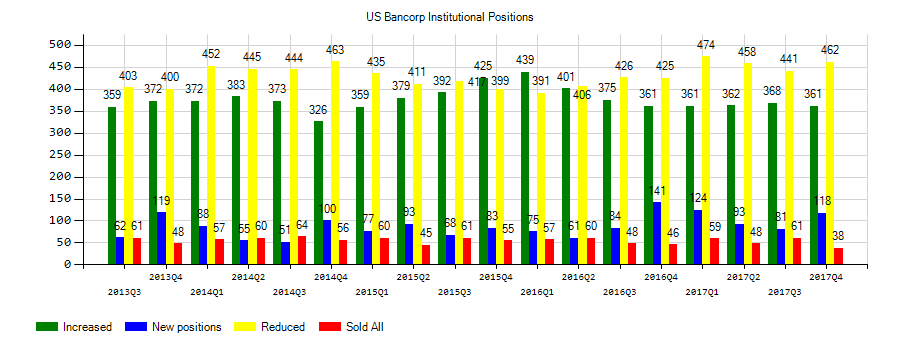

Investors sentiment increased to 1.03 in 2019 Q1. Its up 0.18, from 0.85 in 2018Q4. It improved, as 36 investors sold USB shares while 420 reduced holdings. 116 funds opened positions while 354 raised stakes. 1.15 billion shares or 1.52% less from 1.17 billion shares in 2018Q4 were reported. Argent Mgmt Ltd Liability Corp accumulated 10,474 shares. Whittier Trust Of Nevada invested in 17,709 shares or 0.06% of the stock. 154,303 were accumulated by Teachers Retirement Of The State Of Kentucky. Inv Mngmt Of Virginia Ltd Liability Company stated it has 0.46% in U.S. Bancorp (NYSE:USB). Rafferty Asset Mgmt Limited Company invested in 0.24% or 306,179 shares. Tarbox Family Office invested in 0.87% or 49,582 shares. Davenport Lc invested in 0.03% or 52,253 shares. Alethea Cap Management Limited Liability Co has 18,774 shares. Lombard Odier Asset (Europe) stated it has 15,969 shares or 0.08% of all its holdings. Da Davidson And Company invested in 181,587 shares or 0.15% of the stock. Spears Abacus Advisors Lc invested in 8,665 shares. Savings Bank Of Hawaii reported 44,482 shares. Massmutual Fsb Adv stated it has 0% in U.S. Bancorp (NYSE:USB). Moreover, Federated Pa has 0.01% invested in U.S. Bancorp (NYSE:USB). Mar Vista Prns Limited Liability reported 2.25 million shares or 2.86% of all its holdings.

Since February 4, 2019, it had 0 insider buys, and 1 insider sale for $758,956 activity. GODRIDGE LESLIE V sold 14,737 shares worth $758,956.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.