Strs Ohio decreased its stake in Vicor Corp (VICR) by 88.33% based on its latest 2018Q4 regulatory filing with the SEC. Strs Ohio sold 10,600 shares as the company’s stock declined 9.95% while stock markets rallied. The institutional investor held 1,400 shares of the industrial machinery and components company at the end of 2018Q4, valued at $52,000, down from 12,000 at the end of the previous reported quarter. Strs Ohio who had been investing in Vicor Corp for a number of months, seems to be less bullish one the $1.56B market cap company. The stock increased 3.34% or $1.25 during the last trading session, reaching $38.65. About 202,568 shares traded. Vicor Corporation (NASDAQ:VICR) has risen 25.21% since May 4, 2018 and is uptrending. It has outperformed by 20.84% the S&P500.

Institute For Wealth Management Llc decreased its stake in Aflac Inc (AFL) by 39.88% based on its latest 2018Q4 regulatory filing with the SEC. Institute For Wealth Management Llc sold 11,053 shares as the company’s stock rose 8.16% with the market. The institutional investor held 16,661 shares of the accident &health insurance company at the end of 2018Q4, valued at $759,000, down from 27,714 at the end of the previous reported quarter. Institute For Wealth Management Llc who had been investing in Aflac Inc for a number of months, seems to be less bullish one the $37.64B market cap company. The stock increased 0.48% or $0.24 during the last trading session, reaching $50.49. About 2.11M shares traded. Aflac Incorporated (NYSE:AFL) has risen 11.93% since May 4, 2018 and is uptrending. It has outperformed by 7.56% the S&P500.

Investors sentiment decreased to 0.98 in Q4 2018. Its down 0.88, from 1.86 in 2018Q3. It dived, as 21 investors sold VICR shares while 42 reduced holdings. 25 funds opened positions while 37 raised stakes. 12.37 million shares or 0.99% more from 12.25 million shares in 2018Q3 were reported. Tudor Corp Et Al has 14,538 shares. Guggenheim Ltd Liability Corporation holds 0% or 9,484 shares in its portfolio. Tiaa Cref Invest Management Lc, a New York-based fund reported 35,202 shares. Grp Inc One Trading LP owns 23,313 shares for 0.01% of their portfolio. Nj State Employees Deferred Compensation Plan holds 0.09% or 11,000 shares in its portfolio. Susquehanna Intll Grp Inc Ltd Liability Partnership holds 0% or 85,063 shares. Van Eck accumulated 16,057 shares. Ameritas Investment Prtnrs Inc stated it has 1,422 shares. Fdx Advisors owns 80,564 shares. State Of Alaska Department Of Revenue owns 0% invested in Vicor Corporation (NASDAQ:VICR) for 5,411 shares. San Francisco Sentry Investment Gp (Ca) reported 19 shares. Goldman Sachs Gp holds 63,314 shares or 0% of its portfolio. Oregon Pub Employees Retirement Fund invested in 232,711 shares. Tocqueville Asset LP reported 5,500 shares. Ls Advsr Ltd Limited Liability Company reported 4,298 shares.

Strs Ohio, which manages about $19.70B US Long portfolio, upped its stake in Extra Space Storage Inc (NYSE:EXR) by 11,791 shares to 181,573 shares, valued at $16.43M in 2018Q4, according to the filing. It also increased its holding in Broadcom Ltd by 19,095 shares in the quarter, for a total of 456,790 shares, and has risen its stake in Duke Energy Corporation (NYSE:DUK).

