Affinity Investment Advisors Llc increased Microsoft Corp (MSFT) stake by 39.89% reported in 2019Q1 SEC filing. Affinity Investment Advisors Llc acquired 34,415 shares as Microsoft Corp (MSFT)’s stock rose 6.56%. The Affinity Investment Advisors Llc holds 120,689 shares with $14.23 million value, up from 86,274 last quarter. Microsoft Corp now has $ valuation. The stock decreased 0.95% or $1.32 during the last trading session, reaching $137.57. About 12.02M shares traded. Microsoft Corporation (NASDAQ:MSFT) has risen 29.33% since August 9, 2018 and is uptrending. It has outperformed by 29.33% the S&P500. Some Historical MSFT News: 07/05/2018 - Microsoft is luring A.I. developers to its cloud by offering them faster customizable chips; 04/04/2018 - LogiGear Hosts Exclusive Webinar with Deliveron; 07/05/2018 - MSFT: Microsoft now describes the opportunity for its developers as being in 4 areas: Azure, Microsoft 365, Xbox Gaming, MS Dynamics 365. #MSBuild is about the first 2 - ! $MSFT; 16/05/2018 - Microsoft attempted to launch an affordable Surface-branded laptop in 2012 with the release of the Surface RT; 07/05/2018 - Recode Daily: Expect AI-in-everything at this week’s Microsoft and Google developer conferences Plus, a new $36 million VC fund exclusively for black female founders; will the Supreme Court legalize U.S; 29/05/2018 - Brad Smith, Microsoft’s president and chief counsel, spoke about the company’s antitrust case in the 1990s at the Code Conference on Tuesday; 07/03/2018 - BluChip Solutions, an ITPS Company, Partners with 2 of the Largest Universities in the Country to Launch Microsoft Office 365 Practice; 05/05/2018 - BUFFETT SAYS TIMES, JOURNAL AND POST HAVE VIABLE MODEL FOR GENERATING DIGITAL REVENUE; 26/04/2018 - MICROSOFT CEO SAYS LINKEDIN RESULTS AHEAD OF EXPECTATIONS; 02/05/2018 - INGRAM MICRO & MICROSOFT REPORT ALLIANCE

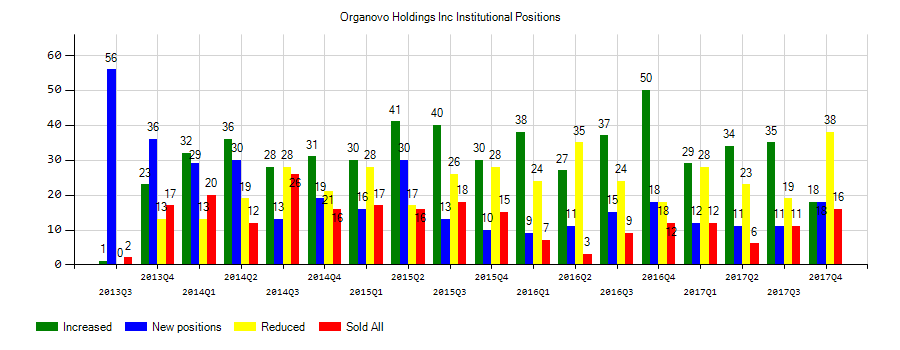

Organovo Holdings Inc (ONVO) investors sentiment increased to 1.4 in Q1 2019. It’s up 0.37, from 1.03 in 2018Q4. The ratio improved, as 35 funds increased or started new holdings, while 25 sold and decreased positions in Organovo Holdings Inc. The funds in our database now possess: 30.12 million shares, up from 23.90 million shares in 2018Q4. Also, the number of funds holding Organovo Holdings Inc in top ten holdings was flat from 0 to 0 for the same number . Sold All: 10 Reduced: 15 Increased: 29 New Position: 6.

Penbrook Management Llc holds 0.28% of its portfolio in Organovo Holdings, Inc. for 273,675 shares. Nikko Asset Management Americas Inc. owns 2.00 million shares or 0.05% of their US portfolio. Moreover, American Financial Group Inc has 0.02% invested in the company for 251,500 shares. The Utah-based Albion Financial Group Ut has invested 0.01% in the stock. American Money Management Llc, a California-based fund reported 14,900 shares.

More notable recent Organovo Holdings, Inc. (NASDAQ:ONVO) news were published by: Nasdaq.com which released: “Organovo to Explore Strategic Alternatives and Implement Restructuring Plan - Nasdaq” on August 07, 2019, also Nasdaq.com with their article: “Organovo (ONVO) Reports Q1 Loss, Lags Revenue Estimates - Nasdaq” published on August 09, 2019, Nasdaq.com published: “Organovo Announces Release Date for Fiscal First-Quarter 2020 Financial Results - Nasdaq” on July 18, 2019. More interesting news about Organovo Holdings, Inc. (NASDAQ:ONVO) were released by: Benzinga.com and their article: “The Daily Biotech Pulse: Glaukos To Buy Avedro, Mixed Adcom Vote For Gilead, Dynavax Offering - Benzinga” published on August 08, 2019 as well as Benzinga.com‘s news article titled: “25 Healthcare Stocks Moving In Today’s Pre-Market Session - Benzinga” with publication date: August 08, 2019.

