Alley Company Llc increased its stake in Broadridge Finl Solution (BR) by 7.22% based on its latest 2019Q1 regulatory filing with the SEC. Alley Company Llc bought 3,370 shares as the company’s stock rose 20.96% with the market. The institutional investor held 50,074 shares of the miscellaneous company at the end of 2019Q1, valued at $5.19 million, up from 46,704 at the end of the previous reported quarter. Alley Company Llc who had been investing in Broadridge Finl Solution for a number of months, seems to be bullish on the $15.32 billion market cap company. The stock decreased 0.15% or $0.2 during the last trading session, reaching $131.94. About 226,774 shares traded. Broadridge Financial Solutions, Inc. (NYSE:BR) has risen 3.98% since June 11, 2018 and is uptrending. It has underperformed by 0.45% the S&P500. Some Historical BR News: 08/05/2018 - Broadridge Financial Solutions 3Q Profit Rises 44%; FY EPS Guidance Raised; 27/03/2018 - Broadridge Acquires ActivePath, Further Enhances Platform To Help Clients Accelerate Digital Adoption; 18/04/2018 - New Investor Communications Technology Portal Announced by Broadridge; 10/04/2018 - VP Carey Disposes 47 Of Broadridge Financial Solutions Inc; 27/03/2018 - BROADRIDGE BUYS ISRAELI FINTECH STARTUP ACTIVEPATH; 10/04/2018 - SIDUS:TOLD THAT ACTG TOLD BROADRIDGE IT’S CANCELLING JUNE 7 MTG; 08/05/2018 - BROADRIDGE SEES FY REV. +2% TO +4%; 31/05/2018 - Enabling Cryptocurrency Transactions Key to Going Mainstream; 14/03/2018 - Investors Support Say-on-Pay and Environmental Proposals Broadridge and PwC ProxyPulse™ Report Shows; 31/05/2018 - Research Report Identifies Broadridge Financial Solutions, Pacific Ethanol, MAG Silver, Playa Hotels & Resorts N.V, Camping Wor

Palestra Capital Management Llc decreased its stake in Ptc Inc (PTC) by 21.86% based on its latest 2019Q1 regulatory filing with the SEC. Palestra Capital Management Llc sold 219,670 shares as the company’s stock declined 3.63% while stock markets rallied. The hedge fund held 785,285 shares of the prepackaged software company at the end of 2019Q1, valued at $72.39 million, down from 1.00M at the end of the previous reported quarter. Palestra Capital Management Llc who had been investing in Ptc Inc for a number of months, seems to be less bullish one the $10.42 billion market cap company. The stock decreased 0.26% or $0.24 during the last trading session, reaching $90.53. About 389,020 shares traded. PTC Inc. (NASDAQ:PTC) has risen 0.83% since June 11, 2018 and is uptrending. It has underperformed by 3.60% the S&P500. Some Historical PTC News: 08/03/2018 - Staples Solutions Goes Live with PTC’s Retail Product Lifecycle Management (PLM) Solution; 30/04/2018 - S&PGR Asgns JPM Chase Cm Mtg Sec Trst 2018-PTC Cts Prelim Rtgs; 29/03/2018 - The Wrap: Even PTC Likes `Roseanne’ Revival: `Seems Like a Winning Formula,’ Group President Says; 30/05/2018 - KloudGin Joins the PTC Partner Network Bringing AI-based Connected Field Service, Asset and Inventory Management Cloud Product; 12/05/2018 - Mumbai Bourse: Ptc India Financial Services Ltd. - Disclosure As Per Regulation 52(4); 03/04/2018 - C-RAD AB: C-RAD SIGNS STRATEGIC PACT TO EQUIP ZON-PTC, A; 18/04/2018 - PTC INC PTC.O - SEES FY18 EPS (NON-GAAP) $ 1.31 - $ 1.41; 16/05/2018 - PTC INDIA 4Q OTHER INCOME 175.5M RUPEES; 08/03/2018 - PTC Inc. at Non-Deal Roadshow Hosted By Seaport Today; 20/03/2018 - DOT Railroad: FRA Takes Proactive Approach to Help Railroads Meet Congressional PTC Requirement

Analysts await PTC Inc. (NASDAQ:PTC) to report earnings on July, 17. They expect $0.18 earnings per share, down 28.00% or $0.07 from last year’s $0.25 per share. PTC’s profit will be $20.71M for 125.74 P/E if the $0.18 EPS becomes a reality. After $0.19 actual earnings per share reported by PTC Inc. for the previous quarter, Wall Street now forecasts -5.26% negative EPS growth.