More notable recent Vicor Corporation (NASDAQ:VICR) news were published by: Seekingalpha.com which released: “A 43% Drop In Vicor’s Share Price Is A Buying Opportunity - Seeking Alpha” on October 15, 2018, also Finance.Yahoo.com with their article: “5 Top Stock Trades for Thursday — Buy the Dip in GM or AT&T? - Yahoo Finance” published on July 25, 2018, Seekingalpha.com published: “Vicor Corporation (VICR) CEO Patrizio Vinciarelli on Q3 2018 Results - Earnings Call Transcript - Seeking Alpha” on October 19, 2018. More interesting news about Vicor Corporation (NASDAQ:VICR) were released by: Seekingalpha.com and their article: “Vicor Corporation (VICR) CEO Patrizio Vinciarelli on Q4 2018 Results - Earnings Call Transcript - Seeking Alpha” published on February 26, 2019 as well as Benzinga.com‘s news article titled: “50 Stocks Moving In Wednesday’s Mid-Day Session - Benzinga” with publication date: April 24, 2019.

Since November 7, 2018, it had 0 insider buys, and 3 sales for $194,605 activity. Davies Philip D sold $25,307 worth of stock or 750 shares. $140,000 worth of Vicor Corporation (NASDAQ:VICR) shares were sold by Morrison Kemble D.

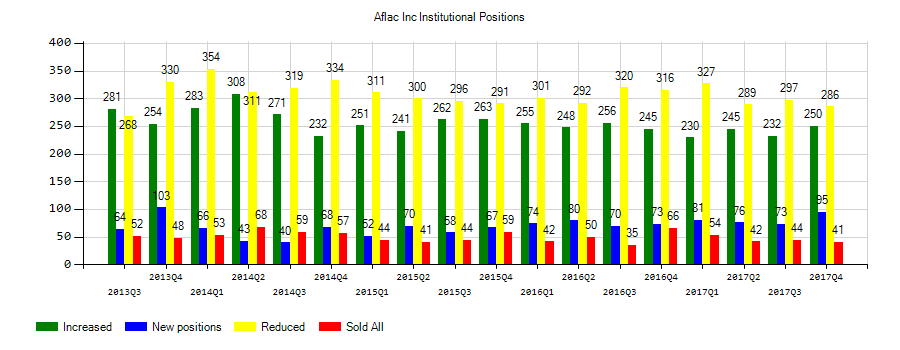

Investors sentiment decreased to 0.87 in Q4 2018. Its down 0.10, from 0.97 in 2018Q3. It is negative, as 48 investors sold AFL shares while 300 reduced holdings. 80 funds opened positions while 223 raised stakes. 485.14 million shares or 0.62% more from 482.13 million shares in 2018Q3 were reported. Guardian Life Co Of America reported 2,177 shares. California-based Destination Wealth Management has invested 1.46% in Aflac Incorporated (NYSE:AFL). The New York-based Art Advsrs Lc has invested 0.05% in Aflac Incorporated (NYSE:AFL). Robeco Institutional Asset Mngmt Bv has 1.76M shares for 0.36% of their portfolio. Chem State Bank holds 0.15% or 26,927 shares in its portfolio. Bradley Foster Sargent Inc Ct owns 13,189 shares for 0.02% of their portfolio. Neuberger Berman Gru Ltd Co accumulated 0.01% or 116,240 shares. Contravisory Inv Mngmt reported 0% in Aflac Incorporated (NYSE:AFL). Boys Arnold &, a North Carolina-based fund reported 53,582 shares. Pitcairn stated it has 15,635 shares. Moreover, Private Advisor Gru Llc has 0.01% invested in Aflac Incorporated (NYSE:AFL) for 13,312 shares. Gradient Invs Limited holds 0% or 130 shares in its portfolio. Mufg Americas accumulated 10,101 shares. British Columbia Invest Management Corp holds 0.11% of its portfolio in Aflac Incorporated (NYSE:AFL) for 203,839 shares. 5,548 are held by Bkd Wealth Advsr Limited Liability.

Since December 20, 2018, it had 1 buy, and 4 selling transactions for $3.21 million activity. Lloyd Karole bought $99,659 worth of stock or 2,000 shares. The insider Williams Richard JR sold 1,129 shares worth $49,647. Shares for $1.82 million were sold by LAKE CHARLES D II on Tuesday, February 5. $1.29 million worth of Aflac Incorporated (NYSE:AFL) was sold by Koide Masatoshi on Monday, February 4.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.