The stock decreased 0.61% or $0.0016 during the last trading session, reaching $0.2607. About 997,027 shares traded. Organovo Holdings, Inc. (ONVO) has declined 64.68% since August 9, 2018 and is downtrending. It has underperformed by 64.68% the S&P500. Some Historical ONVO News: 16/04/2018 - Organovo Achieves Key Development Milestones for Its Liver Disease and lntestinal Tissue Models; 26/03/2018 - ORGANOVO HOLDINGS INC - LONZA WILL MARKET HUMAN CELL PRODUCTS FROM SAMSARA FOR FURTHER DISTRIBUTION TO ITS CUSTOMERS; 12/04/2018 - Organovo Presents Data on Modeling Liver Disease Using 3D Bioprinted Human Liver Tissue at The International Liver Congress™; 16/04/2018 - ORGANOVO ACHIEVED CAPABILITIES FOR 3D BIOPRINTED TISSUES; 03/05/2018 - Organovo and Samsara Sciences Partner with New Manufacturing USA Institute; 26/03/2018 - Organovo Division Samsara Sciences Announces Multi-Year Supply Agreement With Lonza Bioscience Solutions; 10/05/2018 - Organovo to Present New Preclinical Data for Its Liver Therapeutic Tissue IND-Track Programs at the World Advanced Therapies and Regenerative Medicine Congress; 12/04/2018 - Cirius Therapeutics’ Preclinical Data Demonstrates Potential for Lead Drug Candidate MSDC-0602K in NASH; 26/03/2018 - ORGANOVO HOLDINGS INC - CO’S UNIT, SAMSARA SCIENCES ENTERED NON-EXCLUSIVE SUPPLY AGREEMENT WITH LONZA BIOSCIENCE SOLUTIONS; 16/04/2018 - ORGANOVO ACHIEVES KEY DEVELOPMENT MILESTONES FOR LIVER DISEASE

Organovo Holdings, Inc., an early commercial stage company, creates and creates functional and three-dimensional human tissues for use in medical research and therapeutic applications. The company has market cap of $24.18 million. The firm develops 3D human tissue models through internal development and in collaboration with pharmaceutical, academic, and other partners. It currently has negative earnings. The Company’s 3D human tissues could be employed in drug discovery and development, biological research, and as therapeutic implants for the treatment of damaged or degenerating tissues and organs.

More notable recent Microsoft Corporation (NASDAQ:MSFT) news were published by: Nasdaq.com which released: “Microsoft (MSFT) is an Incredible Growth Stock: 3 Reasons Why - Nasdaq” on August 09, 2019, also Seekingalpha.com with their article: “Microsoft Continues To Amaze - Seeking Alpha” published on July 31, 2019, Nasdaq.com published: “Microsoft (MSFT) and Artificial Intelligence - Nasdaq” on August 07, 2019. More interesting news about Microsoft Corporation (NASDAQ:MSFT) were released by: Benzinga.com and their article: “When Reverse Actually Means Drive - Benzinga” published on August 09, 2019 as well as Nasdaq.com‘s news article titled: “Notable Wednesday Option Activity: KR, REGI, MSFT - Nasdaq” with publication date: August 07, 2019.

Investors sentiment decreased to 0.91 in 2019 Q1. Its down 0.03, from 0.94 in 2018Q4. It is negative, as 64 investors sold MSFT shares while 922 reduced holdings. 159 funds opened positions while 742 raised stakes. 5.41 billion shares or 1.21% less from 5.48 billion shares in 2018Q4 were reported. United Kingdom-based Merian Invsts (Uk) Ltd has invested 1.47% in Microsoft Corporation (NASDAQ:MSFT). Joel Isaacson & Lc has 0.88% invested in Microsoft Corporation (NASDAQ:MSFT) for 51,101 shares. Exchange Capital Mgmt holds 2.59% or 78,238 shares in its portfolio. Calamos Advsrs Ltd accumulated 3.55 million shares. Woodstock Corp, Massachusetts-based fund reported 225,950 shares. Efg Asset Mngmt (Americas) Corporation reported 71,082 shares. Spears Abacus Advisors Ltd Com owns 504,921 shares for 7.6% of their portfolio. Fin Counselors Inc holds 2.56% or 511,954 shares in its portfolio. Timber Creek Capital invested in 46,452 shares. Stewart And Patten Limited Liability Co reported 224,661 shares. Whittier Of Nevada reported 365,983 shares. 50,065 are held by Heritage Wealth Advsrs. Moreover, Pensionfund Dsm Netherlands has 2.16% invested in Microsoft Corporation (NASDAQ:MSFT) for 99,500 shares. Weatherly Asset Management Lp reported 2.35% of its portfolio in Microsoft Corporation (NASDAQ:MSFT). Invsts Asset Mgmt Of Georgia Ga Adv has 18,025 shares for 1.49% of their portfolio.

Affinity Investment Advisors Llc decreased Celgene Corp (NASDAQ:CELG) stake by 66,088 shares to 40,861 valued at $3.86M in 2019Q1. It also reduced Jm Smucker (NYSE:SJM) stake by 22,221 shares and now owns 60,373 shares. American Express (NYSE:AXP) was reduced too.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.