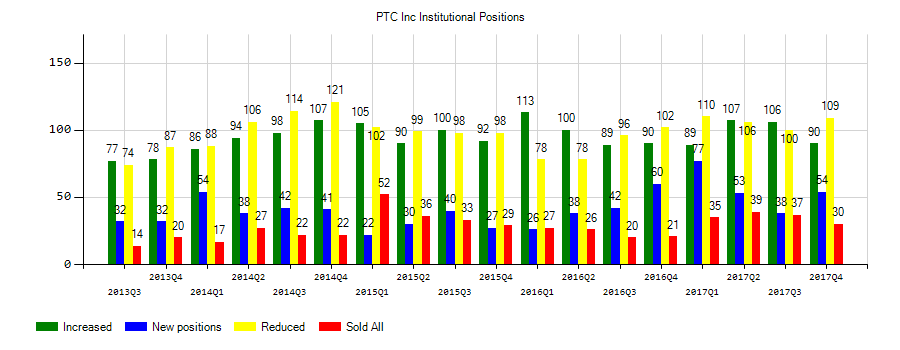

Investors sentiment increased to 1.13 in Q1 2019. Its up 0.12, from 1.01 in 2018Q4. It is positive, as 29 investors sold PTC shares while 112 reduced holdings. 58 funds opened positions while 101 raised stakes. 67.38 million shares or 3.96% less from 70.15 million shares in 2018Q4 were reported. Psagot Inv House Ltd holds 1,011 shares or 0% of its portfolio. Moody National Bank & Trust Trust Division reported 0.16% of its portfolio in PTC Inc. (NASDAQ:PTC). Kornitzer Cap Management Inc Ks invested 0.29% in PTC Inc. (NASDAQ:PTC). Tensile Cap Mgmt Llc has invested 8.73% in PTC Inc. (NASDAQ:PTC). Amer Century Cos holds 0.1% or 1.06 million shares in its portfolio. Assetmark, a California-based fund reported 253 shares. Cipher Capital LP owns 3,109 shares for 0.02% of their portfolio. Morgan Stanley reported 1,922 shares stake. Northwestern Mutual Wealth Mgmt reported 0% of its portfolio in PTC Inc. (NASDAQ:PTC). Nordea Inv Mngmt Ab holds 0% or 3,728 shares. Moreover, State Board Of Administration Of Florida Retirement has 0.04% invested in PTC Inc. (NASDAQ:PTC) for 151,001 shares. Dimensional Fund Advsr Ltd Partnership accumulated 0.01% or 892,827 shares. Brant Point stated it has 163,405 shares. Aqr Capital Mgmt Ltd accumulated 12,424 shares. Moreover, Hrt Fincl Limited Liability has 0.04% invested in PTC Inc. (NASDAQ:PTC).

More notable recent PTC Inc. (NASDAQ:PTC) news were published by: Nasdaq.com which released: “PTC Inc. (PTC) Reports Next Week: What You Should Expect - Nasdaq” on April 17, 2019, also Businesswire.com with their article: “CORRECTING and REPLACING PTC Extends Windchill PLM Platform by Integrating Requirements, Systems and Software Engineering Capabilities - Business Wire” published on June 10, 2019, Businesswire.com published: “PTC Announces ThingWorx 8.5 to Help Customers Drive Digital Transformation to New Levels - Business Wire” on June 11, 2019. More interesting news about PTC Inc. (NASDAQ:PTC) were released by: Businesswire.com and their article: “PTC Recognized as Winner and Finalist for Three 2019 Microsoft Partner of the Year Awards - Business Wire” published on June 10, 2019 as well as Finance.Yahoo.com‘s news article titled: “Why PTC Shares Got Crushed Today - Yahoo Finance” with publication date: April 25, 2019.

Palestra Capital Management Llc, which manages about $755.46M and $3.06B US Long portfolio, upped its stake in Worldpay Inc by 308,035 shares to 2.06 million shares, valued at $233.93 million in 2019Q1, according to the filing.

Investors sentiment increased to 1.24 in 2019 Q1. Its up 0.41, from 0.83 in 2018Q4. It improved, as 45 investors sold BR shares while 165 reduced holdings. 73 funds opened positions while 188 raised stakes. 92.99 million shares or 3.93% less from 96.79 million shares in 2018Q4 were reported. 21,755 are owned by Stoneridge Prtnrs Limited Liability Company. The Japan-based Sumitomo Mitsui Tru has invested 0.05% in Broadridge Financial Solutions, Inc. (NYSE:BR). Tiverton Asset Management Limited Com has invested 0.01% in Broadridge Financial Solutions, Inc. (NYSE:BR). Westpac Banking accumulated 68,668 shares or 0% of the stock. Macquarie Grp holds 242,778 shares or 0.04% of its portfolio. First Bancorporation Of Omaha holds 66,818 shares. Zwj Investment Counsel owns 0.02% invested in Broadridge Financial Solutions, Inc. (NYSE:BR) for 2,302 shares. Mufg Americas Corp invested in 992 shares. Hilltop Inc, a Texas-based fund reported 10,997 shares. Prelude Cap Management Ltd Llc owns 2,264 shares. Bahl Gaynor Incorporated reported 967,917 shares stake. 11,556 were accumulated by Marshall Wace Llp. Bartlett Com Ltd Liability Corporation, a Ohio-based fund reported 200 shares. California Pub Employees Retirement owns 739,231 shares or 0.09% of their US portfolio. Wells Fargo Communication Mn invested 0.04% in Broadridge Financial Solutions, Inc. (NYSE:BR).

More notable recent Broadridge Financial Solutions, Inc. (NYSE:BR) news were published by: Prnewswire.com which released: “Samir Pandiri Joins Broadridge as President of Broadridge International - PRNewswire” on June 03, 2019, also Streetinsider.com with their article: “Form 8-K BROADRIDGE FINANCIAL For: May 21 - StreetInsider.com” published on May 21, 2019, Streetinsider.com published: “Form 8-K BROADRIDGE FINANCIAL For: Jun 10 - StreetInsider.com” on June 10, 2019. More interesting news about Broadridge Financial Solutions, Inc. (NYSE:BR) were released by: Prnewswire.com and their article: “Broadridge to Acquire a Leading Provider of Canadian Wealth Management Technology - PRNewswire” published on May 21, 2019 as well as Prnewswire.com‘s news article titled: “Companies and Consumers Alike Clamour for Safe and Speedy Fintech Platforms - PRNewswire” with publication date: May 20, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.